The UK coffee market has faced a series of headwinds in recent years. From the ongoing cost of living crisis and its impact on disposable incomes, to global political and economic instability disrupting supply chains and pushing up costs. The ever-increasing impact of climate change leading to droughts, crop failures, and supply shortages makes the category operate under immense pressure.

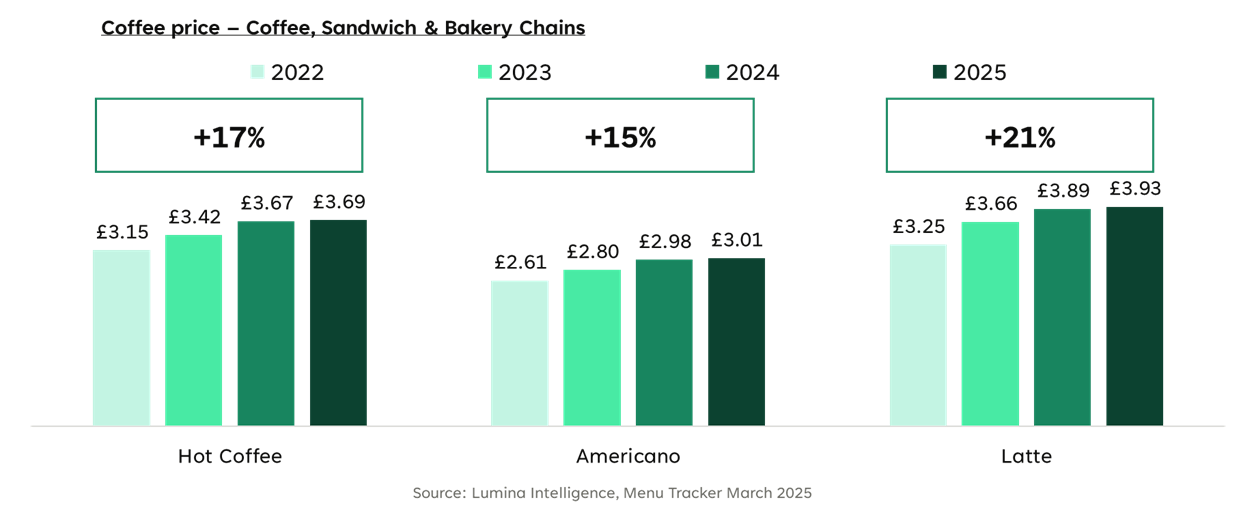

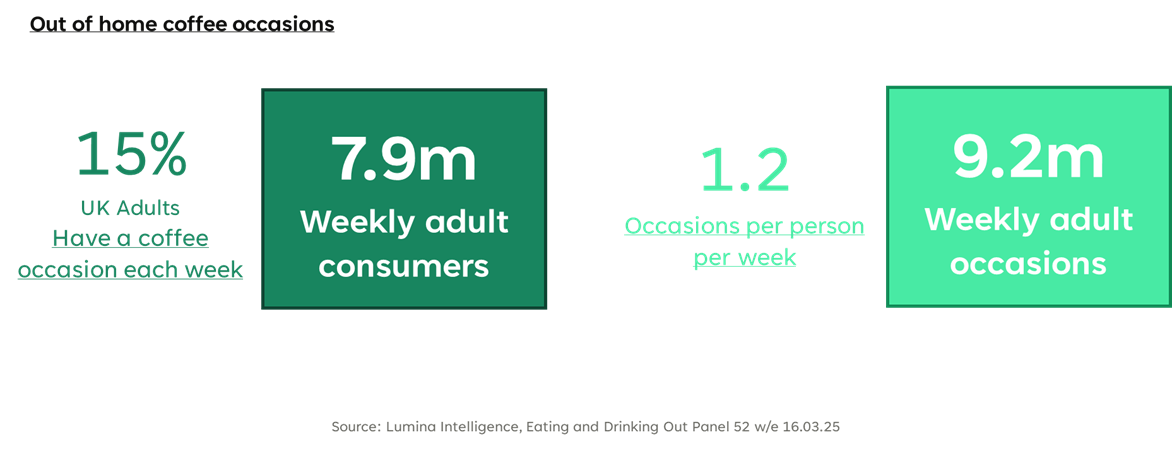

Despite these challenges, coffee consumption in the UK remains strong. According to Lumina Intelligence’s Menu Tracker data, the average price of a hot coffee has risen by 17% since 2022 – well ahead of inflation –, and 15% of UK adults buy an out-of-home coffee at least once a week, equating to over 9 million out-of-home coffee occasions. And that number continues to grow.

Insight covered in this article

What Is the Size of the UK Coffee Market in 2025?

With a £6.1bn turnover in 2024/25, coffee shops/cafés & dessert parlours are up +4.1% YoY. The category is poised for robust growth led by physical expansion and product innovation across brands including Blank Street Coffee, Blacksheep Coffee, Starbucks or Caffè Nero.

The UK coffee market increased its share of the eating out market turnover from 6.6% in 2022 to 7.1% in 2025F. Investment in franchise models and net new space alongside more premium brands and expanded ranges has driven an outlet growth of +2.4%, 12,229 outlets, with a wave of newer, more premium UK coffee brands expanding in this channel.

Equally, a more pervasive coffee culture is broadening the mass market appeal of cafés and fostering channel growth.

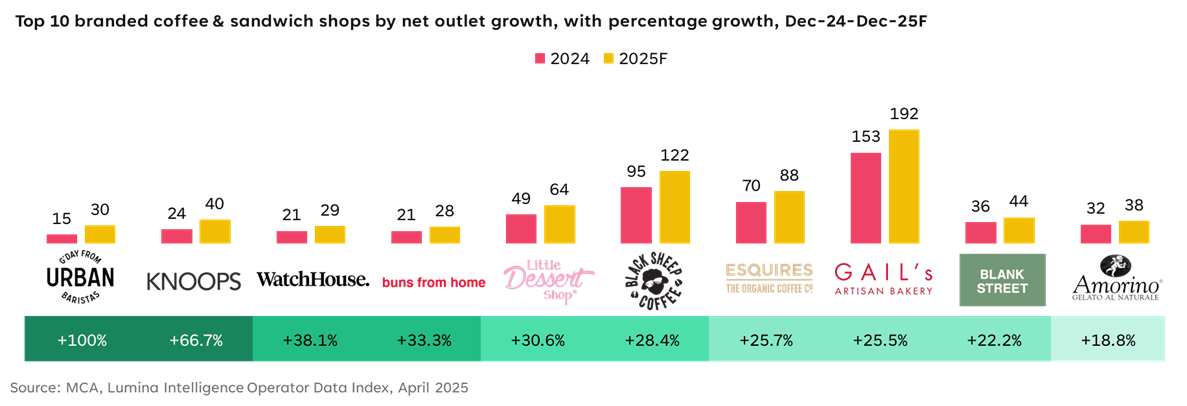

Said growth is concentrated among brands with premium, distinctive offers. Urban Baristas is expected to double its estate in 2025 driven by its franchise model enabling the brand to target regional whitespace. Novelty hot chocolate chain Knoops and speciality coffee concept WatchHouse are leveraging investor backing to scale UK footprints with Knoops eyeing international markets while WatchHouse launches its franchise prospectus to grow in core London markets and abroad.

Growth Trends in the UK Coffee Market

- Premiumisation

Premium coffee operators are thriving, with consumers increasingly seeking higher quality, artisan-style experiences. Premium chains such as WatchHouse (+38% turnover growth), Black Sheep Coffee (+28%), and Blank Street (+27%) reported strong double-digit growth between December 2024 and December 2025. All this confirms there’s a willingness to spend more for perceived quality, especially during social or indulgent occasions. - Cold Coffee and RTD Formats

Mindful indulgence and seasonal innovation are pushing the popularity of iced and ready-to-drink (RTD) coffee formats. Operators like Coco di Mama and Caffè Nero have introduced eye-catching iced matcha drinks and flavoured lattes (e.g., pistachio or chocolate variants), tapping into younger, health-conscious demographics and social-media-savvy audiences.

Black Sheep Coffee saw a +227% year-on-year uplift in iced beverage sales in the last week of April, following its spring range launch. Lemonades rose +315%, driven by the introduction of Matcha Lemonades, highlighting growing demand for functional, flavour-led options. Iced drinks have transitioned from seasonal novelties to year-round staples, driving both footfall and spend. - Sustainability and Ethical Sourcing

There is increasing demand for locally sourced ingredients and ethical transparency. Latest insights from Lumina Intelligence’s Menu Tracker indicates a noticeable emphasis on locally sourced ingredients for their “treat missions”, which consumers ranked highly, alongside quality and having a wide choice, suggesting an underlying preference for sustainable coffee consumption when indulging. - Increased Home and Hybrid Consumption

The growing complexity of consumer coffee habits, from functional morning routines to social weekend treats, suggests a hybrid lifestyle has been stablished when it comes to coffee consumption in UK. Consumers want value and convenience during the week, and premium, café-style experiences during leisure time. Cafés are also positioning themselves as alternative late-night venues, expanding usage occasions.

Segments Growing the Fastest

Out-of-Home vs Retail vs Online

Out-of-home coffee UK consumption has shown resilience amid economic pressures, with weekly penetration increasing from 13.0% in 2022 to 15.1% in 2025, a 3% rise in weekly coffee occasions. Despite price increases (average coffee up +17% since 2022), 7.9 million UK adults continue to consume coffee OOH weekly, indicating robust demand for public-facing coffee experiences.

Branded vs Private Label

Branded coffee chains are outpacing the market through innovation, tech-enabled service, and quality differentiation. Greggs, a value-focused branded operator, has successfully balanced cost and quality, with increased satisfaction ratings for taste and value, and now commands 9% share of all OOH coffee occasions. Meanwhile, artisanal and premium chains are also growing rapidly, leveraging brand identity and exclusive offerings to capture discretionary spending.

UK Coffee Market Share

Coffee shops and cafés now represent approximately 6.0% of the total UK eating out market, up from 5.5% in 2022, reflecting a +0.5ppt increase in turnover share, according to data from the Lumina Intelligence Eating & Drinking Out Panel. This continued growth underscores the strength of the channel, driven by robust outlet expansion, franchising momentum, and a consumer shift toward more premium and accessible formats.

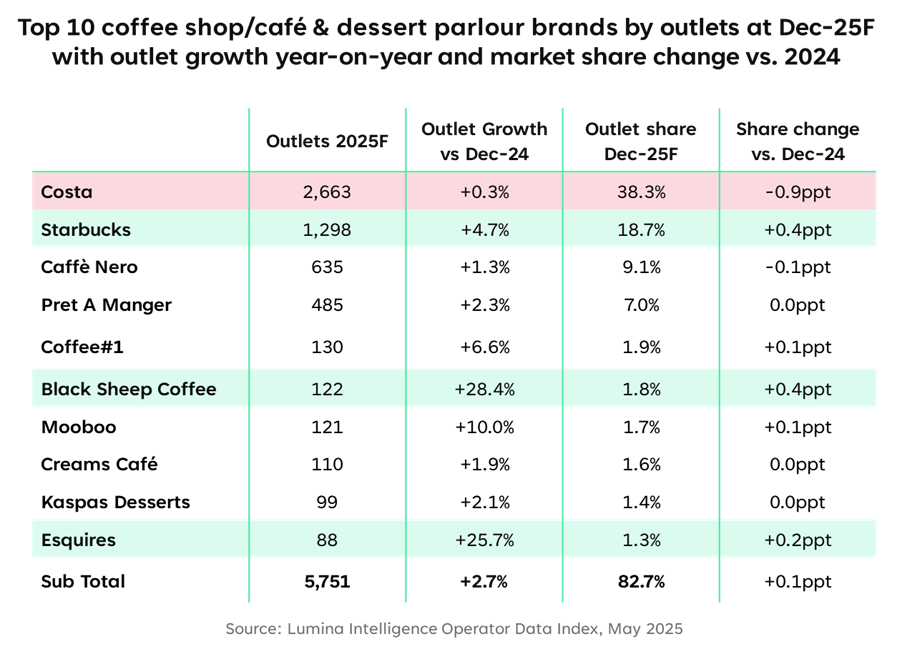

According to Lumina Intelligence Operator Data Index (May 2025), the top 10 coffee shop, café and dessert parlour brands are projected to operate a total of 5,751 outlets by December 2025, representing a +2.7% year-on-year outlet growth. Together, these brands account for 82.7% of the market share, a modest increase of +0.1ppt compared to the previous year.

Costa continues to lead the market with 2,663 outlets, securing a dominant 38.3% share. However, its share has slipped by -0.9ppt versus December 2024. In contrast, Starbucks has strengthened its position, with its outlet growth of +4.7% supporting an 18.7% share of the market and a +0.4ppt increase. Other established players such as Caffè Nero and Pret A Manger maintain significant positions with 9.1% and 7.0% market share respectively, though their year-on-year share changes have been minimal or flat.

This outlet expansion across challenger and established brands reflects a wider market trend. Coffee shops/cafés are one of the strongest-performing segments in the eating out market, driven by investment in franchise models and the opening of new premium and differentiated store formats. Alongside newer premium brands such as Knoops, Black Sheep Coffee and Gail’s Artisan Bakery, this channel is benefiting from broadened propositions and algorithm-driven site selection strategies. Overall, coffee shops and cafés are forecast to grow turnover by 4.1% in 2025F, with their channel share rising by +0.5ppt compared to 2022.

Leading Coffee Brands in the UK (2025)

Growth across the branded coffee and sandwich shop market is increasingly being driven by premium and distinctive offers. Brands such as Urban Baristas, Knoops and WatchHouse are seeing strong gains, each leveraging a clear brand proposition and strategic expansion model. Urban Baristas is expected to double its estate in 2025, driven by its franchise model that enables it to target regional whitespace. Knoops, known for its novelty hot chocolate, and WatchHouse, a speciality coffee concept, are leveraging investor backing to accelerate their UK footprint. Knoops is also eyeing international markets, while WatchHouse is set to launch its franchise prospectus to grow in core London locations and abroad.

The top five branded operators by net outlet growth forecast for December 2025F highlight the brands set to lead the next phase of expansion in the UK coffee and sandwich space:

- Gail’s Artisan Bakery: +192 outlets (+25.5%)

- Black Sheep Coffee: +122 outlets (+28.4%)

- Esquires: +88 outlets (+25.7%)

- Little Dessert Shop: +64 outlets (+30.6%)

- Knoops: +40 outlets (+66.7%)

These brands support the trends towards differentiated, quality-led formats supported by financial investment and scalable expansion strategies.

Future Outlook

Coffee shops and cafés are set to remain one of the strongest-performing segments within the UK eating out market over the coming years. Their continued market share growth is expected to be driven by net outlet expansion, particularly in high footfall locations such as travel hubs, and by sustained investment in product innovation. Brands are increasingly focusing on more premium, health-led and differentiated propositions to attract a broader customer base and boost frequency of visit.

The UK coffee industry growth is also being fuelled by evolving consumer habits and lifestyle shifts. A rising appetite for higher quality, artisan-style experiences is underpinning the success of premium operators such as WatchHouse, Knoops and Black Sheep Coffee. At the same time, iced and ready-to-drink formats are moving from seasonal novelties to year-round staples, contributing to increased footfall and spend. Weekly penetration of out-of-home coffee UK occasions has reached 15.1% in 2025, up from 13.0% in 2022, demonstrating both resilience and growing demand despite economic pressures. As cafés continue to diversify their offering across a wider range of day-parts and usage occasions, they are poised to play an even greater role within the eating out landscape.

What is the UK coffee market worth in 2025?

The UK coffee shop, café and dessert parlour segment is forecast to reach £6.1 billion in turnover in 2024/25, reflecting a +4.1% year-on-year growth.

How big is the coffee market in the UK?

Coffee shops and cafés are expected to represent 7.1% of the total eating out market turnover in 2025, with around 12,229 outlets operating across the UK.

Is coffee becoming more popular in the UK?

Yes. Out-of-home coffee consumption has grown, with weekly penetration increasing from 13.0% in 2022 to 15.1% in 2025, equating to over 7.9 million regular consumers.

What are the 5 largest coffee chains in the UK by market share?

- Costa – 38.3%

- Starbucks – 18.7%

- Caffè Nero – 9.1%

- Pret A Manger – 7.0%

- Greggs – 9% share of out-of-home coffee occasions

How much does the UK spend on coffee?

UK consumers are projected to spend £6.1 billion on out-of-home coffee in 2025, despite a 17% increase in average coffee prices since 2022.

How fast is the UK coffee industry growing?

The sector is expanding steadily, with +4.1% turnover growth, +2.4% outlet growth, and increased frequency of coffee occasions—especially among premium and branded operators.

Who are the top coffee brands in the UK?

The market leaders include Costa, Starbucks, Caffè Nero, Pret A Manger, and Greggs. Fast-growing challengers include Black Sheep Coffee, WatchHouse, Knoops, and Gail’s Artisan Bakery.

What type of coffee is most popular in the UK?

While traditional hot coffee dominates, iced and ready-to-drink (RTD) formats are rapidly gaining popularity, now seen as year-round staples driven by health, indulgence, and social media appeal.