Quick service restaurants (QSRs), known for their speed, affordability and scalable models, remain a core part of the UK’s eating out landscape, and continues to outpace much of the wider hospitality market. This article offers a concise quick service restaurant industry analysis, spotlighting performance, innovation and evolving consumer needs in 2025. We explore key quick service restaurant trends, uncover the quick service restaurant market size, and examine how fast-food brands are adapting.

The UK quick service restaurant market carries on, with resilience and relevance, accounting for a substantial share of the nation’s eating out spend. In 2024 QSRs contributed significantly to the overall sector value, driven by their ability to deliver speed, affordability and consistent experiences: attributes that remain vital as consumers navigate inflation and time pressures. According to recent Lumina Intelligence quick service restaurant statistics, branded QSRs now represent over a third of total foodservice turnover, with fast food maintaining one of the highest visitation frequencies.

Explore insight covered in this article

QSR market growth

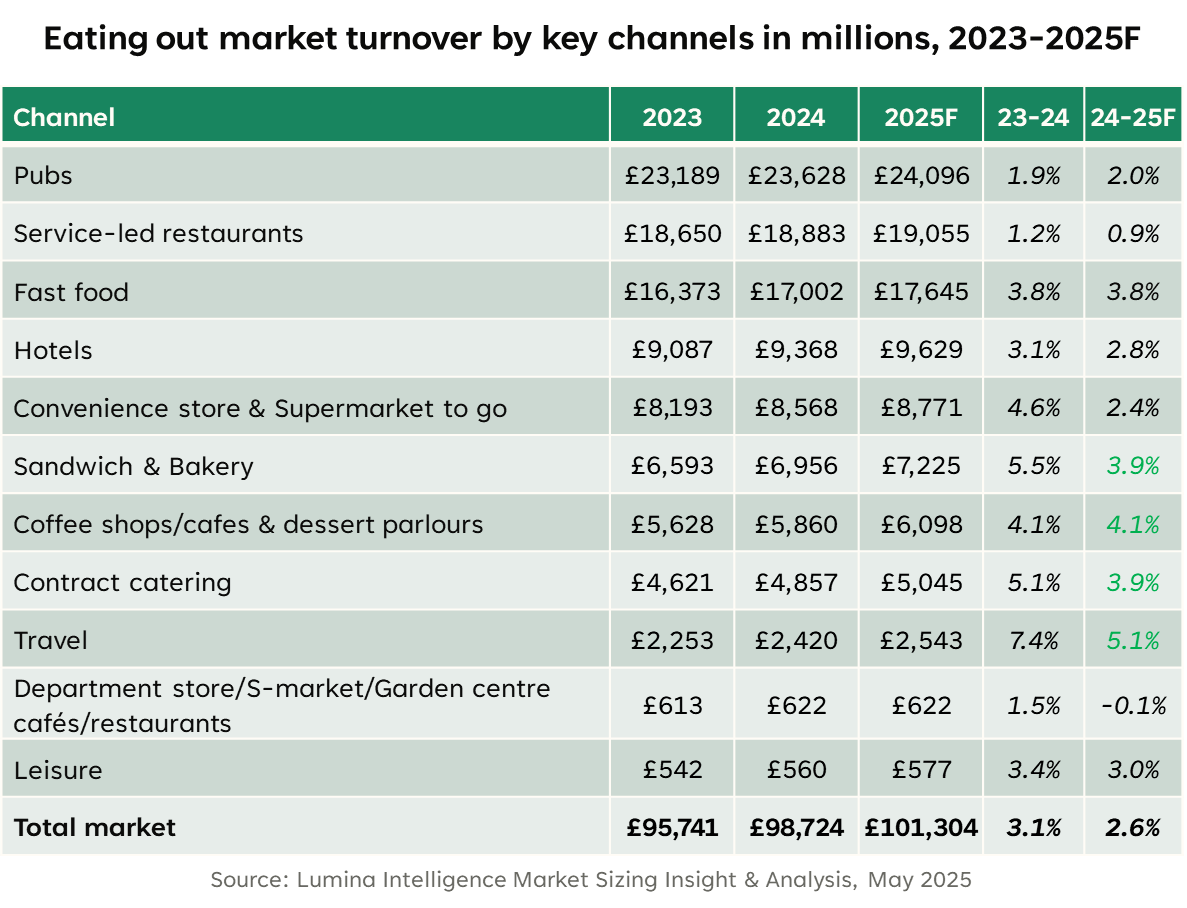

When it comes to the quick service restaurant market size, we observe it has grown steadily year-on-year, benefiting from its adaptability and operational efficiency. Burger chains, bakery-led operators and fried chicken formats are among the top performers, boosted by strong meal deal structures and digital ordering functionality. Meanwhile, the rise of hybrid models – combining dine-in, takeaway and delivery – continues to shape how brands scale and serve customers.

Market share

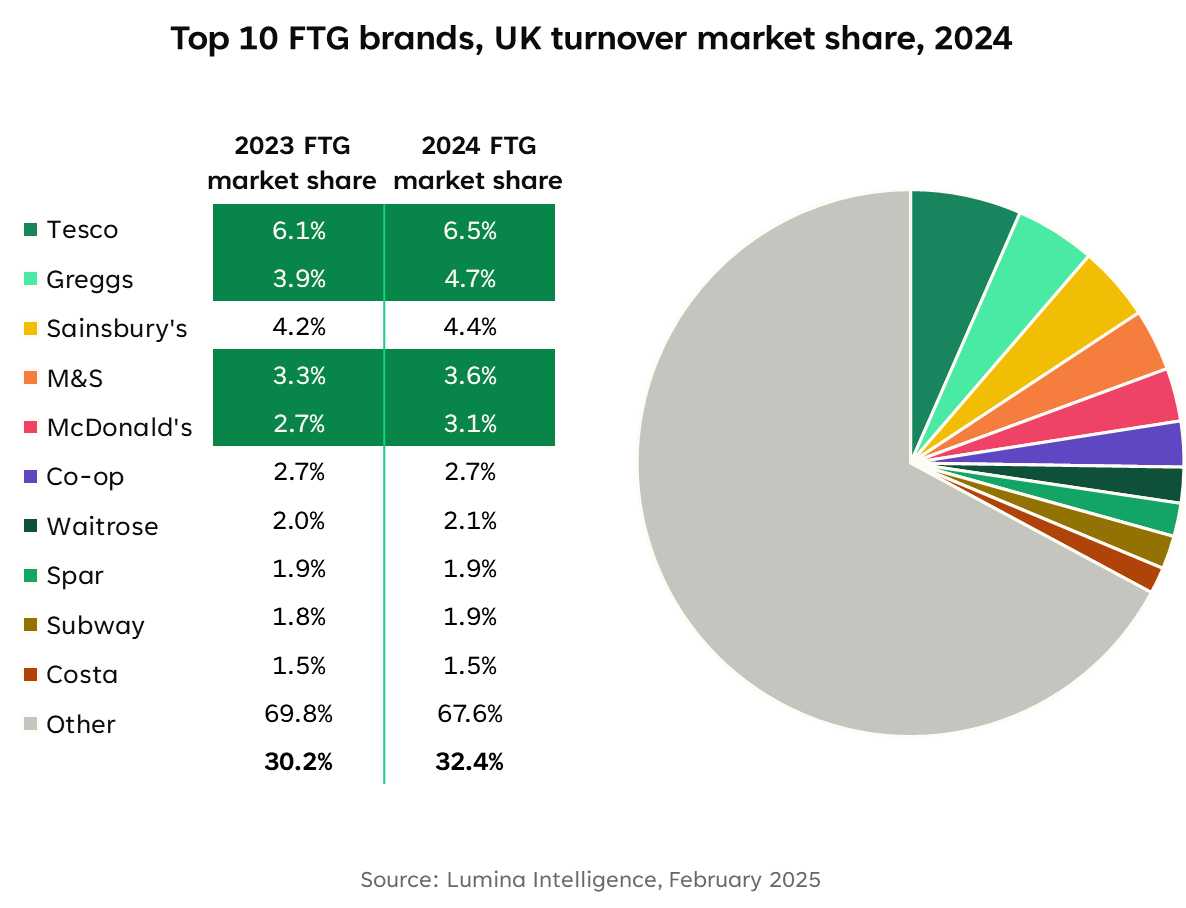

As for the UK fast food market share, established operators such as McDonald’s, Greggs and KFC hold substantial stakes, while challenger brands gain traction through product differentiation and regionalised growth. The quick service restaurant industry analysis shows that streamlined operations, simplified menus and value-led positioning are helping QSRs meet evolving demand and sustain growth in an increasingly competitive landscape.

Consumer behaviour

Consumer behaviour in the UK quick service restaurant market is evolving, shaped by cost-of-living pressures, flexible working patterns, and the desire for both value and speed. One of the standout trends in 2025 is the growth of lunchtime missions, with QSRs increasingly seen as affordable, reliable destinations for solo meals, particularly during the working week.

Younger consumers, especially those aged 25–34, continue to over-index in QSR visitation, favouring app-based ordering, digital rewards, and click-and-collect. These behaviours support brand loyalty while increasing average transaction values. Meanwhile, families are seeking affordable bundle offers, fuelling demand for meal deals and multi-person value formats.

Further trends in quick service restaurants include a growing interest in health-conscious options. While indulgence remains important, consumers are increasingly expecting transparency and choice, with more vegetarian and plant-forward options appearing on menus. Hot food-to-go and healthier meal deals are helping QSR brands meet these shifting expectations.

As delivery and takeaway channels mature, QSRs are optimising their in-store operations to accommodate multiple fulfilment routes, ensuring consistency across all touchpoints. This shift reflects broader changes in the sector and reinforces the need for responsive, tech-enabled service models as a standard for QSR.

Digital transformation remains a defining force, according to our quick service restaurant industry analysis, with operators embracing technology to meet rising consumer expectations and streamline operations. Mobile ordering, self-service kiosks, and loyalty apps are now standard in leading QSR chains, driving efficiency while allowing for personalisation and data capture.

A key shift in 2025 is the growing role of artificial intelligence in inventory planning, staff scheduling, and dynamic pricing. Brands are using AI-powered tools to anticipate demand, reduce waste and maintain speed during peak trading periods. These innovations are particularly valuable in the quick service restaurant market, where service time directly impacts satisfaction and repeat visits.

Franchise-led QSRs are also investing in delivery integration, offering direct ordering through their own platforms while maintaining partnerships with aggregators to maximise reach. This dual strategy ensures wider coverage while maintaining control over margin and customer experience.

Operationally, menu simplification remains central to ensuring consistency and speed. Many brands are rationalising SKUs while introducing modular builds and seasonal LTOs to maintain interest. These efforts not only reduce complexity but also support fulfilment across multiple channels.

As part of broader 2025 QSR trends, tech-led innovation is no longer optional, but a core growth driver in an increasingly digital-first hospitality landscape.

The UK quick service restaurant market enters 2025 with a strong stance that also showcases a high capacity to evolve. . As consumers seek speed, value, and quality, QSRs continue to outperform broader hospitality through digital adoption, operational agility, and menu relevance. This momentum is underscored by our latest data, which reveal strong market penetration and increasing spend across core dayparts. For operators, staying ahead might mean investing in tech, simplifying service models, and responding to shifting behaviours. Success will rely not only on efficient execution, but on interpreting the data currently shaping the sector.

What is the quick service restaurant market size in the UK?

Branded QSRs now make up over a third of total UK foodservice turnover, with strong performance across fast food, bakery, and chicken-led formats.

What are the key quick service restaurant trends in 2025?

The top quick service restaurant trends 2025 include menu simplification, digital ordering, healthier food-to-go, and value-driven lunch deals.

How has consumer behaviour changed in the QSR sector?

Consumers are visiting QSRs more frequently for solo meals, especially at lunch, and are increasingly using apps, click-and-collect, and loyalty rewards.

Which brands hold the largest UK fast food market share?

McDonald’s, Greggs, and KFC lead in market share, supported by regional growth, digital engagement, and consistent value propositions.

How is technology impacting the quick service restaurant industry?

Tech investments in AI, mobile ordering, and delivery integration are streamlining operations, improving speed, and enhancing customer experience.

What are the key quick service restaurant trends in 2025?

Delivery remains a growth channel, with QSRs using both aggregators and direct platforms to expand reach while protecting margin and brand control.