When it comes to health and nutrition, the idea of a single set of global nutrition trends can be misleading. In the wellness conversation, what consumers prioritise, and how they define healthy eating, varies sharply by country.

Lumina Intelligence’s global consumer study surveyed 9,500 consumers across 13 markets including the US, UK, China, Japan, India and major European economies. The findings are clear: health goals, perceptions and nutrition behaviours are shaped by culture, lifestyle and food traditions.

For brands, relying on assumed “global” nutrition narratives risks misaligned product development, reformulation and messaging. The real opportunity lies in understanding why priorities differ and responding locally.

Why global nutrition trends are not one-size-fits-all

The research shows stark differences in how consumers approach health across markets. While broad themes like wellness and longevity appear everywhere, their priority and behaviours attached to them vary significantly.

The definition of health in some countries consists in maintaining balance through fresh, minimally processed foods. In others, it is associated with functionality, added benefits or targeted solutions. These differences influence purchasing decisions, willingness to pay, and openness to innovation.

These factors make localisation central to an effective nutrition strategy.

The health goals shaping nutrition choices globally

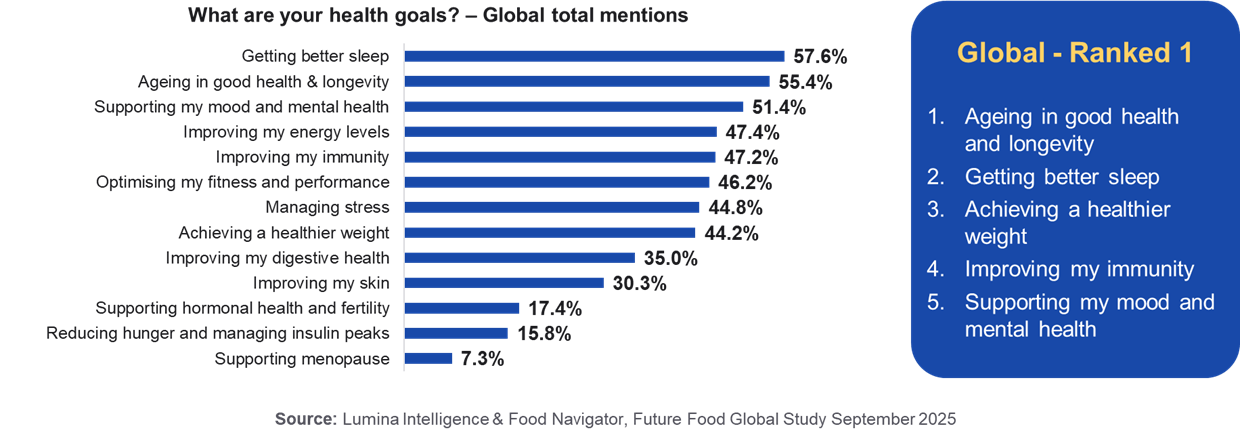

Globally, consumers cite a wide range of health goals, but a small cluster dominates across markets:

- Ageing in good health and longevity

- Better sleep

- Achieving a healthier weight

- Improving immunity

- Supporting mood and mental health

These appear consistently, but their priority ranking differs by market. For example, longevity leads in many Western countries, while sleep rises to the top in markets with demanding work cultures. In China and India, immunity takes precedence.

Stated health goals predict purchasing behaviour. Consumers are actively buying products that align with their priorities, whether that means protein-enriched foods, immune-supporting ingredients or functional benefits.

Cultural heritage and traditional health beliefs

In Asia, traditional systems of health continue to shape modern nutrition choices. In China and India, Traditional Chinese Medicine and Ayurvedic practices emphasise strengthening the body’s natural defences. This translates into strong consumer focus on immunity-supporting foods and ingredients.

In contrast, Southern European markets such as Italy, France and Spain place greater emphasis on fresh, natural diets rooted in culinary tradition. Here, health is often seen as something inherent to how food is prepared and eaten, not added through fortification.

Work culture, modern lifestyles and health focus

Lifestyle pressure is another major driver of nutrition priorities. Sleep emerges as a top health goal in Japan and Singapore, reflecting demanding work cultures and widespread awareness of sleep deprivation.

This creates opportunities for nutrition solutions beyond energy and performance, addressing instead recovery and relaxation.

What “healthy eating” means in different markets.

Across markets, consumers tend to define healthy eating more by what they add than what they restrict. Eating plenty of fruit and vegetables, staying hydrated and maintaining dietary balance consistently rank above avoidance behaviours.

That said, regional differences remain. Avoidance of ultra-processed foods is far more embedded in Southern Europe, while in other markets it is a newer concept.

Regional nutrition trends in practice

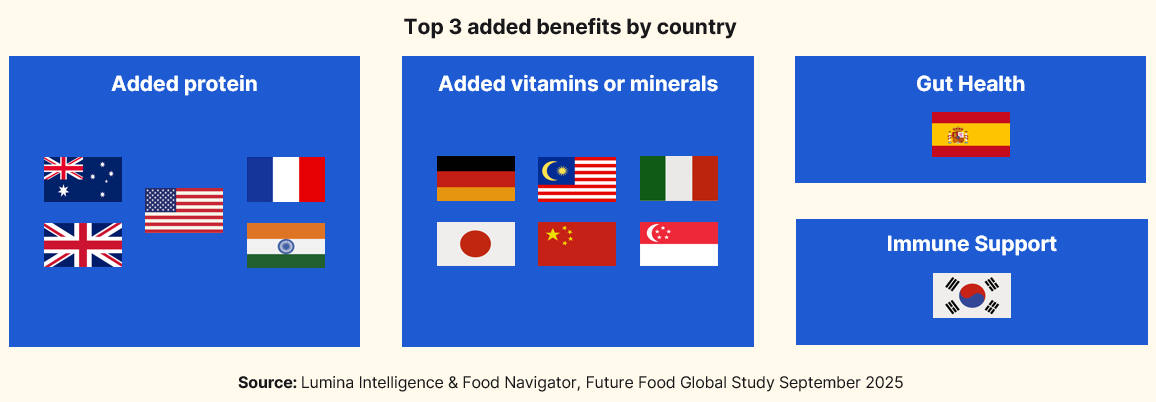

Western markets In the US, UK and Australia, protein is the leading added benefit. Protein-led innovation has expanded beyond sports nutrition, spanning cereals, snacks and confectionery. These markets also show strong demand for functional benefits linked to fitness, energy and performance.

Asian markets Asian markets demonstrate higher engagement with functional ingredients. Consumers in China, India, Malaysia and South Korea are more familiar with ingredients like functional mushrooms, adaptogens, nootropics and seaweed-derived nutrients.

Japan stands apart as an exception. Functional ingredients are often seen as part of the everyday diet rather than something to be added, contributing to greater scepticism toward overtly fortified products.

Southern & Continental Europe In France, Italy and Spain, interest in added benefits is notably lower. Strong food cultures, emphasis on home cooking and lower consumption of conventionally “unhealthy” categories reduce the perceived need for functional enhancement.

Perception vs reality in healthy eating

A striking insight from the research is the gap between perception and consumption.

Around four in five consumers globally believe they eat healthily. Yet in several markets – including the UK, US, Australia and China – this confidence sits alongside above-average consumption of conventionally unhealthy categories.

Conversely, France and Italy show closer alignment between perception and reality, with both low consumption of unhealthy categories and lower interest in health-led innovation. This disconnect elsewhere creates challenges for education and brand communication.

Global nutrition trends are shaped locally

In conclusion, the idea of a single set of global nutrition trends does not reflect how consumers think about health. While shared goals such as better sleep, longevity and immunity appear across markets, the meaning, priority and behaviours attached to them vary widely by country.

Culture, lifestyle and food tradition play a decisive role in shaping how health is defined. Just as importantly, consumers’ perceptions of how healthy they eat often diverge from their actual behaviour, creating further regional complexity.

Understanding global nutrition today therefore requires moving beyond headline trends to examine how health priorities are interpreted locally.

About the data

These insights have been powered by Lumina Intelligence’s global quantitative online survey, commissioned exclusively for Food Navigator. Fieldwork was completed in July 2025, capturing the views of 9,500 consumers across 13 countries: Australia, China, France, Germany, India, Italy, Japan, Malaysia, Singapore, South Korea, Spain, the UK, and the USA. Each national sample is representative, with larger bases in China and the USA (2,000 respondents each) and 500 respondents in all other markets.

FAQs

What are global nutrition trends?

Global nutrition trends refer to broad patterns in health priorities and eating behaviours observed across multiple countries, such as interest in longevity, better sleep, immunity and healthier weight. However, while these goals appear globally, how they are prioritised and acted upon varies significantly by market.

Why aren’t global nutrition trends the same in every country?

Nutrition priorities are shaped by local culture, lifestyle, work patterns and food traditions. The research shows that consumers define “healthy eating” differently depending on where they live, meaning that the same health goal can lead to very different food choices across markets.

How do nutrition trends differ by country?

The study highlights clear regional differences. Western markets such as the US, UK and Australia show strong demand for protein and performance-linked benefits. Asian markets demonstrate higher engagement with functional ingredients, often influenced by traditional health systems. Southern European countries tend to prioritise fresh, minimally processed foods and show lower interest in added benefits.

What health goals matter most to consumers globally?

Across markets, the most commonly cited health goals include ageing in good health and longevity, better sleep, achieving a healthier weight, improving immunity, and supporting mood and mental health. While these goals are widely shared, their ranking and influence on purchasing behaviour differs by country.

How does culture influence nutrition behaviour?

Cultural heritage plays a major role in shaping nutrition choices. Traditional Chinese Medicine and Ayurveda influence immunity-focused priorities in China and India, while strong culinary traditions in countries like France and Italy support a view of health rooted in natural, home-cooked food rather than functional fortification.

Do consumers’ perceptions of healthy eating match their behaviour?

Often they do not. While most consumers globally believe they eat healthily, in several markets this perception coexists with high consumption of conventionally unhealthy food categories. Other markets, particularly France and Italy, show closer alignment between perceived and actual dietary behaviour.

What does this mean for understanding nutrition trends globally?

The findings suggest that global nutrition trends cannot be interpreted without local context. Shared health goals exist, but the way consumers define, prioritise and act on them is shaped locally. Understanding these differences is essential to accurately interpret nutrition behaviour across markets.