Across the globe, protein is the most added benefit bought, and continues to dominate in Western markets, namely USA, Australia and UK. Protein-led innovation in these markets will continue to do well, alongside gut health and immunity support, which our latest nutrition data has seen emerging, especially in Spain and South Korea.

Mycoproteins and precision fermentation have the lowest awareness with just over half of global consumers having heard of these technologies. This identifies a notable knowledge gap with an opportunity to educate consumers on these technologies and their potential benefits. Cell cultivated meat has a higher awareness but the lowest desire to try it, indicating resistance to this technology. Meat alternatives and GMO have comparatively higher awareness and intention to try, although the proportions of consumers who would try is still below 20%.

Over 40% of consumers have tried meat alternatives

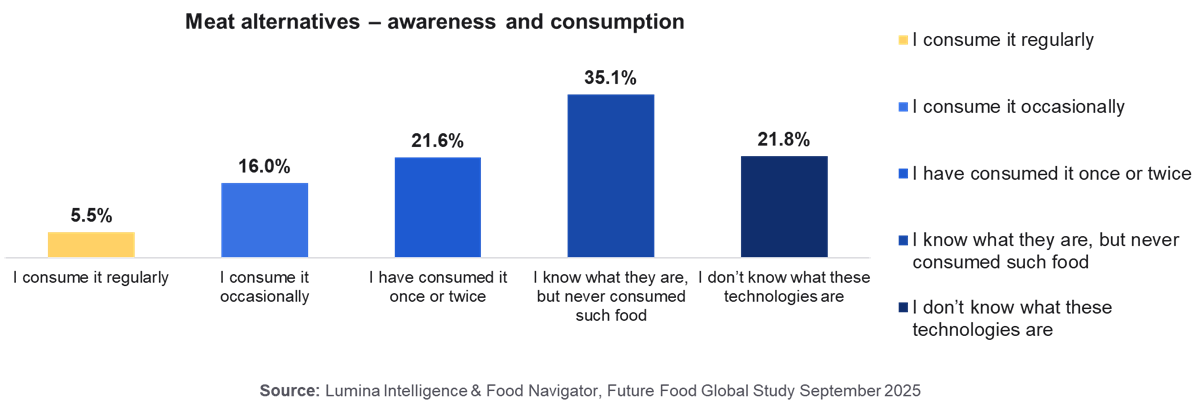

Meat Alternatives had some of the highest awareness globally, although one fifth of consumers have still not heard of the technology. Among consumers aware of meat alternatives, the largest group (35%) have heard of the technology but have never consumed it, indicating an opportunity to convert awareness into trial. Meat alternatives, as the best-known technology, also have some of the most engaged consumers, with over 20% consuming regularly or occasionally.

UK leads consumption and awareness of meat alts

The UK is a strong market for meat alternatives, with most of the population aware of the technology and one third consuming it regularly or occasionally. Our insight indicates polarisation in countries such as USA and Germany, where similar levels of consumption and lack of awareness indicate an opportunity to drive awareness to convert to trial. Comparatively, countries including Japan, Spain and France have low awareness and low conversion from those who are aware, suggesting the low scale of opportunity.

Meat alts are seen as a good alternative

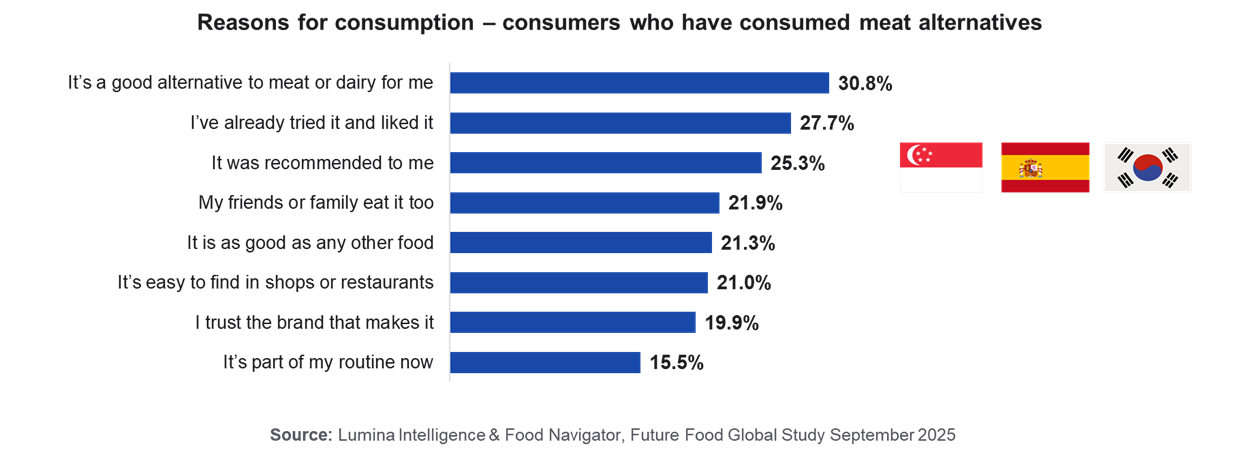

Those that consume meat alternatives view it as a good alternative to meat or dairy and positively, have commonly tried it and like it. Consequently, conversion to meat alternatives will likely lead to repeat purchase. Recommendations are also key, especially in Spain, South Korea and Singapore.

European countries have low interest in meat alternatives

Of the consumers who said they were unaware or aware but had not consumed meat alternatives, over half say they would not consume, and this is driven by European countries: Italy, France and Germany.

Meat Alternative brands should de-prioritise these markets, due to low intent and difficulty converting consumers. Comparatively, there is greater intent in Asian markets, especially Malaysia, China and Singapore.

Curiosity and animal welfare drive trial

Curiosity is the leading motivator for trial of meat alternatives, as consumers are eager to experiment with new products. Brands should harness this curiosity with innovative positioning and campaigns designed to convert openness into trial. Animal welfare emerges as the second most influential driver, and together with curiosity, consistently ranks as the top motivator across most markets. Communications that emphasise these themes will resonate most broadly. In contrast, narratives centred on environmental benefits have stronger traction in markets such as Japan and South Korea.

Preference for ‘natural’ and lack of knowledge are top barriers

Preference for ‘natural’ or feeling ‘unnatural’ are the top barriers to trial for meat alternatives, with these being the highest concern in Australia, United Kingdom and China. Not knowing enough about it, including long term health implications, also prevent adoption. Businesses need to prioritise challenges around ‘natural’ perceptions and provide more information, including combating health concerns, to increase trial and conversion.

Consumers need educating on mycoproteins

The largest challenge with mycoproteins is awareness with two fifths of consumers having not heard of the technology. This is despite the fact that one of the largest and most established meat alternative brands is Quorn, which uses mycoprotein technologies. The priority for the industry should be driving awareness and communicating the benefits to encourage purchases and consumption.

Operators need to educate consumers about mycoproteins, since 40% would not try because they do not have enough information. Communication about what the technology is and tackling concerns around ‘natural’ and health benefits would encourage adoption. There is particular demand for more information in South Korea, Japan and USA.

About the data

These insights have been powered by Lumina Intelligence’s global quantitative online survey, commissioned exclusively for Food Navigator. Fieldwork was completed in July 2025, capturing the views of 9,500 consumers across 13 countries: Australia, China, France, Germany, India, Italy, Japan, Malaysia, Singapore, South Korea, Spain, the UK, and the USA. Each national sample is representative, with larger bases in China and the USA (2,000 respondents each) and 500 respondents in all other markets.

FAQs

What are meat alternatives?

Meat alternatives are products designed as an alternative to meat or dairy. They are currently the best-known alternative protein technology globally and have some of the highest levels of consumer awareness.

How many consumers are aware of meat alternatives?

Meat alternatives have some of the highest awareness globally, although around one fifth of consumers have still not heard of the technology. Among those who are aware, awareness does not always translate into consumption.

How many consumers have tried meat alternatives?

Over 40% of consumers have tried meat alternatives. However, among consumers who are aware of meat alternatives, the largest group (35%) have heard of the technology but have never consumed it, indicating an opportunity to convert awareness into trial.

How often do consumers eat meat alternatives?

Meat alternatives have some of the most engaged consumers of all alternative protein technologies. Over 20% of consumers eat meat alternatives regularly or occasionally.

Which country leads meat alternative consumption?

The UK leads both awareness and consumption of meat alternatives. Most of the population is aware of the technology, and around one third consume meat alternatives regularly or occasionally.

How do other countries compare to the UK?

Countries such as the USA and Germany show polarisation, with similar levels of consumption and lack of awareness, indicating an opportunity to increase awareness and convert consumers to trial. Countries including Japan, Spain and France show low awareness and low conversion from awareness to consumption.

How do consumers perceive meat alternatives?

Consumers who eat meat alternatives view them as a good alternative to meat or dairy. They have commonly tried meat alternatives, like them, and view them positively, suggesting that trial often leads to repeat purchase.

What motivates consumers to try meat alternatives?

Curiosity is the leading motivator for trial, as consumers are eager to experiment with new products. Animal welfare is the second most influential driver. Together, curiosity and animal welfare consistently rank as the top motivators across most markets.

What are the main barriers to meat alternative adoption?

Preference for natural products and perceptions that meat alternatives feel unnatural are the top barriers to trial, particularly in Australia, the UK and China. Lack of knowledge, including concerns about long-term health implications, also prevents adoption.

Why is interest in meat alternatives low in some European countries?

In countries including Italy, France and Germany, over half of consumers who are unaware or aware but have not consumed meat alternatives say they would not consume them. This low intent makes these markets difficult to convert.

What are mycoproteins and how aware are consumers of them?

Mycoproteins are an alternative protein technology used by established brands such as Quorn. However, two fifths of consumers have not heard of mycoproteins, making awareness the largest challenge for this technology.

Why do consumers need more information about mycoproteins?

Forty percent of consumers say they would not try mycoproteins because they do not have enough information. Communication about what the technology is, alongside addressing concerns about naturalness and health benefits, would encourage adoption, particularly in South Korea, Japan and the USA.