In recent years, UK coffee consumer attitudes have changed significantly. Beyond the wake-me-up cup and the Frappuccino craze of old, coffee culture has evolved to reflect higher expectations and a focus on speciality coffee.

This shift does not respond merely to a change in taste, but also to a stronger consideration of provenance, health and sustainability when selecting a daily or weekly brew. Coffee is no longer just a drink; it is a cultural experience, wellness ritual and sustainability statement.

- 15% of UK adults enjoy a coffee occasion each week

- Over 9 million coffee occasions weekly

- 1.2 coffee occasions per person per week, totalling 9.2 million weekly adult coffee occasions

In recent years, consumer attitudes towards coffee have changed significantly, giving rise to new coffee trends in 2025 that blend quality, wellness and innovation.

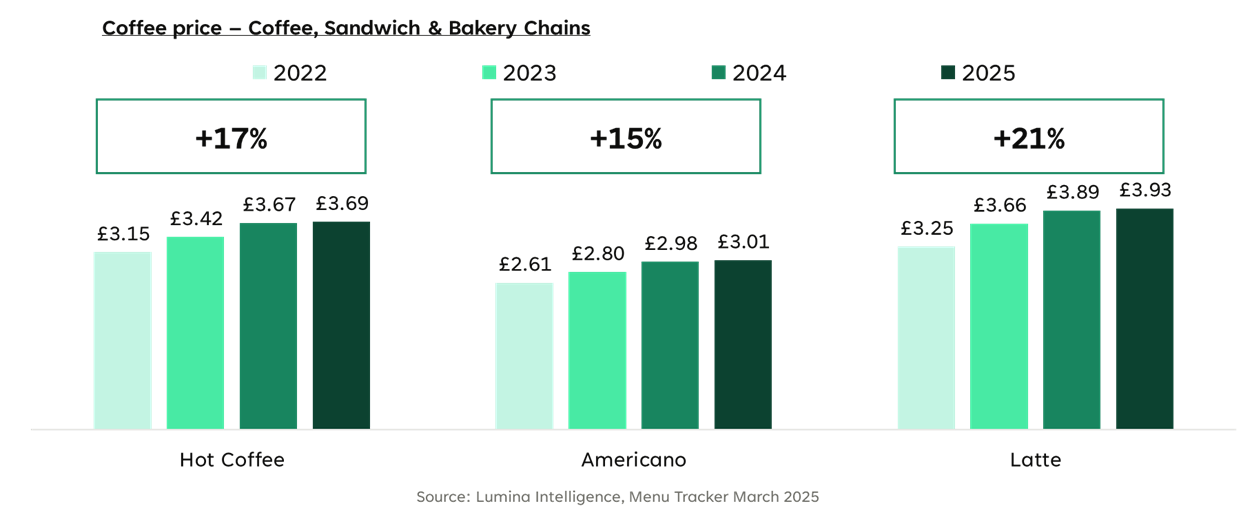

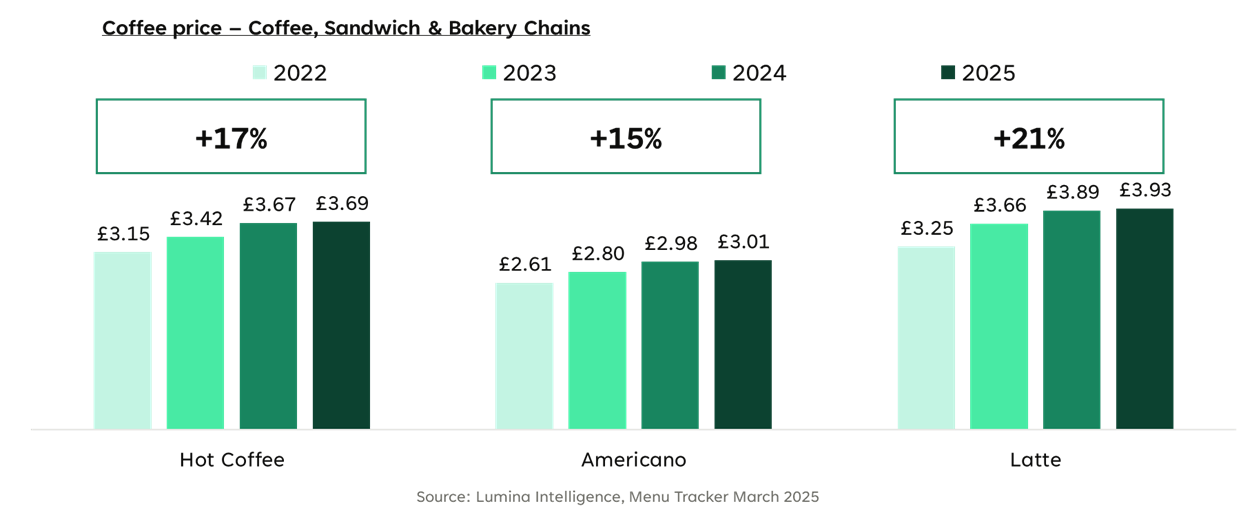

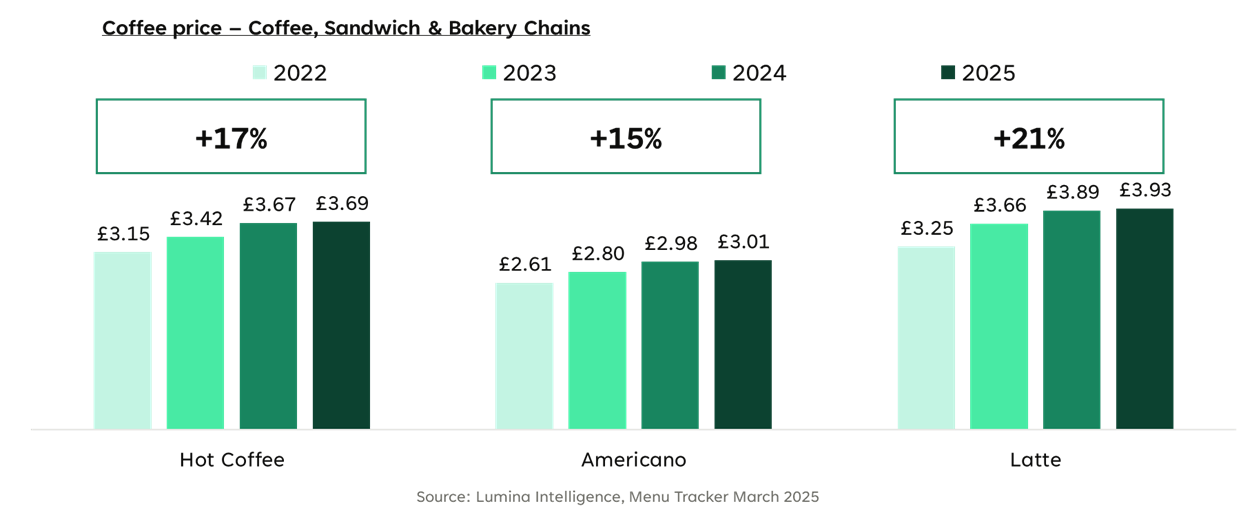

According to Lumina Intelligence’s Menu Tracker (March 2025), the average price of coffee across UK coffee, sandwich and bakery chains has risen by 17% since 2022. Hot coffee prices climbed from £3.15 in 2022 to £3.69 in 2025, while Americanos increased by 15% (to £3.01), and lattes saw the steepest rise of 21% (to £3.93).

These upward price trends highlight ongoing inflationary pressures and operational costs faced by coffee shop operators. Yet they also reflect consumers’ sustained demand for premium, high-quality coffee experiences, even in a cost-conscious environment.

Cold Coffee Goes Mainstream

Among the most notable coffee trends 2025 is the rise of cold coffee as a year-round staple across the UK. Once seen as a summer alternative, iced lattes, cold brews and matcha-based beverages are now enjoyed across all seasons, reflecting a broader shift towards convenience, refreshment and premiumisation.

This rising demand has spilled over into retail, where ready-to-drink (RTD) cold brews and matcha mixes are expanding chilled aisles and fuelling all-day consumption.

For UK foodservice operators, the challenge lies not just in meeting this unrelenting demand but in adapting infrastructure and elevating quality. Ice machines are working overtime, and attention to finer details, from ice clarity to glassware aesthetics, now helps differentiate brands and justify a premium positioning.

At the same time, competition from the at-home market is intensifying as consumers gain access to barista-style innovations from major brands. Products such as Nescafe Espresso Concentrate, Starbucks x Nespresso Iced Capsules and Rude Health Dairy-Free Milks are redefining the home coffee ritual, offering café-style experiences with minimal effort.

As these omnichannel options expand across supermarkets and e-commerce, UK coffee operators are being pushed to stay ahead through constant cold drink innovation, ensuring their offerings deliver not just flavour, but the sensory and social experience that cannot be bottled.

Ready-To-Drink Coffee

Another major coffee trend in 2025, Ready-to-drink (RTD) coffee formats continue to accelerate, closely aligned with the growth of the food-to-go sector. The global RTD coffee market reached an estimated $30 billion in 2023 and is projected to climb significantly by 2025.

In the UK, sales are also on the rise as consumers seek convenient, barista-style beverages on the move. What once belonged primarily to major players such as Starbucks, Costa and Jimmy’s Coffee now shares shelf space with speciality roasters including Grind, Hunt & Brew and Pact. Their arrival signals a shift towards higher quality, traceable provenance and lower-sugar formulations.

While RTD formats remain a natural companion to the worker’s lunch, they also act as a gateway for younger consumers, appealing through self-serve convenience, accessibility and sweeter flavour profiles.

Yet the category’s evolution also reflects a maturing audience. Older, more discerning coffee consumers are now over-indexing in coffee occasions compared with the total out-of-home market. Brands are responding with greater transparency, balanced sweetness and premium cues that resonate with both the health-conscious and the quality-driven drinker.

In essence, RTD innovation is being pulled in two complementary directions: towards youthful accessibility and experiential flavour, and towards refined, provenance-led craftsmanship that caters to a growing base of savvy, experienced coffee consumers.

Matcha, Mindfulness and Wellness

As seen at this year’s London Coffee Festival and reflected in ongoing foodservice trend monitoring, the rise of matcha has been nothing short of meteoric. Once a niche alternative, matcha has firmly established itself as a must-have feature on café menus, appealing to both health-conscious and trend-driven consumers.

Its growing mainstream presence is evident across operators such as Blank Street Coffee and Jenki, where matcha-based beverages now play a central role in defining a modern, wellness-focused coffee offer.

This wellness appeal links matcha not only to mindfulness and café culture but also to tangible cardiovascular health benefits. A meta-analysis published in the British Journal of Nutrition found that regular green tea consumption can lower blood pressure, reducing systolic levels by about 2 mm Hg and diastolic by around 1.7 mm Hg compared with non-drinkers. It also showed modest improvements in cholesterol, with total cholesterol dropping by 0.15 mmol/L and LDL (“bad”) cholesterol by 0.16 mmol/L.

Some consumers are drawn to matcha for its gradual caffeine release, thanks to L-theanine, an amino acid that stimulates alpha brain waves, promoting relaxation and focus. Combined with caffeine, it creates a state of calm alertness, offering a steadier, more balanced energy compared with the sharp spikes often associated with regular coffee.

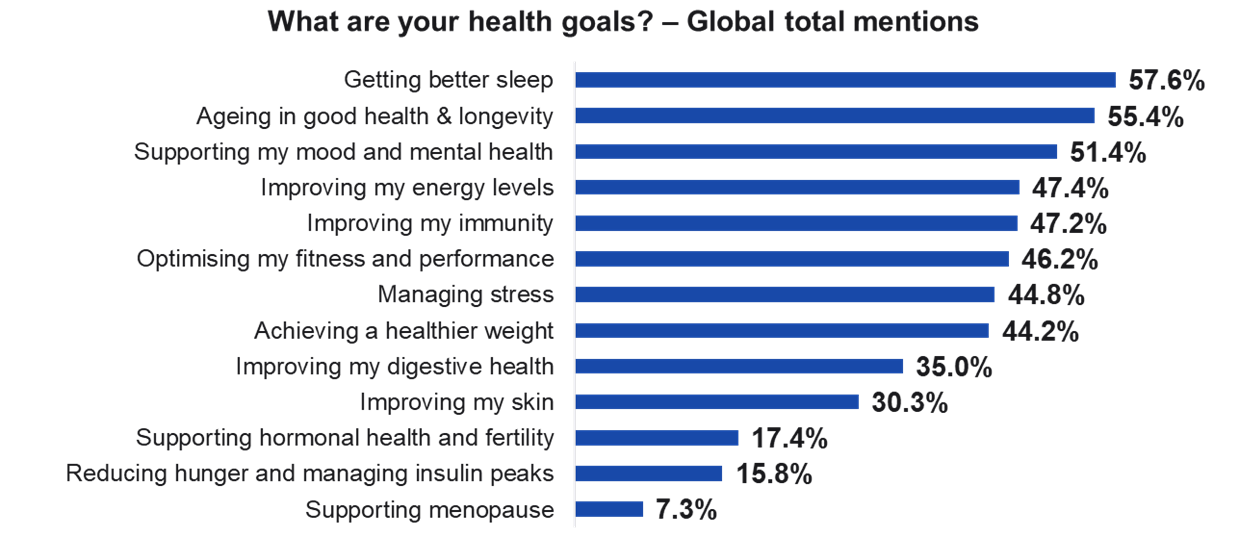

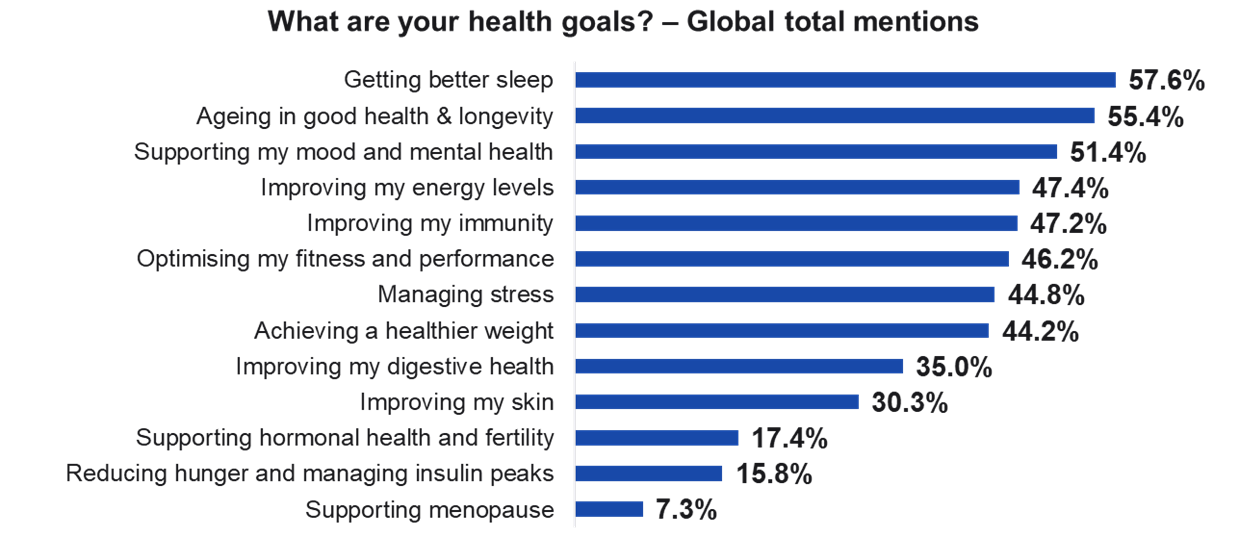

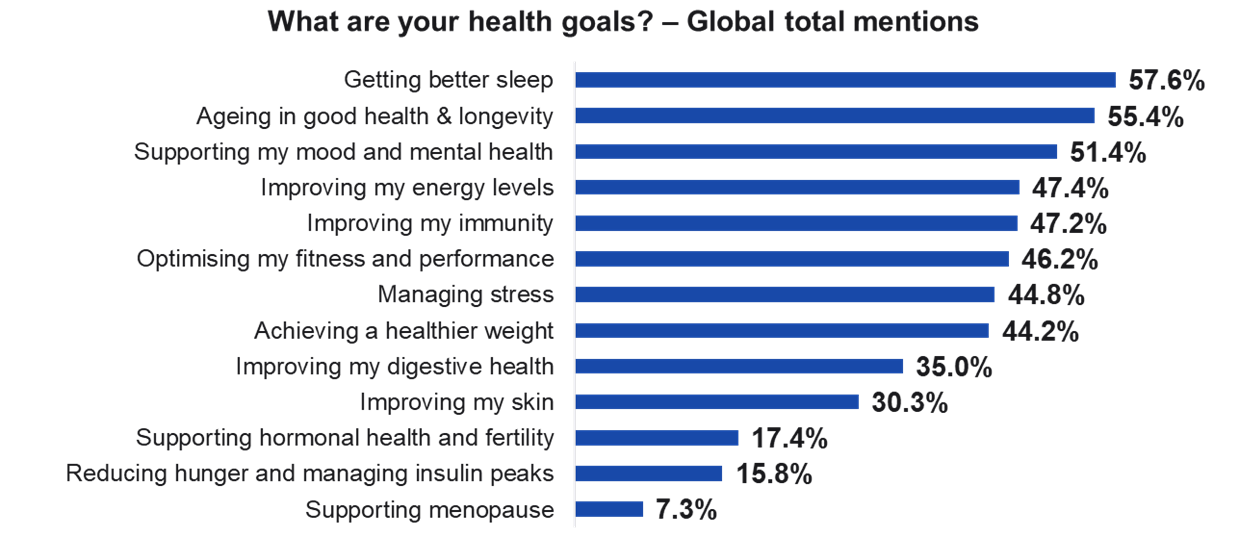

Beyond its balanced energy release, matcha’s naturally lower caffeine content is becoming an additional draw for consumers increasingly mindful of their sleep and overall wellbeing. As highlighted in recent Lumina Intelligence research for the report Future Food: How the UPF debate is reshaping consumer behaviour, commissioned by FoodNavigator, 57.6% of global consumers cite better sleep as a key health goal, with ageing well and mental health close behind. This growing focus on restorative habits is also fuelling interest in lower-caffeine alternatives like matcha and hojicha.

Brewing the next opportunity

Brands and operators stand at the intersection of innovation, wellness and premiumisation. Cold brew trends and the rise of RTDs highlight consumers’ desire for convenient yet quality-driven options, while the momentum behind matcha and hojicha underscores a deeper shift towards functional, health-aligned beverages.

For the industry, the opportunity lies in bridging sensory appeal with substance, crafting beverages that not only deliver flavour but also embody provenance, wellbeing and lifestyle relevance. Those who can authentically unite quality, transparency and innovation will be best positioned to capture the loyalty of the next generation of coffee drinkers.

Key Statistics This Article Covers

- UK coffee market 2025: £24.1bn estimated value (+1.9% YoY growth)

- Average hot coffee price UK: £3.69 (+17% vs 2022)

- Average latte price UK: £3.93 (+21%)

- Average Americano price UK: £3.01 (+15%)

- Weekly adult coffee occasions UK: 9.2m (1.2 per person per week)

- Global RTD coffee market 2023: $30bn (growth expected through 2025F)

- Top global health goals 2025: Better sleep 57.6%, Ageing well 55.4%, Mental health 51.4%

- Green tea health impact: –2.0 mm Hg systolic, –1.7 mm Hg diastolic BP reduction (British Journal of Nutrition)

Sources: Lumina Intelligence, Menu Tracker March 2025; Lumina Intelligence & FoodNavigator, Future Food: How the UPF Debate Is Reshaping Consumer Behaviour (2025); British Journal of Nutrition (Khalesi et al.)

What are the biggest UK coffee trends in 2025?

In 2025, coffee culture is defined by three major trends: the rise of cold coffee as a year-round choice, the rapid expansion of RTD (ready-to-drink) formats, and the growing popularity of wellness-led beverages such as matcha and hojicha. Consumers are looking for drinks that combine quality, convenience and health benefits.

Why is cold coffee becoming so popular in the UK?

Cold coffee has moved beyond being a summer treat. It reflects a wider shift towards on-the-go refreshment and premiumisation, with iced lattes and cold brews now part of daily routines. The at-home market is also growing, with products like Nescafe Espresso Concentrate and Starbucks Iced Capsules helping consumers recreate café-style cold drinks at home.

How is the RTD coffee market evolving?

The global RTD coffee market was worth around $30 billion in 2023 and continues to grow rapidly. In the UK, it’s being driven by demand for convenience, flavour diversity and better ingredients. Alongside established brands like Starbucks and Costa, speciality roasters such as Grind, Hunt & Brew and Pact are elevating the category with traceable sourcing and lower sugar content.

Why are matcha and hojicha becoming more popular?

Consumers are increasingly drawn to beverages that support wellbeing and mental balance. Matcha and hojicha offer lower caffeine levels and contain L-theanine, which promotes calm focus and smoother energy release. Their rise aligns with growing interest in sleep quality, mental health and mindful consumption, as highlighted in Lumina Intelligence’s 2025 wellness research.

What health benefits are associated with matcha?

Research shows that regular green tea consumption can lower blood pressure by around 2 mm Hg and reduce LDL cholesterol by 0.16 mmol/L. Matcha, being a concentrated form of green tea, delivers similar cardiovascular benefits while supporting focus and relaxation due to its L-theanine content.

What opportunities do these trends create for brands and operators?

For brands, the key opportunity lies in bridging innovation and authenticity. Consumers want drinks that are functional, transparent and experiential. Investing in wellness-led cold drinks, RTD ranges with provenance, and lower-caffeine options can help operators meet the expectations of a more health-conscious, quality-driven market.

Is the wellness trend reshaping how UK consumers view coffee?

Yes. Coffee is increasingly seen as part of a broader wellness lifestyle, rather than just an energy boost. Consumers are balancing productivity with mindfulness, favouring beverages that offer flavour, function and balance. This shift is driving innovation across both foodservice and retail channels.