About this data

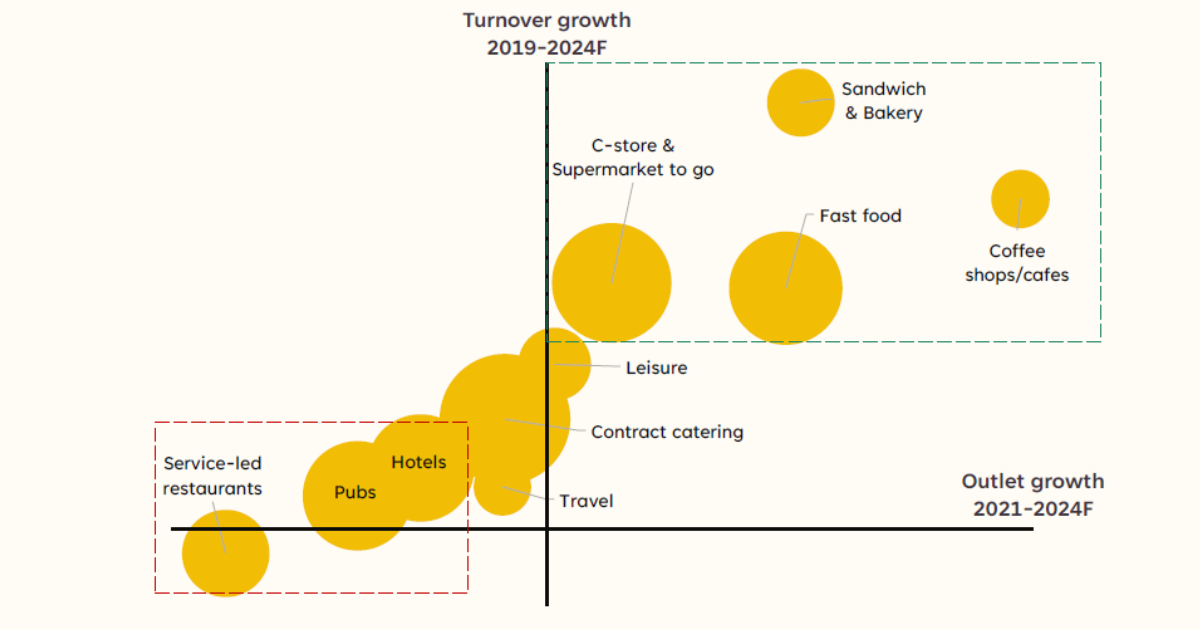

This dataset explores the performance of eating out market channels by turnover and outlet growth.

It provides a breakdown of total market turnover and outlet count by key channel, highlighting

year-on-year changes in value and physical presence. The dataset supports benchmarking and performance

tracking across a variety of eating out formats including quick service restaurants, casual dining,

pubs and bars, cafés, and more.

Key insights

- Fast food, sandwich & bakery, and coffee shops/cafés are forecast to deliver both strong turnover and outlet growth between 2019 and 2024F, placing them in the top-right quadrant of market expansion.

- C-store & supermarket-to-go channels are among the top performers in turnover growth, benefiting from their integration into retail footprints and convenience-driven demand.

- Leisure and contract catering channels show modest turnover gains but minimal outlet expansion, reflecting consolidation and efficiency-focused strategies.

- Hotels and pubs exhibit flat or negative outlet growth with limited turnover increases, suggesting ongoing pressure in these traditionally service-heavy sectors.

- Service-led restaurants (e.g. full-service dining) are expected to contract in both turnover and outlet count, facing challenges from inflation, labour shortages, and shifting consumer preferences.

- Travel sector remains stagnant, indicating a slower post-COVID recovery in foodservice performance tied to travel infrastructure.

Source:

UK Eating Out Market Report 2024

Release date:

June 2024