In 2024 the UK convenience market valued £47.3 billion, a growth of +0.5% from 47,276 outlets. The unaffiliated independent and symbol sector faced a difficult year hampered by price competition from multiples and discounters and poor weather dampening Spring and Summer sales uplifts.

Latest data for 2025 signals convenience channel trends including destination offers and services, technology, value and fresh and chilled. These mirror convenience store shopper behaviour, and are expected to be at the centre of strategies for growth across the coming three years.

Market Overview & Size

The UK convenience market growth experienced a flat trajectory in 2024, held back by unseasonably poor weather and increased competition from supermarkets and discounters. These factors particularly affected unaffiliated independents and symbol groups, both of which saw pressure on sales despite some growth in store numbers.

Forecast to grow by +3.1% in 2025, fuelled by planned top-up missions, better weather and increased investment in fresh, chilled and food-to-go categories, the UK convenience market value is now projected to reach £48.8bn.

Larger convenience multiples have performed strongly, benefiting from aggressive expansion and their ability to offer sharper pricing. Co-operatives saw modest growth, limited by store closures and softer shopper demand. Meanwhile, the forecourt segment also edged up, supported by gains in travel-related spend.

The convenience market is seeing a shift in share across its segments, with multiples gaining ground due to revitalised investment and strategic focus. By 2025, multiples are forecast to hold 22.3% of the market, driven by opportunities around travel hubs and chilled food ranges. Store upgrades and the focus on destination categories could help symbol groups retain the largest share. Meanwhile unaffiliated independents, co-operatives, and forecourts are all set to lose share, a potential consequence of consolidation and tougher trading conditions.

Key Consumer Trends

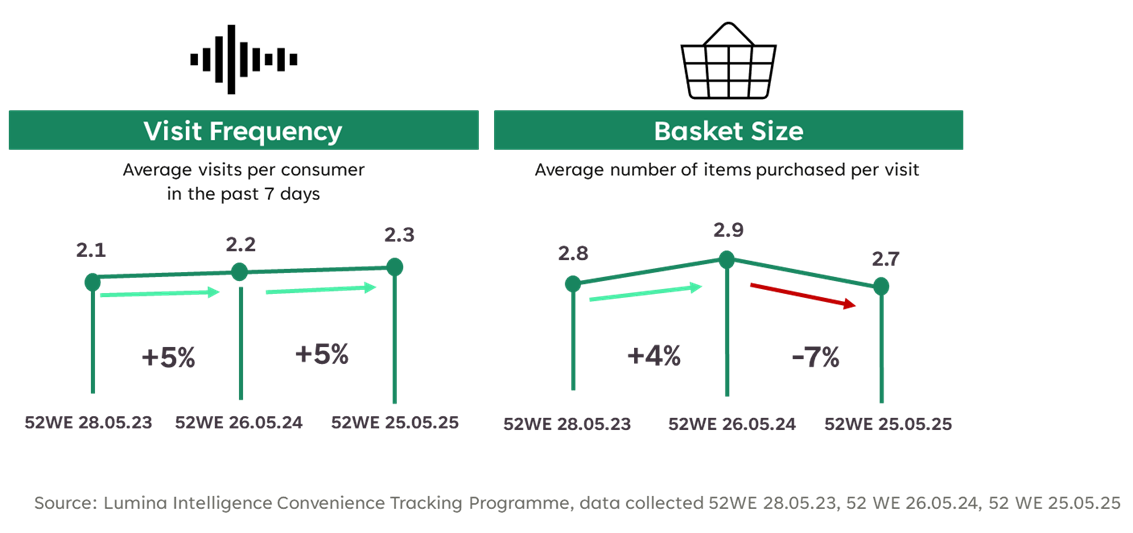

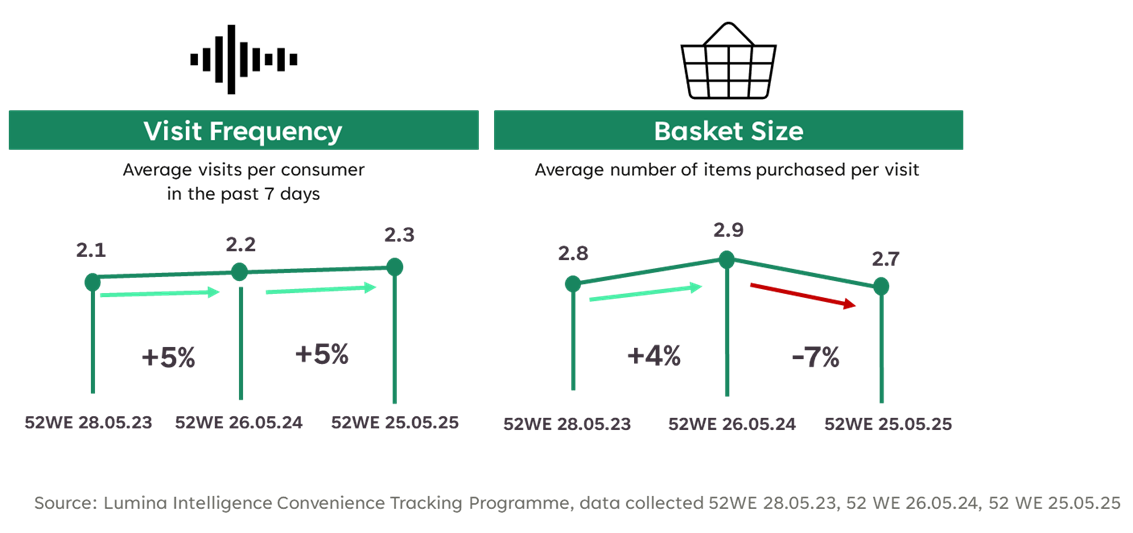

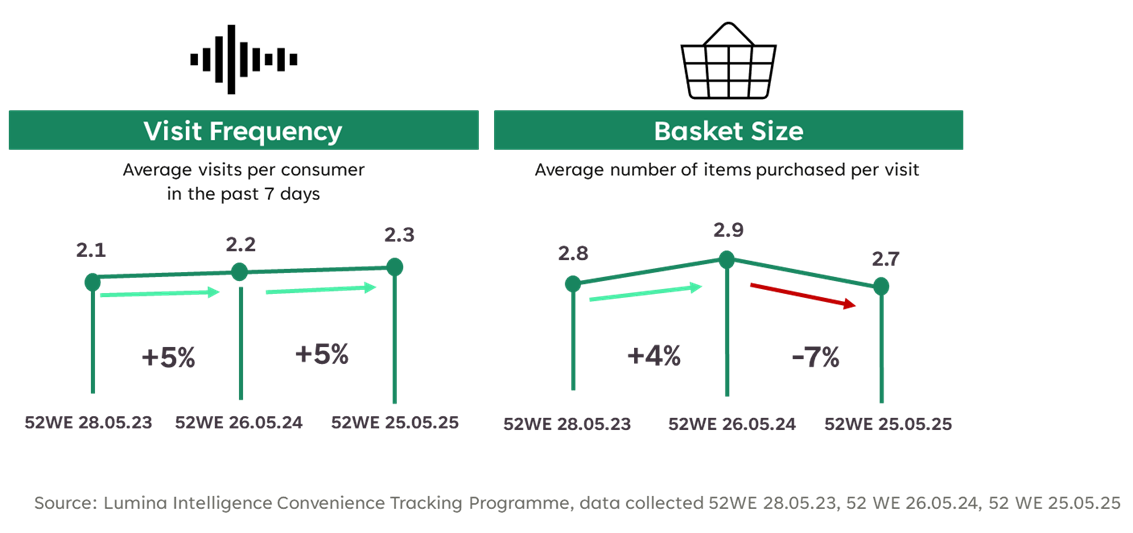

When examining the convenience shopper behaviour, we observe they are visiting Convenience stores more often, although to purchase fewer items per trip. Planned top up missions have increased and are driving growth in the market. Managed stores have invested in value and loyalty strategies which have benefitted this mission and staple categories.

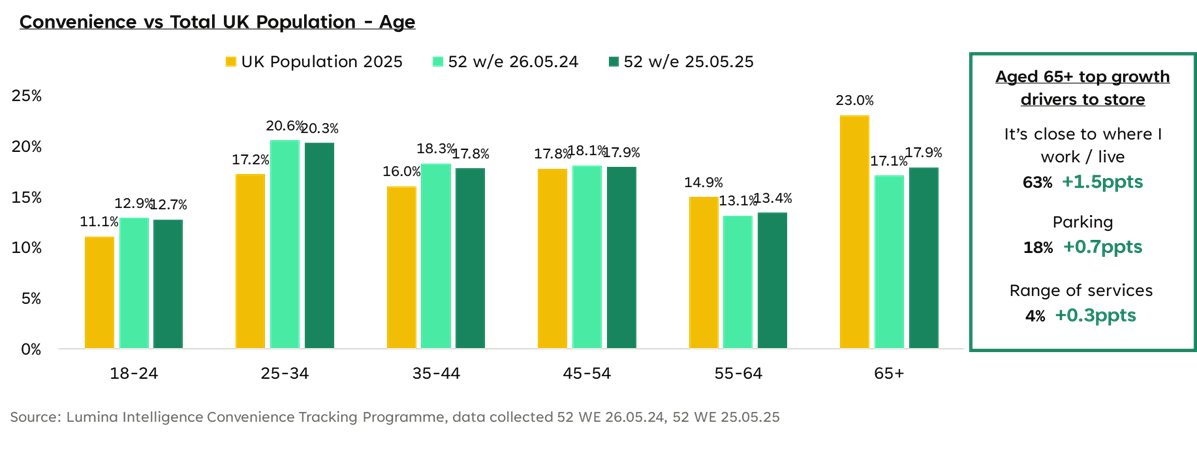

Convenience young shoppers primarily visit Convenience for food-to-go, meal solutions and treat missions. Conversely, older shoppers visit for newsagent and topping up. These older shoppers are gaining share through visiting Convenience more for core top up trips and are adding meal solutions and treat to their mission repertoire.

Location and proximity are the top ranked reasons for choosing a Convenience store, regardless of age. Younger shoppers are more enticed with price, while millennials are increasingly concerned about product range and availability. Meanwhile, the oldest shoppers look for an easy and friendly shopping experience.

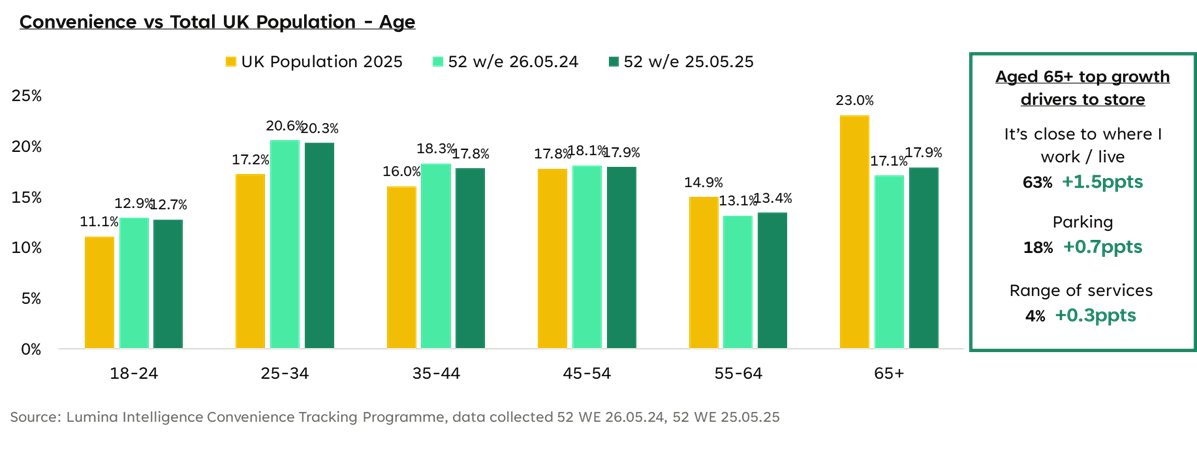

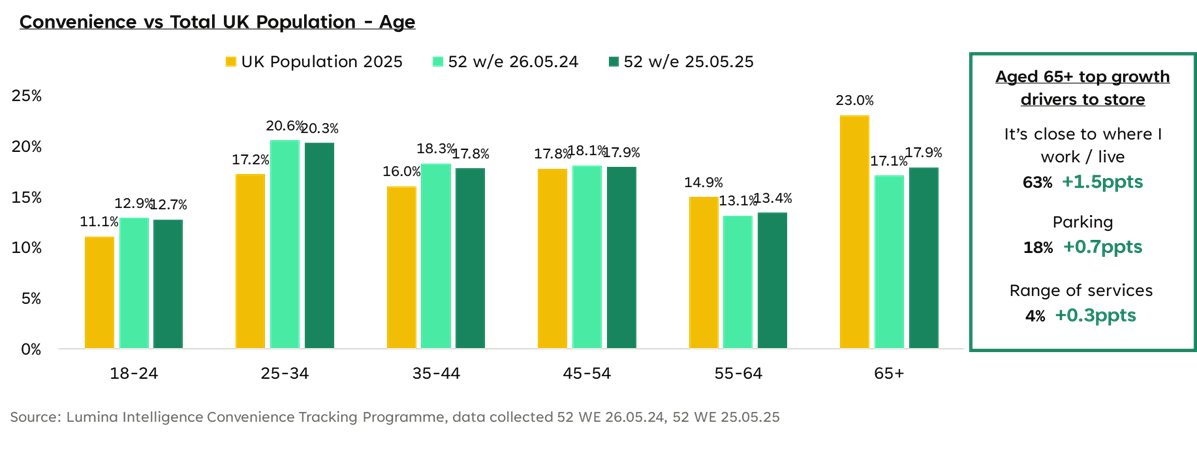

Younger millennials over trade in Convenience and are the largest group visiting the channel, indicating their importance. Older shoppers under trade in Convenience compared to the UK population. However, an ageing population and the growing engagement in this demographic, means this group is becoming more important. Parking availability and a wide range of services could be key to attract them.

Technology & Digital Influence

Developments are driving expectations for in-store, loyalty and pricing. Digital convenience retail is evolving rapidly, with convenience retailers investing to boost efficiency in energy and staff. Loyalty strategies are evolving, with retailers prioritising hyper-personalised pricing, digital integration and emotional engagement. One great example of this is One Stop, who is adopting an omnichannel approach, linking app-based rewards to online spend through Snappy Shopper, a renowned player amongst local delivery apps. Similarly, Tesco’s experiential Clubcard pop-up campaign is driving a renewed engagement.

On the other hand, delivery stalled at 65% share of the market, as symbols shift towards click-and-collect to cut delivery costs. Independents also leaned further away from delivery services, as labour costs pushed them to streamline staffing, a trend that will impact the future of quick commerce.

Online ordering continues to hold major market share, but frustrations with navigation, search, and stock visibility persist, highlighting the need for better digital infrastructure.

Opportunities and challenges

Margin pressures persist, and so retailers are leaning on technology to unlock operational efficiencies across processes. This includes automation and digital tools that help reduce labour dependency and streamline inventory and transaction management, which can help offset rising wage and utility costs. Another key area of opportunity lies in supplier-retailer collaboration, particularly in tailoring store formats and premium range offerings that reflect local demographics and shopper needs. There’s also scope to capitalise on premiumisation trends in BWS (beers, wines, and spirits) and chilled goods to elevate spend per visit.

As for challenges, the convenience sector faces mounting cost pressures, including a +6.7% rise in the National Minimum Wage, increasing National Insurance contributions, and ongoing utility price hikes, all of which add onto the challenge of maintaining profitability. On top of these, regulatory developments, such as HFSS (High Fat, Salt & Sugar) restrictions, and tighter rules on single-use plastics and vapes, which often require costly product reformulations and merchandising adaptations. UK convenience retailers must also navigate a volatile supply chain marked by fluctuating distribution costs and global geopolitical instability. Additionally, while sustainability remains a consumer priority, the cost of implementing meaningful environmental initiatives (e.g., packaging changes, net-zero logistics) can be prohibitive, hindering the balance between commercial viability and ethical responsibility.

Future Outlook

Looking ahead, the UK convenience channel evolutions will be shaped by hyper-personalised loyalty schemes, deeper digital integration, and innovative approaches to omnichannel engagement.

As the lines between online and in-store continue to blur, leading retailers are setting the pace with initiatives that extend loyalty programmes into experiential engagement zones. Expect to see greater use of AI, digital rewards, and immersive brand experiences online and offline.

While convenience retail has outperformed in agility and community connection, its competition with supermarkets and discounters remains intense, particularly as those channels invest in efficiency and tech-led differentiation. However, the convenience sector’s edge lies in its ability to offer ease-of-use, immediacy, local relevance, and flexibility.

Conclusion

The UK convenience sector is looking at a balancing act that will have operators juggling rising operational costs with the need to innovate across loyalty, pricing, and digital execution. Trends such as technology-led efficiencies, premiumisation, and hyper-local personalisation are reshaping the competitive landscape, while regulatory pressures and sustainability expectations are redefining how retailers must operate. The opportunity lies in embracing omnichannel capabilities and future-fit loyalty strategies that drive both value and engagement.

FAQs

How much is the UK convenience market worth in 2025?

The UK convenience market is forecast to be worth £48.8 billion in 2025, up from £47.3 billion in 2024, driven by planned top-up missions, better weather, and more investment in chilled, fresh and food-to-go categories.

What are the main factors behind the market’s growth?

Growth is being fuelled by improved weather, a rise in top-up shopping, and a focus on fresh and chilled products, alongside store upgrades and investment from larger convenience chains.

Which retailers are performing well in the convenience sector?

Multiples are performing strongly, especially those with competitive pricing and expansion plans. Co-operatives have seen modest growth, while symbol groups are focusing on destination offers to retain market share.

How are shopper habits changing?

Shoppers are visiting more frequently but buying fewer items per trip. There’s been a rise in planned top-up missions, and younger customers are particularly drawn to food-to-go and meal solutions, while older shoppers still focus on core groceries.

What role does technology play in convenience retail now?

Technology is helping improve loyalty schemes, pricing, and operational efficiency. Retailers are also investing in digital convenience retail tools, such as app-based rewards and improved in-store tech, to engage customers and reduce staffing pressures.

Are local delivery apps still growing in the convenience market?

Delivery share has stalled at 65%, as many retailers shift to click-and-collect to reduce costs. However, local delivery apps like Snappy Shopper remain an important part of omnichannel strategies.

What is ‘quick commerce’ and how is it impacting the sector?

Quick commerce refers to ultra-fast local delivery, often through apps. While it faces cost challenges, it still plays a role in UK convenience retail.

What are the key challenges facing convenience retailers?

Retailers are dealing with rising costs, including higher wages and utility bills, as well as regulatory hurdles around HFSS, single-use plastics, and vapes. Supply chain disruptions and sustainability costs are also concerns.

How are loyalty programmes evolving?

Loyalty strategies are becoming more hyper-personalised and digitally integrated, with retailers linking online rewards to in-store and app-based activity. Examples include One Stop and Tesco’s Clubcard initiatives.

What’s the outlook for the convenience market over the next few years?

The future will be shaped by omnichannel retail, better use of AI and digital tools, and a focus on local relevance and premiumisation. Despite cost pressures, the sector’s strengths in convenience and flexibility position it well for continued growth.