Sustainability in UK food and drink is entering a new phase. Once a clear driver of change, its role is evolving alongside shifting consumer priorities, from health and quality to questions around sourcing and responsibility.

As expectations continue to change, what do UK consumers expect from food and drink brands in 2026?

Sustainability VS new consumer priorities

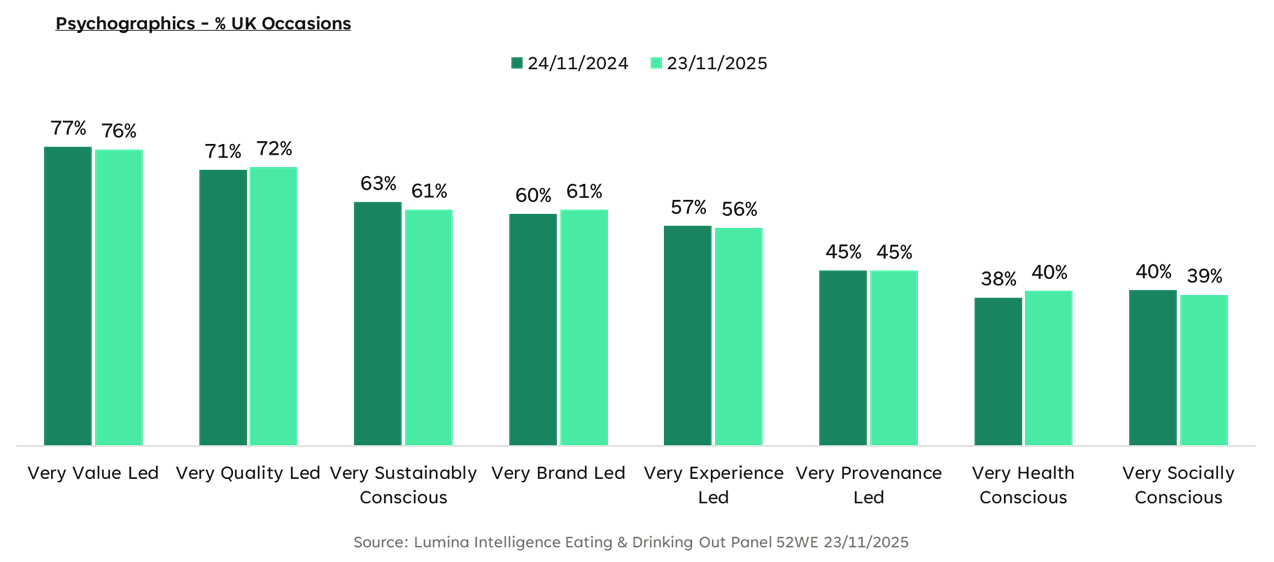

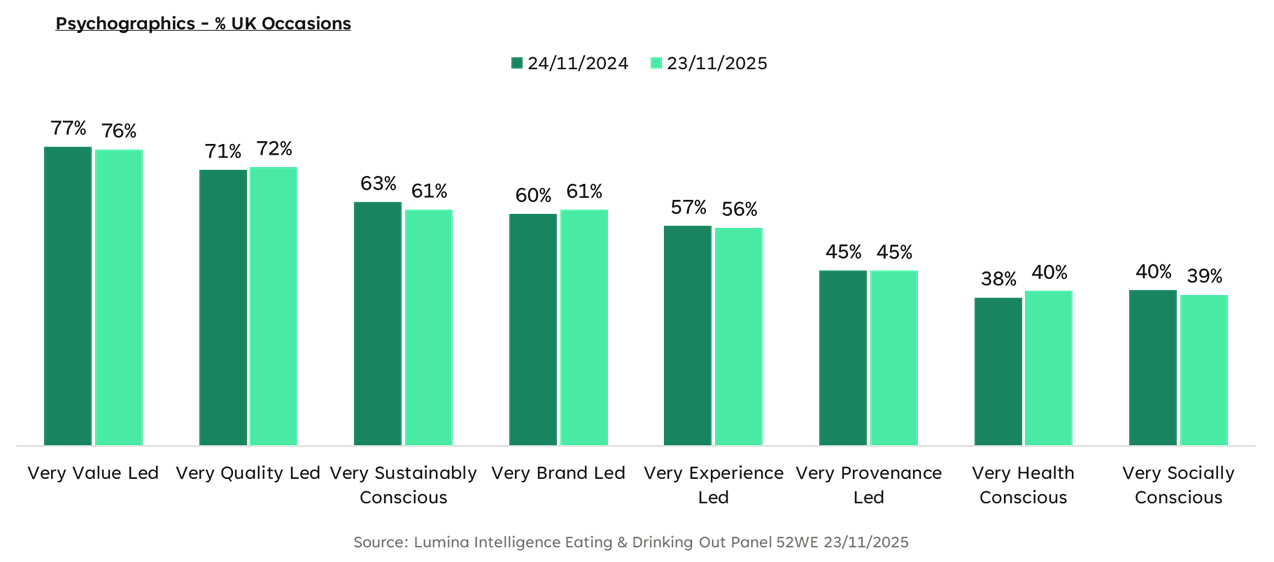

To start with some data, the proportion of consumers who describe themselves as very sustainably conscious has softened, dropping around 2 percentage points.

The same pattern is emerging with social consciousness. This doesn’t signal apathy; rather, it shows that sustainability is no longer the headline driver when it comes into direct competition with price, quality or everyday convenience. Consumers remain value- and quality-led first, but sustainability is being reshaped rather than abandoned.

Insights from our recent psychographic survey, which explored consumer attitudes and beliefs, highlights this shift in behaviour. When asked how often they eat meat, the combined “never” and “rarely” responses fell by 1.6 percentage points, while “often” was the only segment to grow, marking a clear reversal of the trends seen over the past decade.

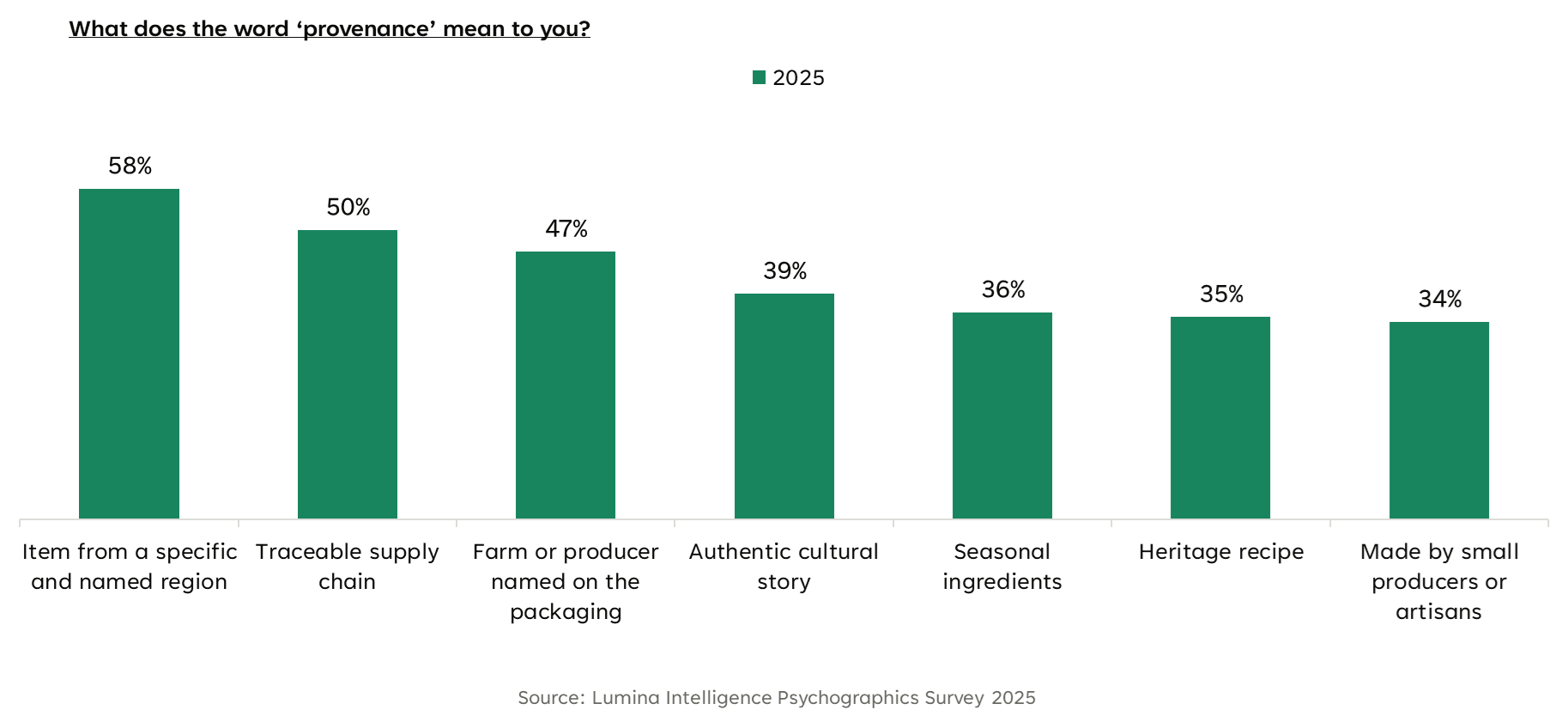

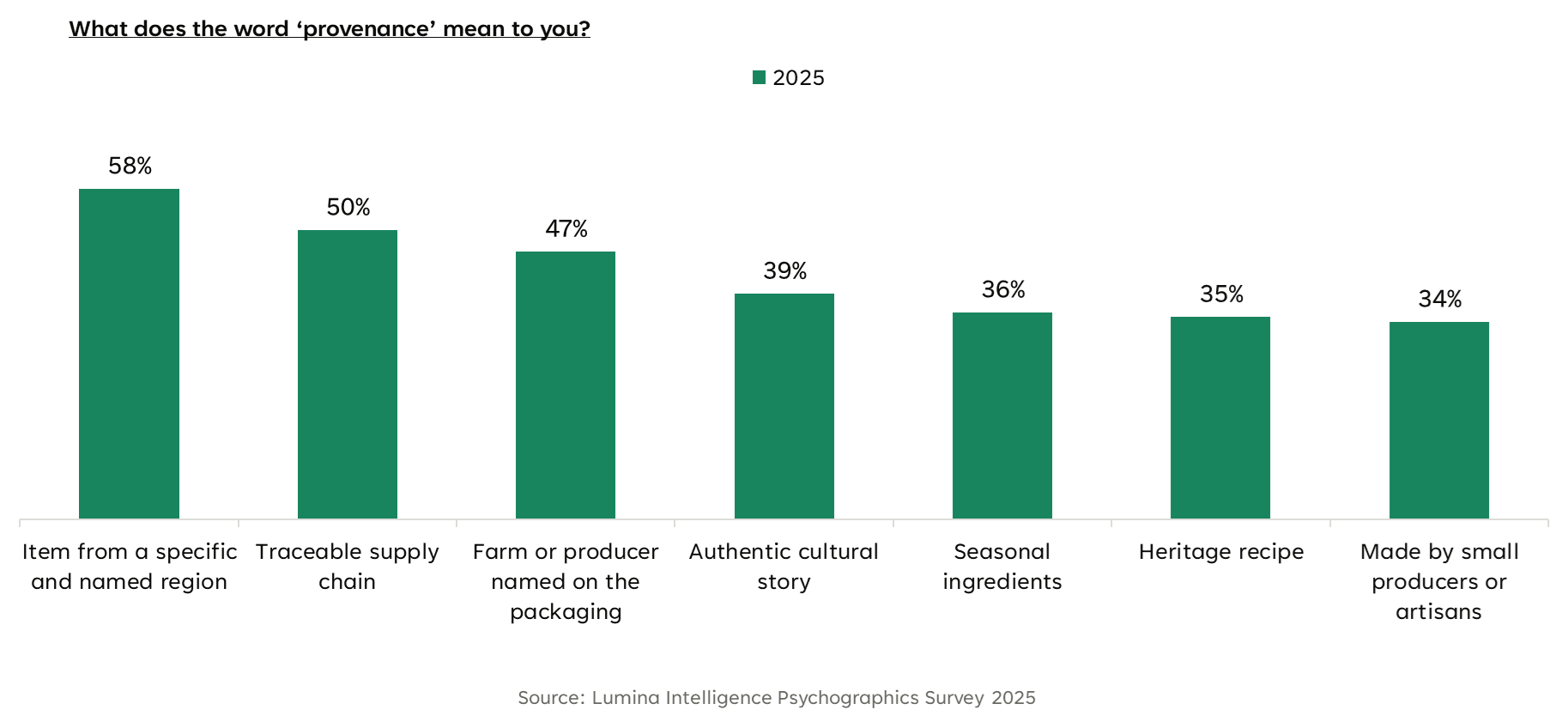

At the same time, provenance is re-emerging as a priority. More than a third of consumers say they would pay more for provenance, while over half associate it with a traceable supply chain. Together, these signals point to a new sustainability narrative: one centred on where food comes from, how it is produced, and how responsibility is embedded across areas such as climate security, packaging and waste, regenerative sourcing and long-term business practices.

Sustainability Then vs Now

Then: Plant-based boom, sustainability as a driver

The plant-based industry expanded rapidly, with new vegan dishes, products and consumers entering the market. Sustainability acted as a clear driver during this period.

Now: Sustainability as a consideration rather than a driver

Sustainability now sits below value and quality in consumer priorities, becoming more of a consideration than a primary driver. “Eats meat often” has increased by +3.2ppts, with health and UPF concerns triggering a shift towards quality and conscious meat consumption. At the same time, 36% of consumers say they would pay more for provenance, and 54% believe provenance means coming from a traceable supply chain.

Consumers expect sustainability to be embedded

Consumers are expecting sustainability practices to be embedded in items and menus. Engagement with recyclable packaging has increased year-on-year, and operators are focusing on supply chain efficiencies, food waste reduction, carbon emissions reduction and single-use plastics. Sustainability is being reframed around health, provenance and the sharing of information.

Sustainability Sits Below Value and Quality (But It’s Still an Expectation)

Sustainability now sits below value and quality in consumer priorities, reflecting a shift in how decisions are made. While consumers remain engaged with issues such as provenance, recyclable packaging and traceable supply chains, these considerations come after price and product quality. Commercially, this means sustainability alone is unlikely to justify a premium unless it is clearly linked to tangible benefits.

However, as expectations around embedded practices continue to rise, businesses that fail to meet basic sustainability standards risk falling behind.

Consumers define provenance in practical, verifiable terms, rather than at face-value story-telling. For brands, this means named regions, traceability, and supplier transparency are the fastest credibility wins.

Provenance is the New Sustainability Shortcut

Provenance is increasingly acting as a shorthand for sustainability. When consumers are asked what the term means, they associate it most strongly with an item coming from a specific and named region, a traceable supply chain, and a farm or producer named on the packaging.

Authentic cultural stories and heritage recipes also form part of the definition. In this context, provenance provides something tangible and verifiable. Clear information about origin, supply chain and producer builds credibility more effectively than broad sustainability messaging.

Climate Security is Now the Sustainability Story

Sustainability is increasingly being shaped by climate security. Extreme weather is already affecting key ingredients, with British wheat harvests impacted by drought and heavy rainfall, cocoa prices surging sharply between 2022 and 2024, and global coffee prices rising due to climate disruption. Looking ahead, suitable growing areas for crops such as coffee are projected to decline significantly.

These pressures move sustainability beyond ethics into commercial reality, linking climate risk directly to supply volatility, rising costs and reformulation. This is not only a question of food security, but food authenticity. As ingredient availability shifts and alternatives emerge, brands face potential risks around substitution, quality perception and maintaining product integrity.

What Operators Are Actually Doing

In response, operators are focusing on practical, operational sustainability. Supply chain efficiencies and food waste reduction are leading priorities, alongside carbon emissions reduction and action on single-use plastics. The emphasis is less on headline claims and more on measurable, embedded initiatives that manage cost pressures while responding to rising expectations around responsible practice.

What “Good” Looks Like in 2026

Best-in-class examples show sustainability integrated across packaging, sourcing, products and experience. Packaging innovation includes sustainable ready meal formats and plastic-free alternatives designed to decompose more quickly.

Regenerative sourcing is gaining visibility, with “regen” positioning appearing on-pack, although a significant proportion of consumers still do not fully understand the term. Sustainability is also being embedded directly into products, from solar-powered production to modular meal kits designed to reduce food waste. Meanwhile, experiential ethics are emerging through behavioural nudges to reduce waste and venue concepts incorporating hydroponic farming or kitchen gardens to reduce food miles.

What This Means for Brands, Retailers and Suppliers

For brands, retailers and suppliers, sustainability must be visible, specific and embedded into core operations. It increasingly needs to connect to quality, health and provenance rather than stand alone. Innovation also requires clearer consumer translation, particularly in areas such as regenerative agriculture where awareness remains limited. Provenance and transparency offer a direct route to credibility, providing tangible signals of responsible sourcing.

Looking ahead, sustainability is being reframed around health, provenance and the sharing of information. At the same time, supply chain risks are intensifying, and rapid trend cycles can further strain global sourcing. Businesses that anticipate these pressures and build resilience into their models will be better positioned to respond.

Conclusion

Sustainability is shifting from a standalone selling point to a practical, embedded expectation shaped by climate risk, supply realities and consumer demand for transparency. The brands that will succeed are those that make sustainability tangible, measurable and aligned with quality and health. For deeper insight into how these shifts are reshaping foodservice and retail strategy, Lumina Intelligence continues to track the data, behaviours and commercial implications driving the market forward.

FAQs

Is sustainability still important to UK consumers?

Yes, but it is no longer the primary driver of decision-making. Sustainability now sits below value and quality in consumer priorities. While it may not lead choice, it remains an expectation and influences perceptions of brands and operators.

Why is provenance becoming more important?

Consumers increasingly associate provenance with a named region, traceable supply chain and identifiable producers. Clear origin and sourcing information provides tangible proof, making it more credible than broad sustainability claims.

How is climate change affecting foodservice?

Extreme weather is impacting key ingredients such as wheat, cocoa and coffee, leading to supply volatility and price increases. Climate disruption is shifting sustainability from a marketing conversation to a supply chain and cost management issue.

What sustainability initiatives are operators focusing on?

Operators are prioritising supply chain efficiencies, food waste reduction, carbon emissions reduction and action on single-use plastics. The focus is on practical, measurable changes embedded into everyday operations.

What does ‘regenerative sourcing’ mean?

Regenerative sourcing refers to farming practices designed to restore soil health and ecosystems. However, consumer understanding remains limited, meaning brands must clearly explain what regenerative claims represent in practice.

How can brands make sustainability more effective?

Sustainability must be specific, visible and embedded into products and operations. Linking it to quality, health and provenance, while providing clear proof points, strengthens credibility and commercial impact.

What are the key sustainability opportunities for 2026?

Opportunities lie in reframing sustainability around health, transparency and provenance, building resilience against supply chain risk, and embedding sustainability into products, packaging and experiences rather than treating it as a standalone campaign.