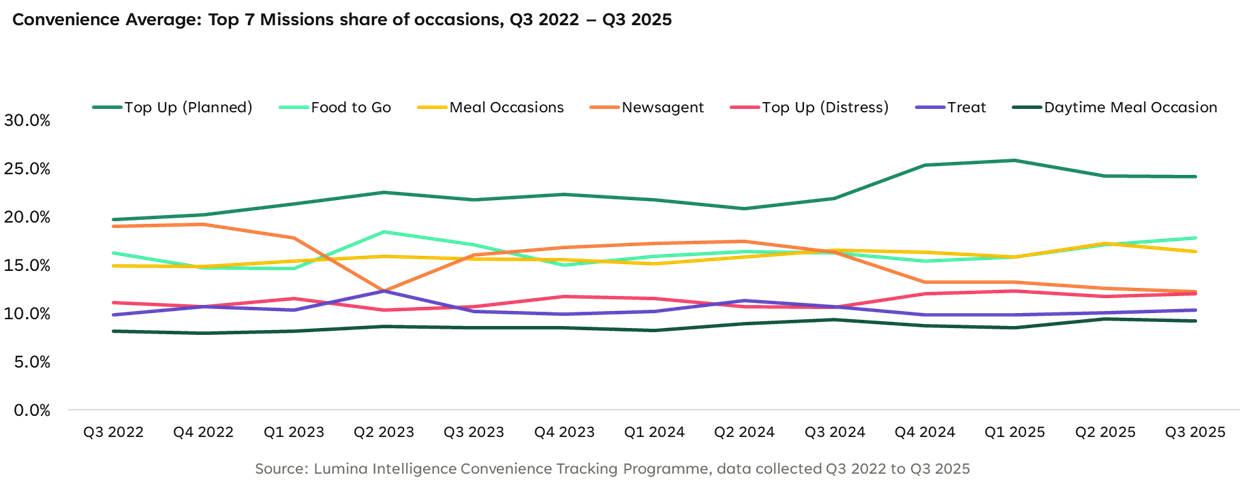

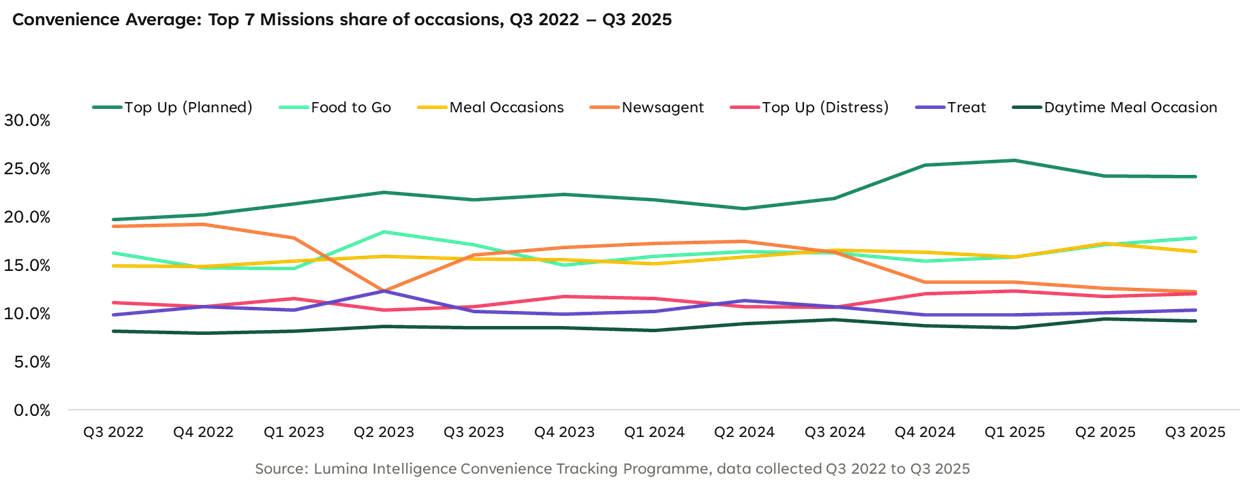

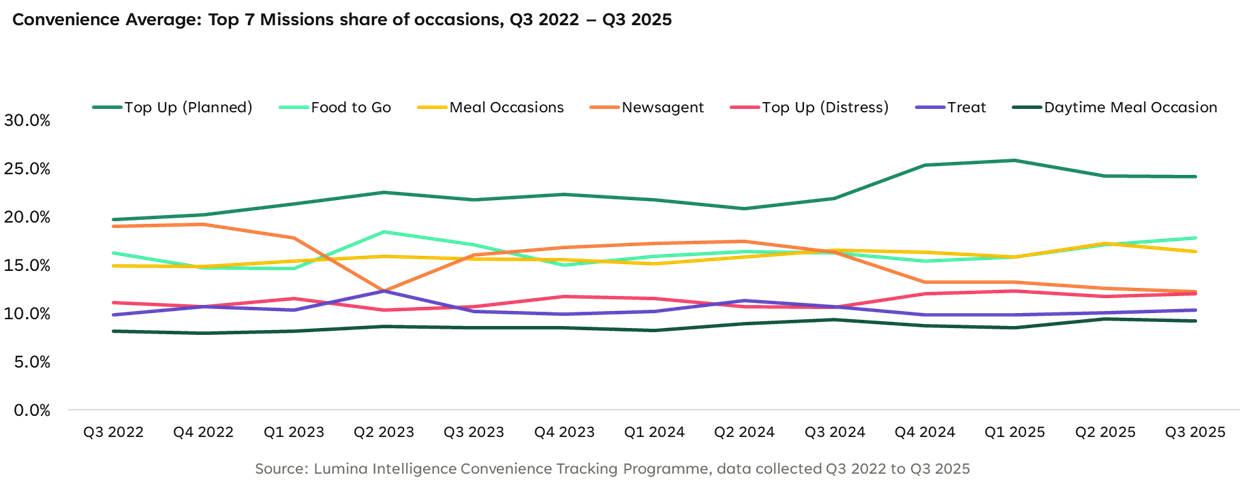

Planned top-ups are on the rise, comprising now almost one in four Convenience trips, as shoppers value the ease of nearby stores. This shift is shaping a new convenience playbook focused on mission-led ranging and clear value cues (including PMPs and promotions).

Growth is mostly driven by Managed Convenience stores, where improved fresh & chilled ranges, value messaging and loyalty strategies have helped encourage this behaviour. As retailers invest in different missions, giving consumers more reasons to visit, they’ll have to navigate cost-consciousness, since this remains front of mind. Consumers might manage their spend by buying fewer items per trip. Despite this, inflation and trading up means that basket spend declines at a slower rate to basket size.

This changing mix of more planned trips, sharper value expectations and immediate-consumption missions is not playing out evenly across convenience. Instead, it is most visible in forecourts, where shoppers are combining top-up needs with “on-the-move” food and drink occasions – and where execution against this new playbook is proving particularly effective.

Forecourts are outperforming: what they’re doing better

This new playbook is not delivering evenly across convenience. Forecourts, in particular, are emerging as the standout sub-channel within convenience. Lumina Intelligence’s CTP data shows that while penetration has been broadly stable across the channel, forecourts have been the strongest-performing format, reaching around 14% of shoppers over the quarter. At the same time, impulse purchasing has softened as trips become more planned; however, forecourts have proved relatively resilient, with impulse purchasing down by around 7 percentage points year-on-year, compared with a much steeper decline among symbols and independents (down by more than 12 points).

Taken together, it is this combination of solid reach and greater resilience on impulse what makes forecourts particularly well placed to benefit from more mission-led, on-the-move shopping behaviour.

Value without a race to the bottom: PMPs rise as promos soften

As shoppers become more value-focused, their planned top-up missions have also become more price sensitive – which historically has been a tough spot for convenience, where shoppers can easily decide to stock-up somewhere cheaper. The recent return to growth in top-up trips is therefore not happening by accident but is being driven by retailers actively responding to value demand.

In practice, that response has taken the form of value-led pricing strategies and clearer value cues designed to make shoppers more comfortable completing a planned top-up in convenience. Managed stores have adopted these strategies to encourage larger baskets, with Sainsbury’s Local’s rollout of Aldi Price Match cited as an example. This move positively impacted key staple categories such as tinned and packaged goods, bread and chilled, and supported a return to growth in planned top-up missions.

At the same time, the way value is delivered in convenience is changing. Promotional activity has softened overall, driven largely by a reduction in chilled food promotions, but this has not weakened value perception across the channel. Instead, PMP sales have risen across most channels, with forecourts reaching record levels. This growth has been led primarily by soft drinks and chilled foods, highlighting how clearer, everyday price reassurance is increasingly replacing deep promotional mechanics as the preferred way to signal value. This shift is becoming even more important ahead of the ban on volume-driving HFSS promotions from 1 October 2025, which will disproportionately impact forecourts that have historically relied more heavily on multibuy offers on confectionery.

Retail ↔ OOH blurring: win ‘right now’ missions

As convenience trips become more purposeful, the mix of missions is shifting away from traditional, incidental shopping towards a blend of planned top-ups and immediate-consumption occasions. In our latest mission comparison, Top Up (Planned) is identified as the fastest-growing mission, while Newsagent trips show the sharpest decline. This underlines a broader reset in how convenience is being used: fewer purely incidental visits, and more trips with a clear need in mind.

At the same time, the Top 10 missions increasingly reflect out-of-home style behaviour. Food to Go, Daytime Meal Occasion and Drink to Go all feature prominently, reinforcing that convenience is now competing directly with foodservice for immediate consumption alongside its traditional top-up role. In this context, execution borrowed from OOH becomes critical, from clear meal solutions to strong visual cues that simplify decision-making.

Retailers are responding by using technology and in-store theatre to bring these missions to life. The report highlights Sainsbury’s Local in Farringdon as an example, where digital screens and prominent in-store displays promote a £7 deli meal deal, combining a main, snack and drink. This type of execution enhances shopper engagement at the point of purchase and shows how retail and OOH are increasingly converging inside the convenience environment.

As planned top-ups grow and convenience trips become more intentional, the winning formula is becoming clearer. Retailers that align range and layout to shopper missions, reduce price anxiety through clearer value cues, and execute strongly against immediate-consumption occasions are best placed to capture spend. Forecourts show how this playbook works in practice, combining mission-led ranging with resilient impulse performance and strong value signalling to meet shoppers’ needs in the moment.

Ultimately, the new value playbook in convenience is about making value easy to understand and decisions easy to make. PMPs, smarter promotional strategies and clearer meal solutions all play a role in reassuring shoppers and encouraging bigger, more confident baskets.

FAQs

What is driving the growth of planned top-up shopping in convenience?

Planned top-up shopping is growing as shoppers value the ease of nearby stores but remain highly cost-conscious. Retailers are supporting this shift by investing in clearer value cues, improved fresh and chilled ranges, and mission-led layouts that make top-up trips feel easier and better value.

Why are forecourts outperforming other convenience formats?

Forecourts are benefiting from a combination of strong reach and greater resilience in impulse purchasing. Their ability to serve both planned top-up needs and on-the-move food and drink occasions makes them well placed to capture more mission-led trips.

Are promotions becoming less important in convenience?

Promotions still matter, but their role is changing. As volume-driving promotions soften, particularly in chilled, retailers are relying more on everyday value signals such as PMPs to reassure shoppers and support basket building.

Why are price-marked packs (PMPs) growing in importance?

PMPs provide clear, immediate price reassurance at shelf, which is increasingly valuable as shoppers manage their spending more carefully. Their growth has been led by categories such as soft drinks and chilled foods, and they are becoming an important alternative to deep promotional mechanics.

How is convenience competing more directly with out-of-home?

Convenience is increasingly winning “right now” missions such as Food to Go, Daytime Meal Occasion and Drink to Go. Retailers are borrowing cues from foodservice—such as meal solutions, strong visual cues and digital screens—to simplify decision-making and increase engagement at the point of purchase.

About the data

These insights have been powered by Lumina Intelligence’s Convenience Tracking Programme, our insight solution based on 50,000 annual interviews from a nationally representative sample by age, gender and region – captured across the year and delivered every 4-weeks providing the most up to date shopper data on the channel .