Health dominates food and nutrition conversations globally, but consumer behaviour is more nuanced than headlines often suggest. According to Lumina Intelligence and FoodNavigator’s Future Food Global Study, consumer health trends and goals are influenced by cultural heritage and societal norms, and while health priorities are increasingly reflected in purchasing behaviour, they do not manifest uniformly across markets.

The research is based on a global quantitative online consumer survey of 9,500 consumers across 13 countries, providing a robust view of changing health attitudes among consumers. The findings show that understanding what consumers mean by health is critical to influencing food choice, product development and health-driven food purchasing strategies.

Understanding what consumers mean by health is critical to influencing food choice, product development and health-driven food purchasing strategies.

What consumers mean when they say they want to eat “healthily”

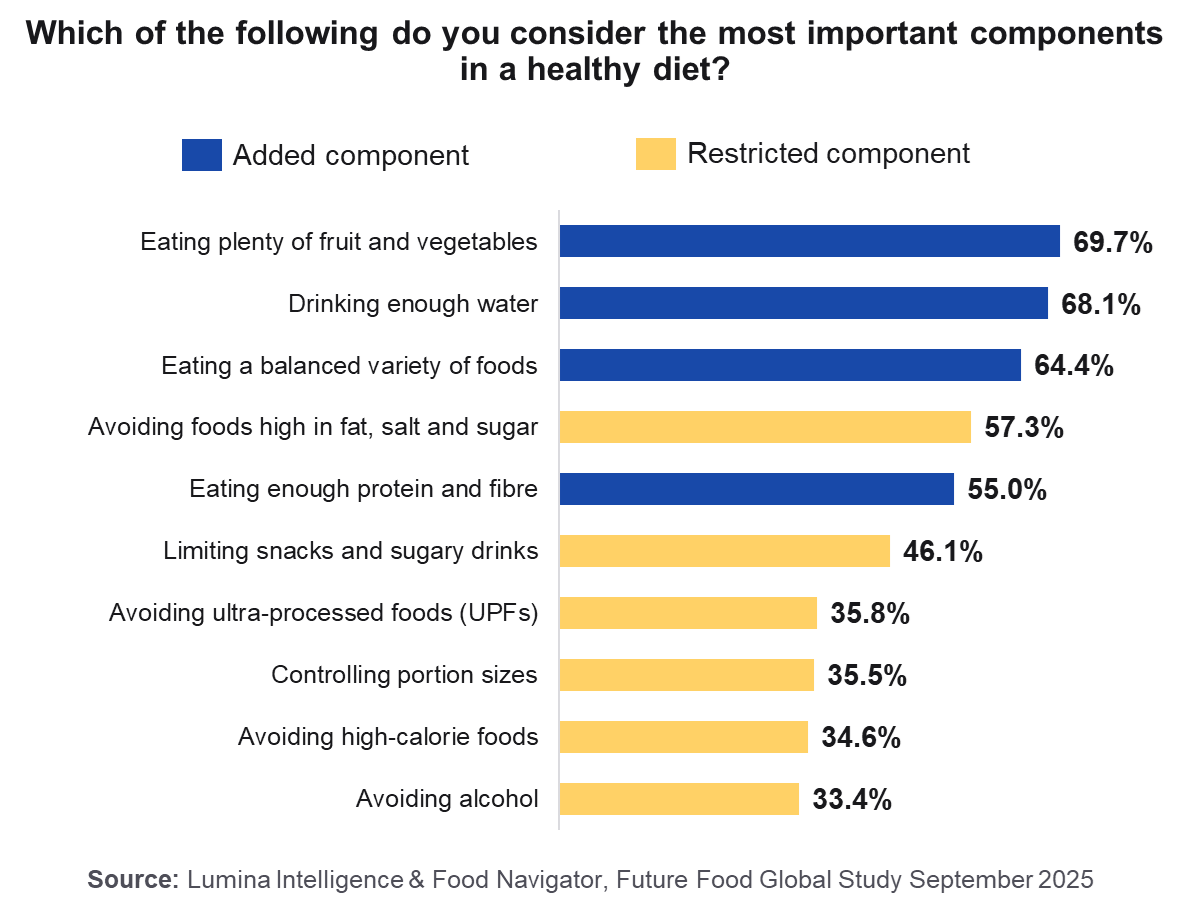

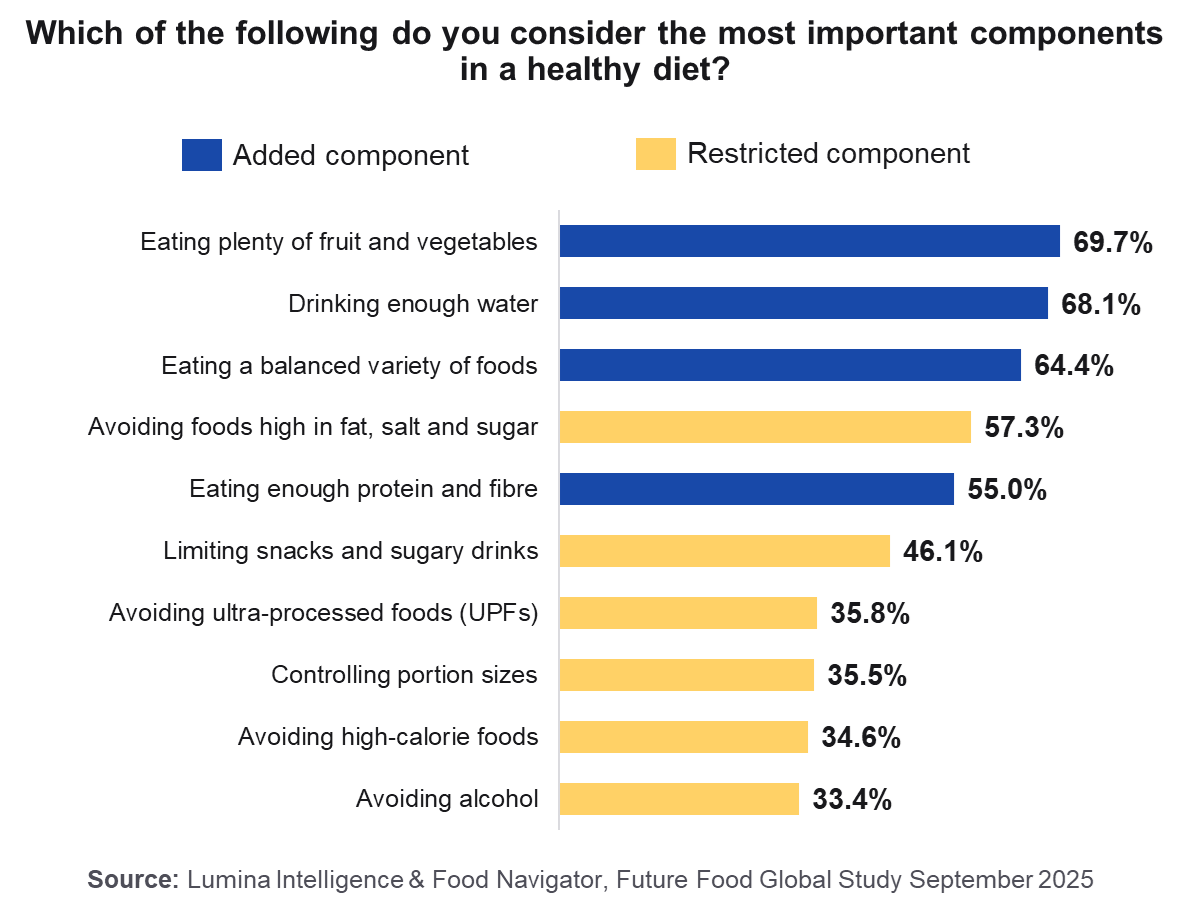

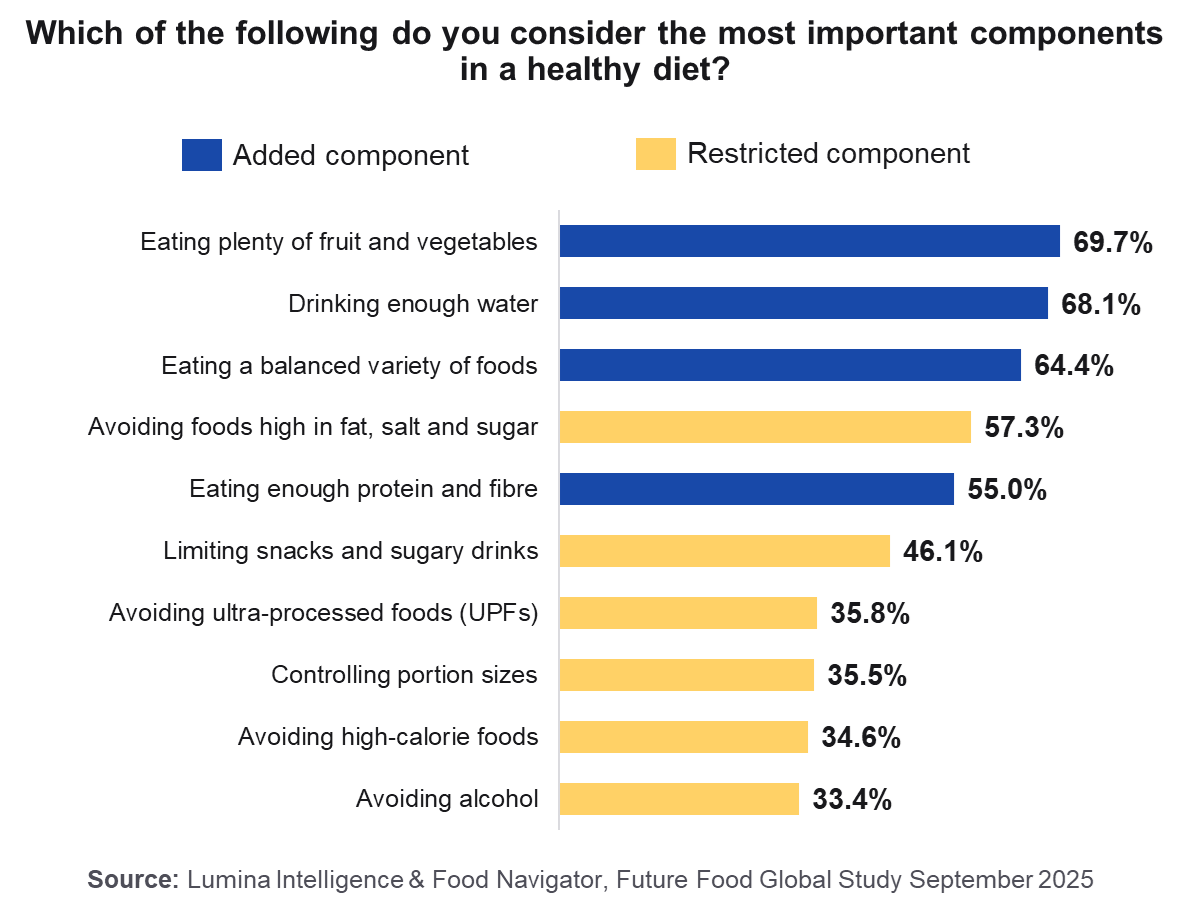

Nutrition consumer behaviour is led by addition, not restriction. Across markets, consumers define a healthy diet more by what is added than what is avoided. That said, there is little that is radical in how most people define healthy eating: eating plenty of fruit and vegetables is the top component considered in a healthy diet, closely followed by drinking enough water and eating a balanced variety of foods.

While many consumers still seek to avoid foods high in fat, salt and sugar, avoidance plays a secondary role in how healthy eating is defined. This indicates a clear preference for health messaging and product innovation that emphasise added benefits rather than restriction. From a nutrition consumer behaviour perspective, balance, hydration and natural food inclusion continue to dominate perceptions of what it means to eat healthily.

Global health priorities consumers say shape food choices

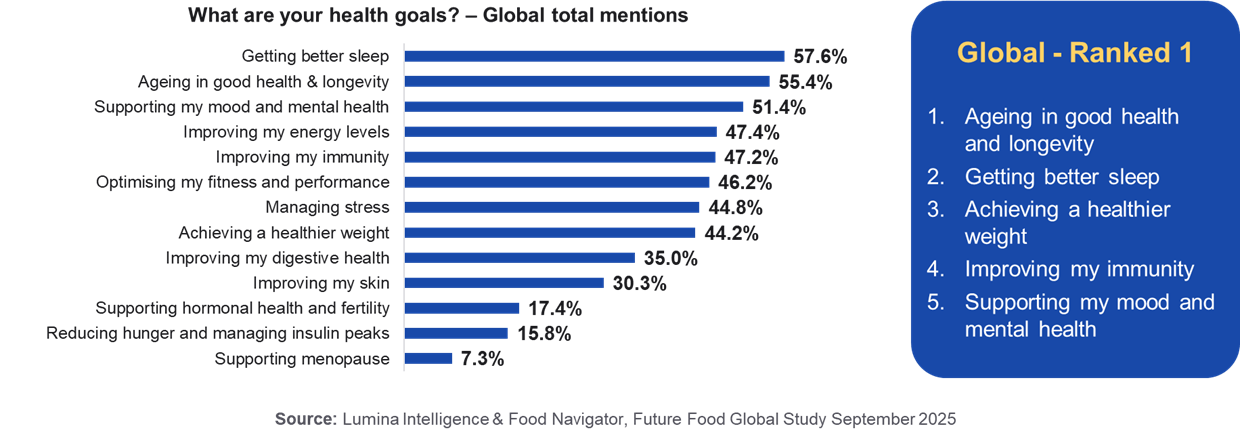

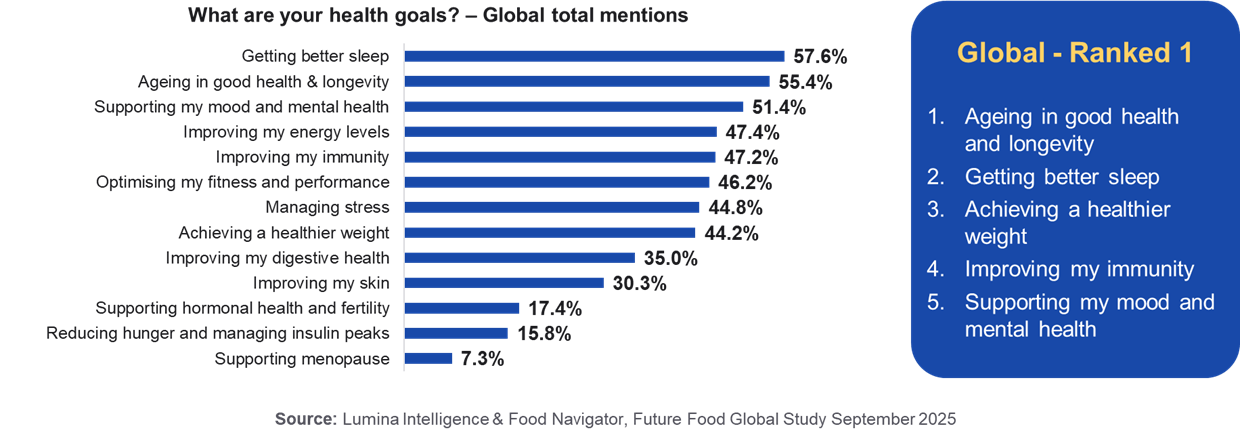

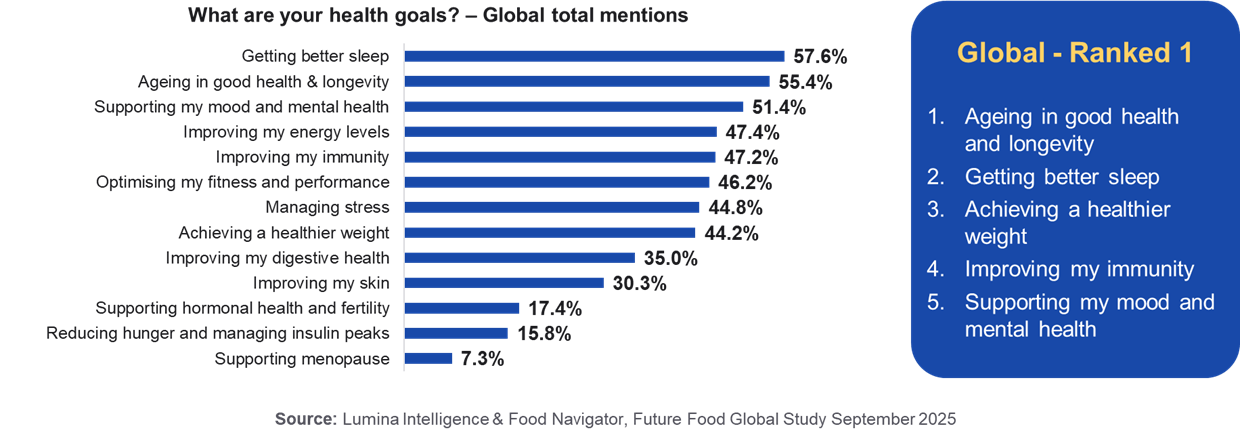

Ranking health goals matters more than total mentions. When examining global health priorities, sleep emerges as the most cited health goal worldwide. However, when consumers are asked to rank their priorities, ageing in good health and longevity is the top goal ranked first, with sleep just behind.

Healthier weight provides a critical insight into how priorities influence behaviour. While it is only the eighth most mentioned health goal overall, it is the third most likely to be ranked first. For consumers who prioritise weight, it is a dominant driver of behaviour rather than a passive aspiration.

This ranking-based approach reveals why global health priorities influence food choices in different ways, depending on how strongly they are prioritised rather than how frequently they are mentioned.

How global health priorities differ by market

Lifestyle pressure plays a significant role in shaping health-driven food purchasing. Demanding work cultures in Singapore and Japan lead sleep to be a top priority, with Japan experiencing a widely recognised sleep crisis.

In these markets, foods, ingredients and products that directly support better sleep present a clear opportunity, as health goals are increasingly reflected in purchasing behaviour.

Culturally rooted health beliefs influence food choice

Cultural health frameworks strongly influence consumer health trends in Asia. In China and India, Traditional Chinese Medicine (TCM) and Ayurvedic practices shape immunity-led health priorities, with a focus on strengthening the body’s natural defences.

Awareness and historical experience of infectious disease also influence immunity to be a major health focus in parts of Asia, reinforcing the importance of culturally rooted health beliefs when interpreting global health priorities consumers act on.

Tradition versus functional health in Europe

In Southern European markets, nutrition consumer behaviour is shaped by tradition rather than functional enhancement. France and Italy perceive themselves to have healthy diets, in line with low consumption of conventionally ‘unhealthy’ categories.

As a result, these markets show low interest in buying food with added benefits, reflecting an emphasis on home cooking, natural diets and culinary tradition over functional or fortified products.

Perception versus reality in healthy eating

Globally, 80% of consumers consider themselves to have a healthy diet, highlighting a significant perception gap. In several markets – including the UK, Malaysia, Australia, China, the USA and Spain – consumers are more likely than average to say they eat healthily while also consuming above-average levels of conventionally ‘unhealthy’ categories.

This mismatch between self-perception and reality complicates health education and brand messaging. In contrast, France and Italy are more realistic about their diets, viewing them as healthy while also showing low consumption of unhealthy categories, which limits the opportunity for health-led innovation.

Our data highlights why targeted health messaging and education are necessary in markets where perception and behaviour diverge most strongly.

How health priorities translate into food purchasing behaviour

Health-driven food purchasing is clear in buying behaviour. Globally, four in five consumers are buying foods with added benefits, demonstrating how health goals directly influence shopping baskets.

Protein remains the top global added benefit bought, particularly in Western markets such as the USA, the UK and Australia. Demand for gut health and immunity support also emerges strongly, especially in Spain and South Korea.

However, not all health goals translate into the same purchasing behaviours. In European markets such as Italy and France, demand for added benefits is lower due to a strong emphasis on fresh, natural produce and home cooking.

The trade-offs consumers are willing to make

Consumer health trends are shaped by realism rather than idealism. Consumers are willing to sacrifice convenience and shelf life to avoid ultra-processed foods, demonstrating a readiness to compromise on functional aspects of food.

However, taste and texture remain non-negotiable. Consumers are not willing to put up with changes to taste or mouthfeel, reinforcing that health must coexist with sensory satisfaction.

Fewer than one in ten global consumers say they are not prepared to put up with any compromise at all, showing that health-driven behaviour is flexible but only within clear boundaries.

What today’s consumer health trends mean for food brands

The research highlights a divergence between self-perceived and actual health, requiring tailored, market-specific messaging. Health-led positioning fails when it ignores cultural context, lifestyle pressure and how consumers prioritise health goals.

Effective strategies require:

- Local relevance rather than globalised health claims

- Clear benefit prioritisation aligned to dominant health goals

- Avoidance of over-claiming in markets resistant to functionalisation

Health should be treated as a strategic lens, not a single message, with global strategies localised to reflect cultural heritage and societal norms.

Conclusion

Health trends don’t drive food choices, priorities do. There is no single universal understanding of what a healthy diet means, and global health priorities vary significantly by region, culture and lifestyle.

Health goals increasingly influence food choice, but understanding which priorities matter, and where, is the key to relevance. In a fragmented global landscape, data-led insight is essential for navigating complexity and aligning nutrition strategy with real consumer behaviour.

About the data

These insights have been powered by Lumina Intelligence’s global quantitative online survey, commissioned exclusively for Food Navigator. Fieldwork was completed in July 2025, capturing the views of 9,500 consumers across 13 countries: Australia, China, France, Germany, India, Italy, Japan, Malaysia, Singapore, South Korea, Spain, the UK, and the USA. Each national sample is representative, with larger bases in China and the USA (2,000 respondents each) and 500 respondents in all other markets.

FAQs

What are the biggest consumer health trends today?

Consumer health trends today are driven more by prioritised health goals than by broad trend labels. Health remains a dominant influence on food choices, but ageing in good health and longevity rank as the top global health goal when consumers are asked to prioritise, while sleep is the most frequently cited concern. Other key areas shaping food choice include immunity, gut health, energy and mental wellbeing, with importance varying by market, lifestyle and cultural context.

How do health priorities influence food purchasing behaviour?

Health priorities increasingly translate into health-driven food purchasing, but not all goals influence behaviour equally. The majority of consumers buy foods with added benefits, demonstrating a clear link between health intention and shopping behaviour. Protein, gut health and immunity are among the priorities most likely to shape purchasing decisions, while other health goals may influence attitudes without directly driving purchase.

How do consumers define a healthy diet?

Across markets, consumers define a healthy diet more by what is added than by what is avoided. Eating plenty of fruit and vegetables, drinking enough water and maintaining a balanced variety of foods are seen as the core components of healthy eating. Avoidance of foods high in fat, salt and sugar still plays a role, but is generally secondary to inclusion-led thinking.

Why do consumer health trends differ by country?

Differences in consumer health trends are shaped by cultural heritage, lifestyle pressure and societal norms. Demanding work cultures elevate sleep as a priority in markets such as Japan and Singapore, while traditional health frameworks in China and India drive immunity-led priorities. In Southern Europe, strong culinary traditions support natural diets and reduce interest in added benefits.

Is there a gap between how healthy consumers think they eat and what they consume?

A significant gap exists between self-perceived diet quality and actual consumption in many markets. A high proportion of consumers globally consider their diets to be healthy, even where consumption of conventionally ‘unhealthy’ categories remains high. This mismatch complicates health education and messaging and highlights the need for targeted, market-specific communication.

What health benefits are most likely to drive food purchases?

Certain health benefits are more likely than others to convert intention into purchase. Added protein is the most widely purchased health benefit globally, particularly in Western markets, while demand for gut health and immunity support is strong in several regions. These benefits consistently show a clearer link between health goals and shopping behaviour.

What trade-offs are consumers willing to make for health?

Consumers pursue health pragmatically rather than ideologically. They are generally willing to compromise on convenience and shelf life in pursuit of healthier choices, but taste and texture remain non-negotiable. Health-led decisions are therefore balanced against everyday eating expectations.

What do today’s consumer health trends mean for food brands?

Health-led strategies are most effective when grounded in local relevance and clear prioritisation. Brands perform best when health is treated as a strategic lens rather than a single message, with product development and communication aligned to regional health priorities, realistic consumer expectations and cultural context.