The concept of the “gut–brain axis” began taking shape as early as the 1840s, when surgeon William Beaumont observed a connection between digestion and emotional states while studying a patient with a permanent opening in his stomach. Later, in the early 1900s, Pavlov further established the foundations of gut–brain communication through his work on the physiological links between the nervous system and digestive processes.

According to the Human Microbiome Project (HMP), more than 200 bacterial species were identified and linked to specific roles in the human body, highlighting the microbiome as “a promising new therapeutic target.” Researchers note that certain probiotic strains – referred to as psychobiotics – can produce neurotransmitters and influence the central nervous system, with studies showing potential benefits for depression, anxiety, stress, sleep disturbances, and neurodegenerative conditions. [Source: Anderson, Cryan & Dinan, via the Human Microbiome Project review (PMC9786924).]

Today, the relationship between our digestive health and overall wellbeing has reached new prominence. People are more aware of this connection than ever before, yet significant gaps remain in fully understanding how the two systems interact, and what are the best practices to ensure mens sana in intestino sano.

Gut Health as a Distinct Consumer Priority

Our research signals gut health as a meaningful priority for consumers, yet their everyday habits often don’t align with this intention. While digestive wellbeing is consistently named as an important health goal, many people still classify their diets as “healthy” even when their weekly intake includes high levels of foods typically viewed as less supportive of gut function. This mismatch suggests that gut-related decisions are still guided more by perception than by behaviour.

When people describe what a “healthy diet” looks like, they tend to emphasise adding positive elements, such as fruits, vegetables, hydration, and a balanced mix of foods, rather than limiting the items that can negatively affect digestion. Actions like reducing ultra-processed foods, monitoring portion sizes, or cutting down on high-calorie options rank far lower. In some countries, naturally fibre-rich diets lead to more alignment between intention and behaviour, while elsewhere the pattern is reversed, highlighting how cultural norms shape gut-health habits as much as nutrition knowledge does.

Understanding of Gut-Linked Foods Is Often Confused

Latest Lumina Intelligence nutrition data reveals a wide variation in how consumers interpret terms associated with food processing, ingredients, and the types of products they think may affect gut health. When asked what comes to mind with the term “ultra-processed food,” responses range from “foods that are bad for your health” and “foods with long ingredient lists” to fast food, ready meals, packaged snacks, and foods made mostly in factories. Younger age groups associate these foods with ready meals, while older groups link them to factory production. This lack of clarity indicates that many consumers are navigating gut-related concerns without a consistent understanding of the categories they are trying to avoid.

And are there, in fact, UPFs that could be deemed good for our digestive health? These would be:

- Prebiotics – such as a whole-grain, vitamin-fortified breakfast cereal.

- Probiotics – Plain, low-sugar versions of yogurt and kefir are considered UPFs because they are industrially processed.

- High fibre products – such as mass-produced whole-grain breads

- High protein products – i.e., baked beans.

It’s important to choose low-sugar, low-additive versions of these products so the added ingredients don’t counteract their intended benefits.

What Consumers Do for Their Gut

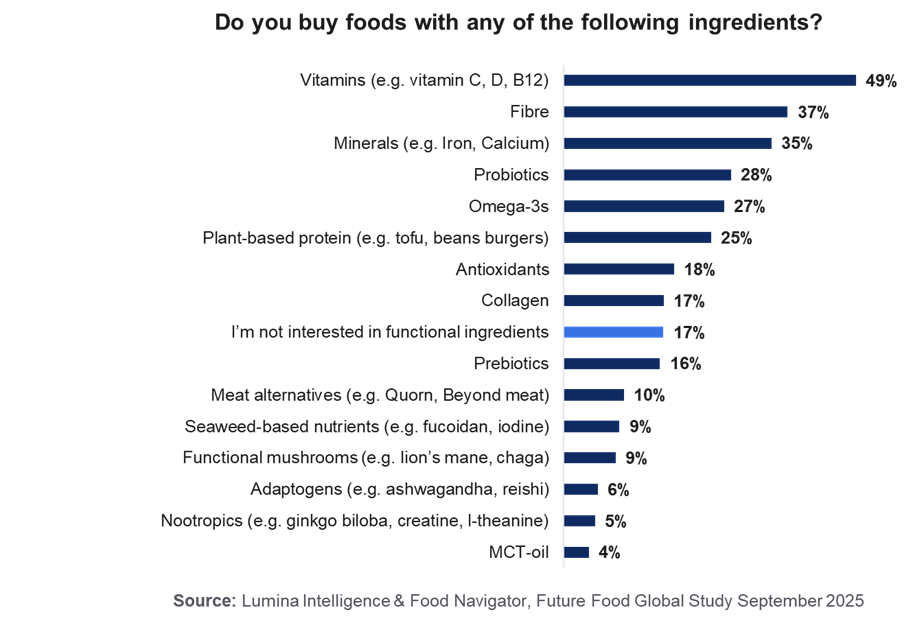

Gut health is an active purchase driver for many consumers, with 28.3% globally buying foods that offer gut-health benefits. When choosing functional ingredients, 28% specifically seek probiotics and 16% choose prebiotics, showing that live cultures and fibre-supporting compounds remain central to how people support digestive wellbeing. This behaviour is even more pronounced in certain markets: in China, 28.4% of consumers report consuming prebiotics – an index of 177 versus the global average – while high-fibre options are a top-three priority in both China and Japan.

Gut health also shapes openness to food innovation, with 24.7% of global respondents to our nutrition survey saying they would be more likely to try foods made with new technology if those products were shown to be good for gut health.

Taste Still Dominates Gut-Health Decisions

Even when people deliberately choose foods for digestive benefits, taste remains the strongest deciding factor. Consumers are generally willing to accept shorter shelf life, more preparation time or reduced convenience if it means avoiding foods they feel are overly processed, but flavour is the one area where compromise rarely happens.

This has direct implications for gut-health categories. Many digestive-supporting ingredients, such as certain fibres, fermented cultures or plant-derived components, can have challenging textures or flavours. When these sensory qualities are not managed well, consumers revert quickly to familiar options, even if those alternatives do less to support gut health. This is especially true during traditionally indulgent moments such as snacking, eating on the go or making quick decisions when time is tight; in those situations, intention gives way to taste.

The Opportunity: Reducing Confusion and Building Clarity Around Gut Health

What our nutrition data repeatedly shows is that while digestive wellness may be a priority, many consumers still feel unsure about which ingredients and processes genuinely support gut function. People frequently read ingredient lists yet struggle to interpret the technical terms associated with fibres, cultures or functional additions. The same applies to modern processing categories: labels such as “ultra-processed” are widely used, but most shoppers do not share a consistent understanding of what qualifies, or whether a product processed in this way can still benefit digestion.

This confusion creates a major opportunity. Consumers repeatedly express that they would feel more confident choosing gut-health products if explanations were clearer, more transparent and easier to understand. Many say they trust products more when knowledgeable experts explain how they are made, or when labels clarify what specific components – such as prebiotics, live cultures or certain plant fibres – actually do. As interest in digestive wellbeing continues to rise, brands that help demystify ingredients and processing stand to build both trust and adoption.

FAQs

What is the gut–brain axis and why does it matter?

The gut–brain axis refers to the two-way communication between the digestive system and the brain. Studies show that gut bacteria can influence mood, stress, sleep and overall wellbeing through chemical messengers like neurotransmitters.

Why are consumers increasingly focused on gut health?

Digestive wellbeing has become a major health priority as people recognise its connection to energy, mood and overall wellness. Growing awareness of probiotics, prebiotics and fibre has made gut health a central part of modern nutrition choices.

Which ingredients do consumers look for to support gut health?

Probiotics, prebiotics and high-fibre foods are among the most sought-after ingredients for digestive support. Many consumers now choose yogurts, kefir, whole-grain products and fermented foods specifically for gut-health benefits.

Why is there so much confusion about gut-friendly foods?

Many shoppers read ingredient lists but struggle to understand terms linked to digestion, such as fibres, cultures or processing methods. Concepts like “ultra-processed foods” are also inconsistently defined, making it harder to judge gut impact.

Do ultra-processed foods always harm gut health?

Not necessarily. Some industrially processed foods, including fortified whole-grain cereals, probiotic yogurts and high-fibre breads, can support gut function. The key is choosing products with low sugar and minimal additives.

How does taste influence gut-health choices?

Taste is the top deciding factor. Even when consumers seek digestive benefits, they rarely compromise on flavour. Gut-friendly products succeed when they deliver appealing taste and texture alongside functional ingredients.

What drives consumers to try new gut-health innovations?

Clear benefits and simple explanations make a difference. Many people are more willing to try new foods or technologies when they understand how they support gut health and when labelling is transparent.

What opportunities exist for brands in gut health?

Brands that clarify ingredients, explain benefits and offer great-tasting gut-health products can build trust and loyalty. Education around fibres, live cultures and processing methods is a key area for differentiation.

About the data

These insights have been powered by Lumina Intelligence’s global quantitative online survey, commissioned exclusively for Food Navigator. Fieldwork was completed in July 2025, capturing the views of 9,500 consumers across 13 countries: Australia, China, France, Germany, India, Italy, Japan, Malaysia, Singapore, South Korea, Spain, the UK, and the USA. Each national sample is representative, with larger bases in China and the USA (2,000 respondents each) and 500 respondents in all other markets.