Foodservice delivery continues to shake up the UK Eating Out sector, with a significantly faster growth rate than the overall market. The delivery market is set to be worth £8.4bn in 2019, growth of 18% on 2018, highlighting substantial growth opportunities for operators.

With the foodservice delivery market forecast to continue to outperform the overall UK eating out market, operators should avoid it at their peril.

Rising demand for convenience and technological improvements have been catalysts for a thriving UK foodservice delivery sector. The Lumina Intelligence UK Foodservice Delivery Market Report 2019/20 explores the rapidly growing foodservice delivery channel. Answering crucial questions about the success factors driving this buoyant market, this report also examines how the expansion of foodservice delivery impacts the wider eating out market With the foodservice delivery market forecast to continue to outperform the overall UK eating out market, operators should avoid it at their peril.

HOW TO USE THE REPORT

- Identify regions where foodservice delivery is used most.

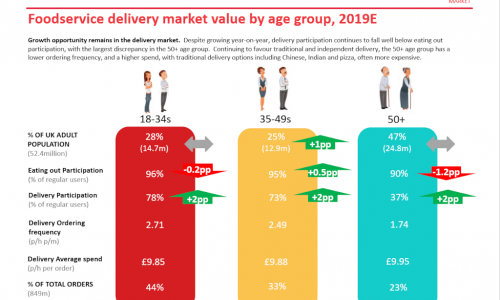

- Understand the consumer groups that use foodservice delivery.

- Learn the consumer needs that are driving demand.

- Gain insight into how leading brands approach delivery

- Understand the benefits between in-house and third-party delivery.

- Find out how you can encourage consumers to use delivery.

- Gain clarity on demand and supply-side market growth drivers.

- Explore ways to differentiate your offer from the competition.

Executive summary

Market Analysis

- How is the market evolving vs 2018?

- What growth is forecasted for 2019?

- What is driving these changes?

- How is the market segmented?

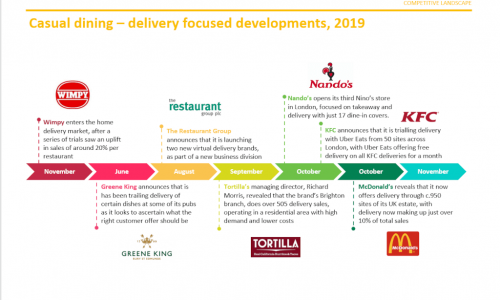

Competitve Landscape

- How are business models changing?

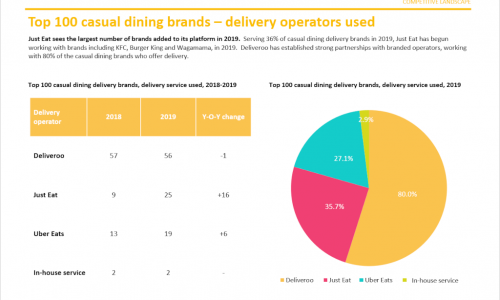

- Which operators lead the market?

- How often do consumers use different operators for delivery?

- What are the latest developments with dark kitchens and virtual brands?

- Which branded restaurants offer foodservice delivery?

- Which delivery operators are used by branded restaurants?

Menu Analysis

- How does menu count differ between delivery and in-store?

- Which dishes are most popular online?

- How do prices differ on delivery menus vs in-store?

Consumer Insight

- How frequently do consumers order delivery?

- What are the most important reasons for ordering delivery?

- How much do consumers spend on average each time?

- What are consumers ordering?

- What factors influence consumer decision making the most?

- How are consumer trends towards delivery changing?

Future Outlook

- What are the trends that will impact the delivery market?

- What growth is forecast over the next three years?

- What concepts are emerging within the delivery market?

- What innovation will shape the delivery market in the future?

Download the sample

- Over 2,000 online consumer surveys to gain knowledge of participation by age group.

- 1,500 bespoke online surveys (1,200 takeaway delivery users and 300 non-users) to understand brand awareness, usage and detailed user experience, attitudes and future outlooks.

- Market size modelling, forecasting and synthesis with wider Lumina Intelligence market sizing databases.

- Desk research, drawn from news articles, trade press, company websites and trade associations.