The UK forecourt market is undergoing a transformation, shaped by shifting consumer needs, rising fuel prices, and the growing presence of electric vehicle (EV) infrastructure. Once centred around petrol sales, today’s forecourts are redefining themselves as convenience-led destinations, increasingly focused on fresh food, food to go, and service expansion. With 69% of purchases made impulsively and basket sizes outpacing other convenience formats, the sector presents both a commercial challenge and a growth opportunity. As operators respond to inflationary pressures and evolving shopper mindsets, understanding the latest forecourt retail trends is critical for stakeholders navigating this dynamic environment.

The UK forecourt market remains a major pillar of the convenience sector, accounting for 18.3% of total UK convenience sales and generating £5.9 billion in revenue from forecourt shops alone in 2024. Despite volume pressures from reduced fuel demand, the sector continues to show resilience through diversification, particularly in foodservice, food to go, and branded coffee partnerships.

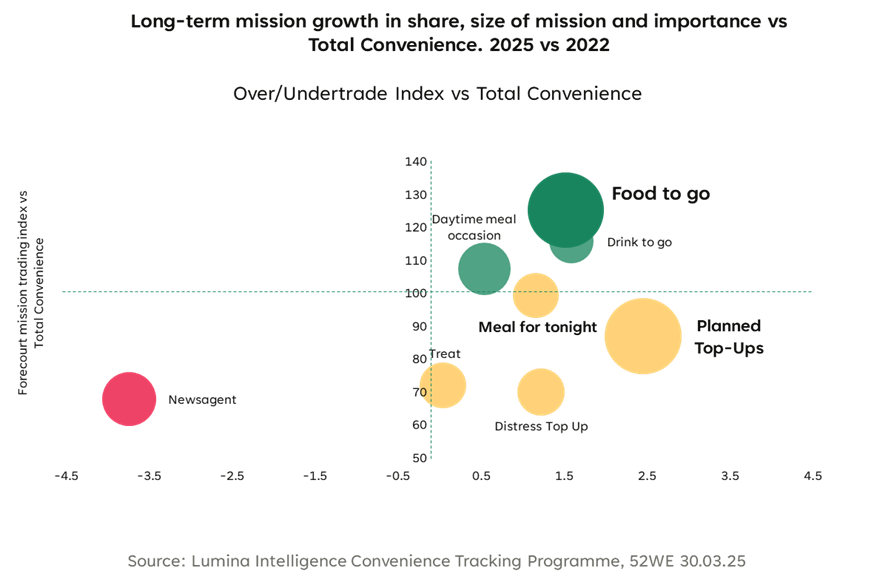

Forecourts now cater to nearly 4 million weekly missions, with a clear consumer shift toward multi-purpose trips – combining fuel purchases, top-up grocery shopping, and fresh food options. According to recent forecourt market statistics, over half of shoppers enter for food and drink, while only 25% visit purely for fuel. This marks a significant evolution in shopper behaviour and highlights the growing importance of forecourt food to go in driving footfall and spend.

As EV adoption accelerates, so does the shift from fuel-first to retail-first formats. Operators are investing in EV charging stations, coffee franchises, and fresh food concepts to capture dwell time and broaden revenue streams. Amidst this retail repositioning, the UK forecourt market is increasingly defined by its adaptability and its role in shaping broader convenience retail trends.

Shopper behaviour within the UK forecourt market continues to evolve, with impulse-led missions and increased food-to-go purchases defining today’s consumer profile. The latest data reveals that 69% of forecourt purchases are unplanned, highlighting the importance of in-store merchandising, promotional triggers, and product visibility in converting traffic into spend.

The food to go category remains a core driver, with 1 in 5 forecourt shoppers now buying food to go during their visit. This trend is particularly pronounced among commuters, younger demographics, and value-driven shoppers, with breakfast and lunch missions growing steadily. Healthier formats, hot food options, and dual meal deals (e.g. “lunch plus coffee”) are gaining ground, aligning with broader convenience retail trends.

Interestingly, EV drivers exhibit different purchasing behaviour, often spending more time on-site and engaging with food and drink offers while charging. This presents a strategic opportunity to tailor promotions and product ranges to match these dwell-heavy missions.

Shopper segmentation also reveals the growing influence of the “top-up and treat” mindset. With forecourts increasingly seen as neighbourhood convenience hubs—not just travel stops—retailers must continue to adapt to changing forecourt shopper behaviour and offer a compelling mix of mission-based value, quality, and speed.

Digital transformation is redefining the UK forecourt market, as operators turn to technology to boost engagement, streamline operations, and future-proof their formats. From digital signage and contactless payments to loyalty apps and AI-driven merchandising, forecourt retailers are investing in tools that personalise the customer journey and maximise spend per visit.

A key area of innovation is the integration of EV charging stations UK-wide, with forecourt brands redesigning layouts to accommodate longer dwell times. This shift is fuelling investment in better seating, Wi-Fi-enabled zones, and premium food-to-go offers designed to appeal to EV users during charging breaks. The forecourt is no longer a brief stop – it’s becoming a destination.

Franchise partnerships with branded foodservice operators – including Greggs, Costa, and Subway – are also on the rise, allowing forecourts to offer established menus without the need for in-house kitchen infrastructure. These partnerships increase footfall and basket value while reinforcing brand equity.

Smart inventory systems, mobile ordering integrations, and digital kiosks are now entering the forecourt environment, bridging convenience and speed. As the fuel and convenience sector leans into retail-first thinking, technology is emerging as a key differentiator, allowing operators to respond in real time to consumer demand and shopping mission complexity.

The future of the UK forecourt market will be shaped by its ability to adapt to three core dynamics: the long-term decline of fuel sales, the rapid rise in EV adoption, and consumers’ growing expectations around food quality and service. With forecourts already accounting for nearly one-fifth of convenience sales, the opportunity to redefine their role within local communities is both immediate and substantial.

Retail-first forecourts are no longer a vision: they are a commercial necessity. Operators who invest in food to go, loyalty ecosystems, and EV-ready infrastructure will be best placed to retain relevance and profitability. The emphasis on forecourt food to go and multi-mission convenience will continue to drive format evolution, with modular stores, kiosk concepts, and collaboration-led formats becoming increasingly prevalent.

To capture value, businesses must also address gaps in data-led decision-making, particularly around forecourt shopper behaviour and site-specific sales performance. As competition increases, real-time insights and flexible formats will be essential in keeping pace with national convenience retail trends.

While the transition may pose challenges, it also presents significant upside for those who act early. The most successful players will not only follow forecourt retail trends – they will define them.

The UK forecourt market is shifting from fuel-led to retail-first, shaped by digital innovation, EV growth, and evolving shopper needs. To succeed, operators must act on key forecourt retail trends, optimise for mission-based purchases, and position themselves as destination-led formats within the wider fuel and convenience sector.

FAQs

What is the current size of the UK forecourt market?

In 2024, UK forecourt stores generated £5.9 billion, accounting for 18.3% of total convenience retail sales.

What are the biggest forecourt retail trends in 2025?

The leading forecourt retail trends include growth in food to go, increased EV charging infrastructure, and digital innovation such as loyalty apps and self-checkout kiosks.

How is shopper behaviour changing in forecourts?

Forecourt shopper behaviour is increasingly mission-driven, with 69% of purchases unplanned and foodservice playing a bigger role than fuel alone.

What opportunities does EV growth create for forecourts?

With longer dwell times, EV charging stations UK are encouraging forecourts to upgrade facilities, offer seating, Wi-Fi, and premium food-to-go services.

What role does food to go play in the forecourt sector?

Forecourt food to go is a key growth driver, particularly during breakfast and lunch. Branded foodservice partnerships help boost spend and loyalty.

Why is format innovation important in the fuel and convenience sector?

As the traditional fuel model declines, forecourts must embrace modular retail formats, digital tools, and food-focused offerings to stay competitive.