The UK wholesale market in 2025 faces rising costs, shifting retailer behaviours, and changing fulfilment models in UK retail. Delivery still dominates purchasing, but symbol groups are increasingly adopting click & collect to reduce costs, while independents lean on delivered wholesale to streamline operations. Against a backdrop of inflation and regulatory change, one in five retailers has delayed investment, focusing instead on core ranges and price-marked packs (PMPs) to reassure shoppers. This article explores some of the dynamics underlining wholesale’s pivotal role in supporting the convenience channel, and the opportunities and challenges ahead.

Convenience Market Performance & Impact on Wholesale

The performance of convenience retailers has a direct bearing on wholesale volumes. The convenience market is forecast to achieve stronger value growth of +3.1% in 2025F, driven by an increase in planned top-up missions from shoppers, especially in the multiples segment. Inflation will support value growth and better weather will contribute to stronger volumes. Symbol groups are projected to account for 38.6% of the market value in 2025, with growth of +11.7% forecast through to 2028. In contrast, independents are expected to see continued decline, down -2.1% over the same period.

Retailer’s Behaviours & Attitudes

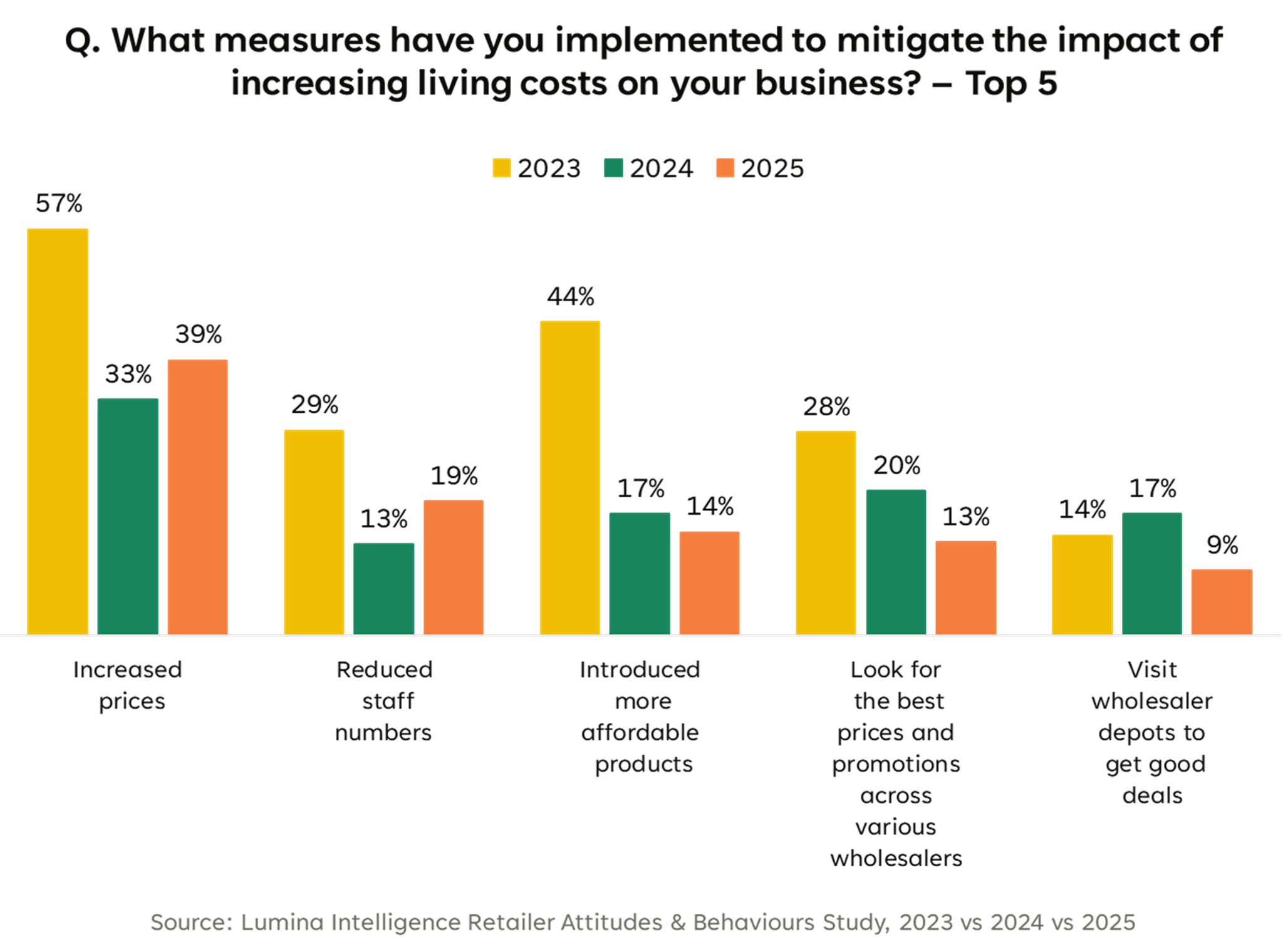

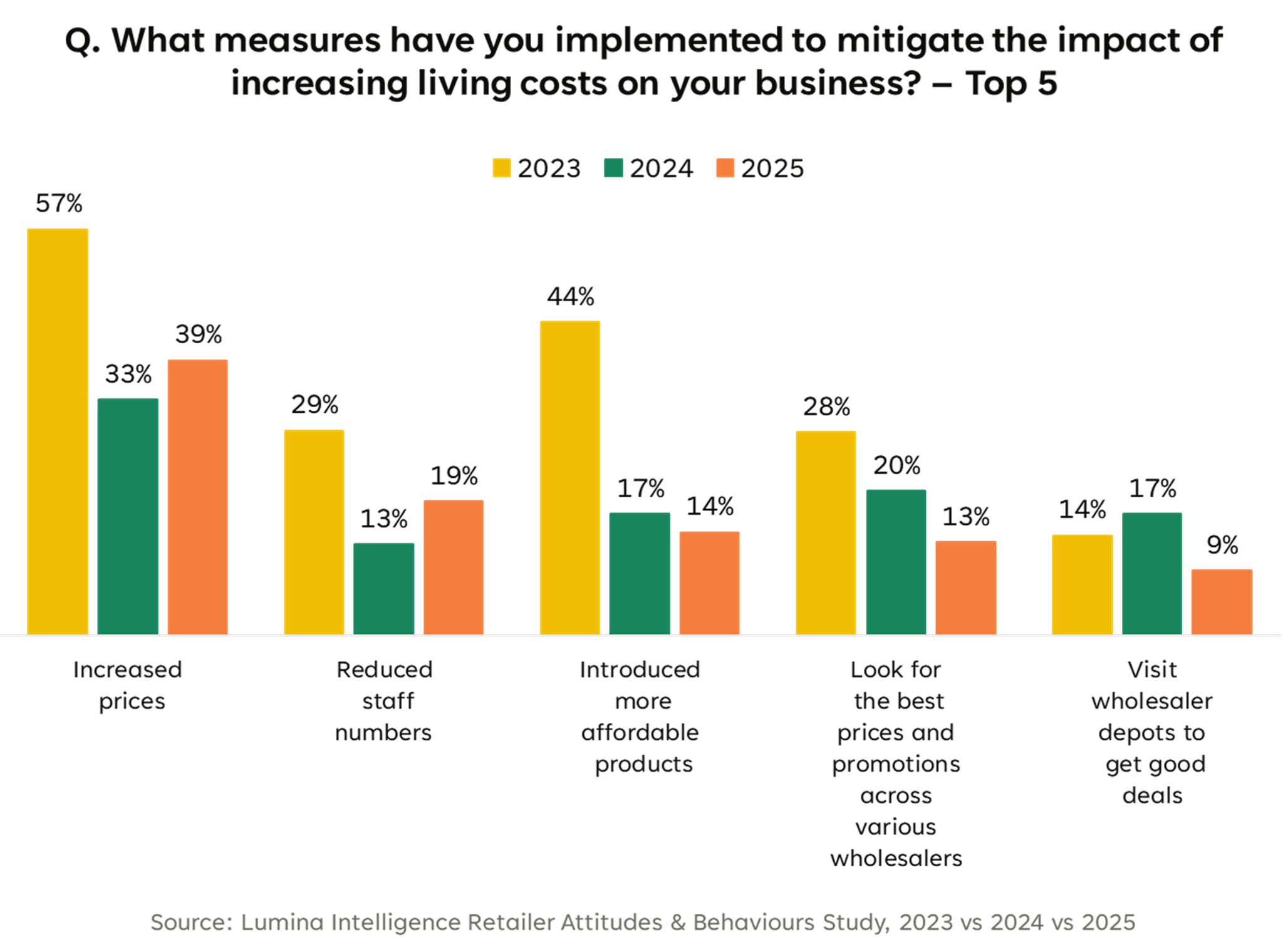

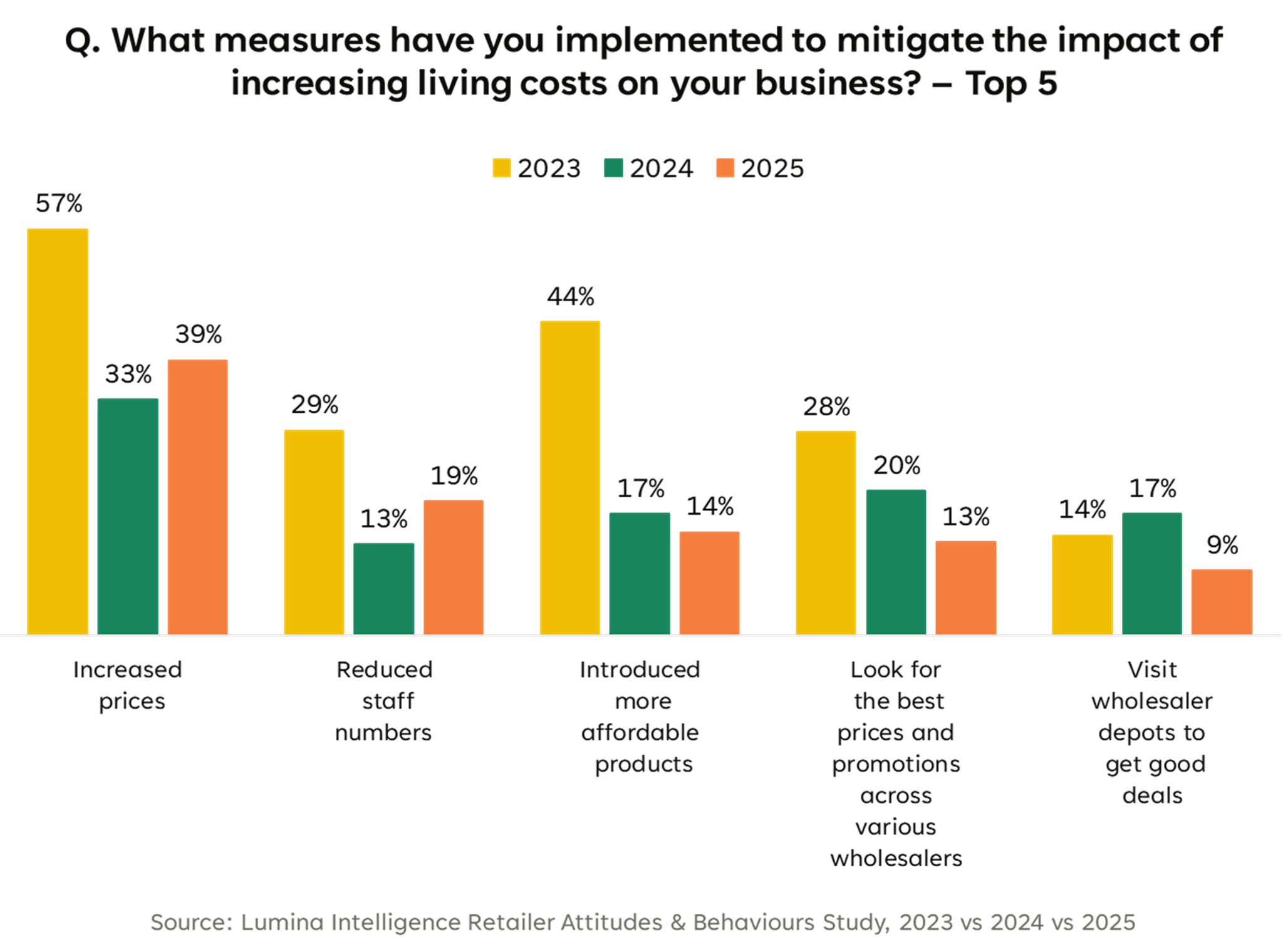

Financial pressures continue to shape retailer behaviour. Rising energy costs, higher staffing expenses, and escalating retail crime are eroding profitability—particularly for independents, whose average margins have dropped 3ppts versus 2024.

The withdrawal of government energy support has left businesses exposed to volatile pricing, while increases to the National Living Wage and National Insurance are inflating labour costs. At the same time, shoplifting has surged to record highs, with one third of independent retailers reporting rising crime since 2025 began.

These pressures have forced many independents to delay investment, cutting staff and shelving refurbishments or sustainability projects. In contrast, symbols, backed by group structures, have more successfully passed costs to shoppers through price adjustments.

Wholesale Responses: Pricing & Promotions

Wholesalers are responding by sharpening the levers of price, promotions, and product mix. Independents are leaning heavily on promotion weeks and events to drive footfall, while symbols use their scale to protect margins.

Price-marked packs (PMPs) are proving especially effective. They build shopper trust, reinforce value perceptions (+5ppts vs 2024), and continue to drive sales uplift (+3ppts vs 2024). PMPs also meet consumer demand for affordable treats, helping boost basket spend. For wholesalers, curating the right PMP ranges and highlighting standout products is a critical way to support retailers and maintain loyalty.

Technology & Fulfilment Transformation

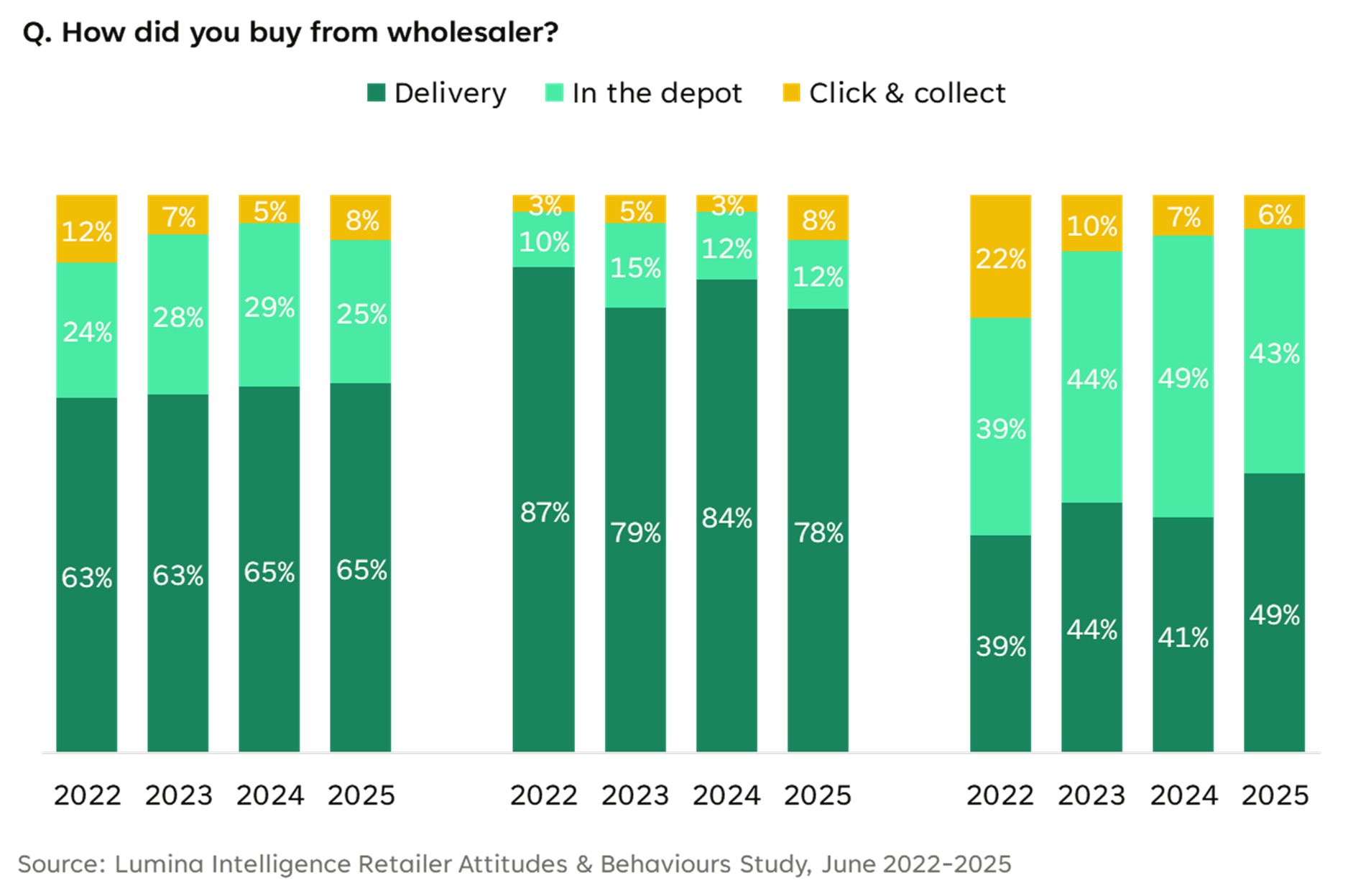

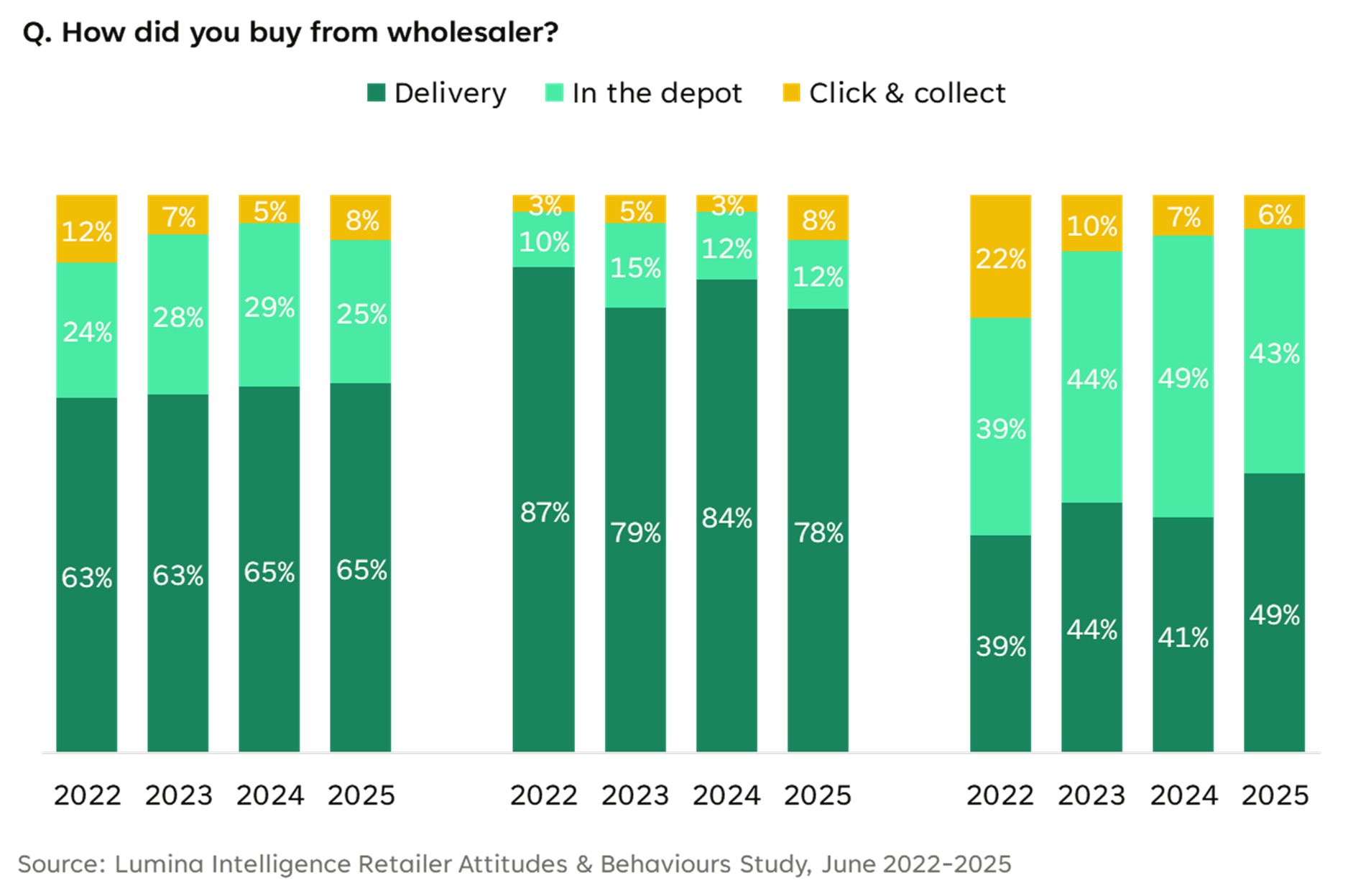

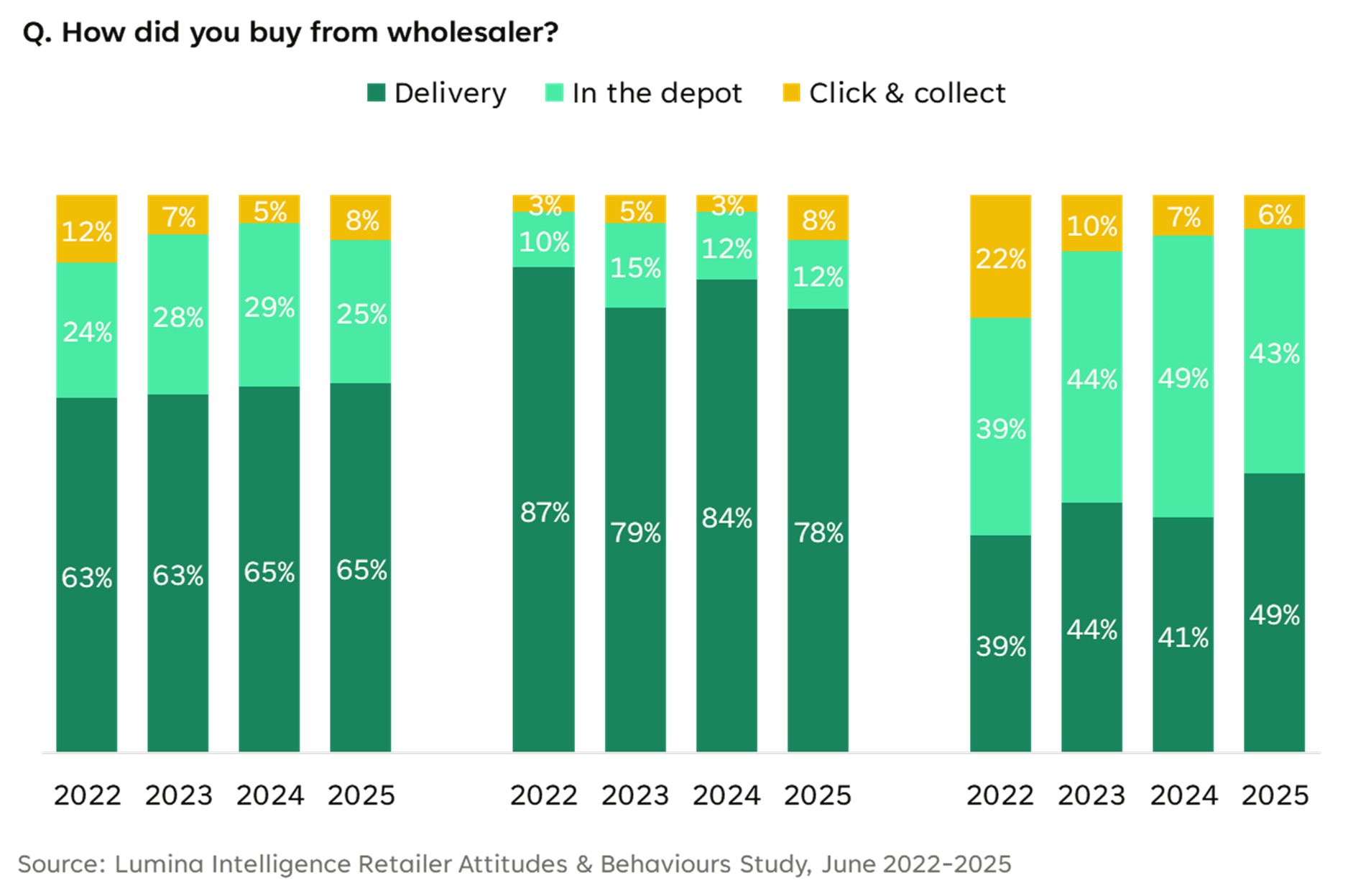

Fulfilment models are evolving. Delivery retains a 65% market share, but growth has stalled as symbol groups expand click & collect, marking their highest uptake in four years. Independents, facing staff cost pressures, are doubling down on delivered wholesale and online ordering for efficiency.

At the same time, technology is transforming retail operations:

- Efficiency & Cost Control: Electronic shelf labels, self-checkouts, and AI-driven replenishment are reducing labour and energy costs.

- Crime Prevention: Facial and age recognition tools are being deployed to tackle theft and compliance risks.

- Shopper Engagement: Loyalty schemes are shifting toward hyper-personalisation and omnichannel integration, with Tesco’s experiential Clubcard campaign and One Stop’s app-based rewards as leading examples.

Digital infrastructure remains a sticking point. Online ordering systems often frustrate retailers with poor search and stock visibility, while in-depot shopping is slowed by difficulties in finding promotions. Solutions such as real-time app updates, WhatsApp deal notifications, and clearer category signage can significantly improve the experience.

Opportunities

Looking ahead, wholesalers can strengthen their role as vital partners by:

- Investing in digital ordering and AI-driven replenishment, aligning with retailer priorities for efficiency.

- Expanding fresh, chilled, and ready-to-eat supplies, tapping into meal-for-tonight and food-to-go demand.

- Diversifying into premium, craft, and artisan categories, supporting consumer interest in new formats.

- Targeting high-footfall travel hubs, where investment in railway and transport networks is driving food-to-go expansion.

In conclusion

The UK wholesale market in 2025 is shaped by growth in the convenience channel, but also by intensifying cost and crime pressures, especially for independents. Symbols are driving expansion, while independents rely heavily on PMP ranges and wholesale delivery to protect margins.

Fulfilment is diversifying as click & collect gains traction, while digital ordering and AI are reshaping operations. Meanwhile, regulation (from EPR to HFSS restrictions and disposable vape bans) continues to raise compliance costs.

The winners will be wholesalers who adapt quickly: investing in digital platforms, broadening ranges, and capturing growth in food-to-go and premium categories. By aligning with retailers’ changing needs, wholesalers can cement their role as essential partners through 2028 and beyond.

FAQs

What is driving growth in the UK convenience market in 2025?

The sector is forecast to grow +3.1% in value, supported by inflation, favourable weather, and an increase in planned top-up shopping missions.

How are symbol groups and independents performing differently?

Symbols are forecast to grow +11.7% through 2028 and now account for 38.6% of market value, while independents are expected to decline by -2.1% over the same period.

Why are price-marked packs (PMPs) so important?

PMPs build shopper trust, protect retailers from negative price perceptions, and deliver stronger sales (+3ppts vs 2024). They also provide affordable “treat” options that help drive basket spend.

What cost pressures are retailers facing in 2025?

Energy, staffing, and retail crime are the biggest pressures. Independents have seen margins fall by 3ppts compared to 2024, while one third report rising levels of shoplifting.

How are fulfilment models changing?

Delivery still dominates with a 65% share, but symbols are adopting click & collect at the highest level in four years. Independents are leaning more on delivered wholesale and online ordering to manage costs and efficiency.

What role is technology playing in wholesale and retail?

AI-driven replenishment, electronic shelf labels, facial recognition, and self-checkouts are cutting costs and preventing crime. At the same time, loyalty schemes are shifting toward hyper-personalised and omnichannel engagement.

What are the biggest opportunities for wholesalers in 2025 and beyond?

Wholesalers can grow by investing in digital ordering and AI tools, expanding fresh and ready-to-eat ranges, diversifying into premium and artisan categories, and targeting high-footfall travel hubs linked to food-to-go demand.