The UK food and beverage market is being reshaped by inflationary pressure, changing consumer expectations and a renewed focus on quality and value. Drawing on insights from Lumina Intelligence’s UK Menu & Food Trends Report 2025, these are the top 10 food and beverage trends forecast to shape the UK market in 2026.

1. Value Is Redefined Beyond Price

Value has shifted into a multidimensional concept encompassing quality, taste and health credentials. Rising costs have pushed menu prices up, but operators are increasingly cautious about blanket price hikes. Instead, value is communicated through quality cues, menu engineering and perceived fairness.

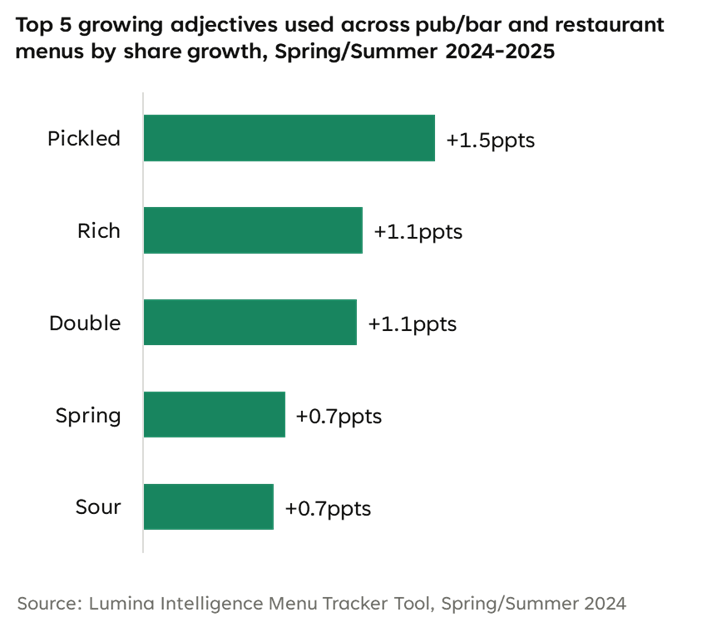

The rise in specific menu adjectives such as “pickled”, “spring”, “rich” and “double” highlights how value is increasingly being communicated through language rather than price. Freshness- and seasonality-led cues like “pickled” and “spring” act as shorthand for craft, technique and timeliness, signalling care in preparation and ingredient quality without relying on cost-heavy claims. Pickles increasingly feature on restaurant menus due to their long shelf life and they add extra flavour at minimal cost. They also align with consumer demand for gut-friendly foods.

At the same time, indulgence-driven descriptors such as “rich” and “double” communicate depth of flavour, generosity and satisfaction, reassuring consumers that menus still deliver enjoyment and perceived worth. Together, these contrasting but complementary cues show how operators are reframing value as a balance of quality, freshness and indulgence, reinforcing the shift away from price-led propositions towards experience-led value.

2. Quality-Led Menus Take Priority

Operators are focusing less on novelty and more on simple formats done well, using high-quality ingredients, flavour and consistency to elevate everyday dishes. Freshness is widely viewed as the strongest signal of quality, with consumers associating minimally processed, recently sourced food with better taste and trust.

This shift is also visible in how menus are being structured. Chain restaurants added an average of 16 more mains and pubs added 10, with both channels leaning heavily into pizzas, burgers and chicken. These categories offer versatility and strong margins, while red meat shares continue to decline amid cost challenges. At the same time, exit prices on starters, including sharers, have risen, reflecting greater investment in premium ingredients to boost quality cues and spend per head. Pubs have lowered entry points across courses, preserving margins through upselling while maintaining an image of affordability.

3. Healthier Eating Becomes Embedded

Health is increasingly prioritised by consumers, who are seeking fresh, natural options with functional benefits. Rather than being a standalone trend, healthier eating is becoming embedded across menus, influencing ingredient choices, formats and portion strategies.

This shift is being reinforced by growing scrutiny of ingredients. Widespread media coverage around ultra-processed foods (UPFs) has increased focus on clean labels and recognisable ingredient lists, as consumers pay closer attention to the health impact of UPFs. Transparency is becoming increasingly important, with wholefoods, natural products and veg-led dishes performing strongly. As a result, premium salad concepts such as Farmer J and Atis have seen strong performance, reflecting rising demand for food that fuels and nourishes. Atis’ Blackened Chicken, Nuts and Grains Salad, featuring pickled and superfood vegetables, exemplifies how health, quality and flavour are being combined on menus.

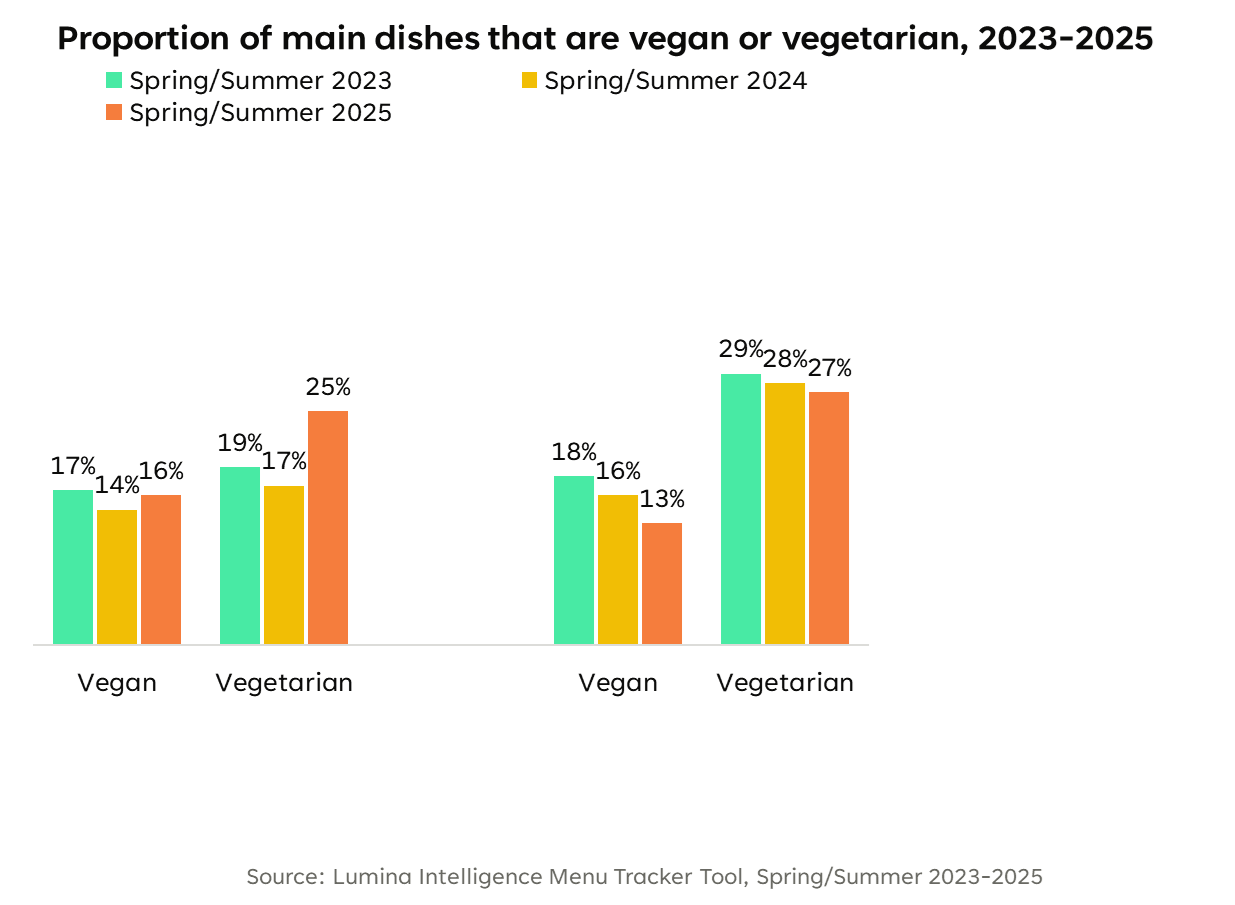

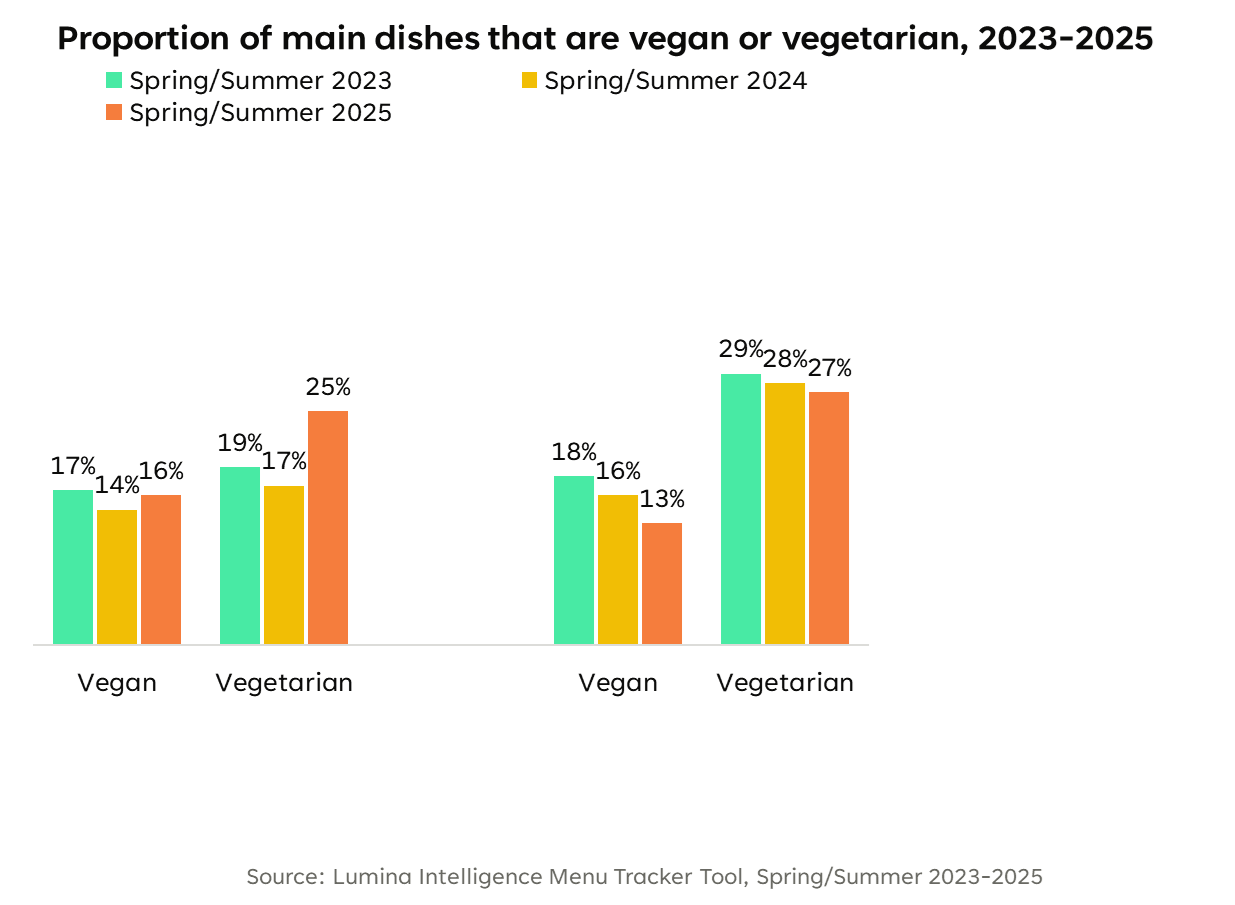

4. Plant-Based Shifts to Whole Vegetables

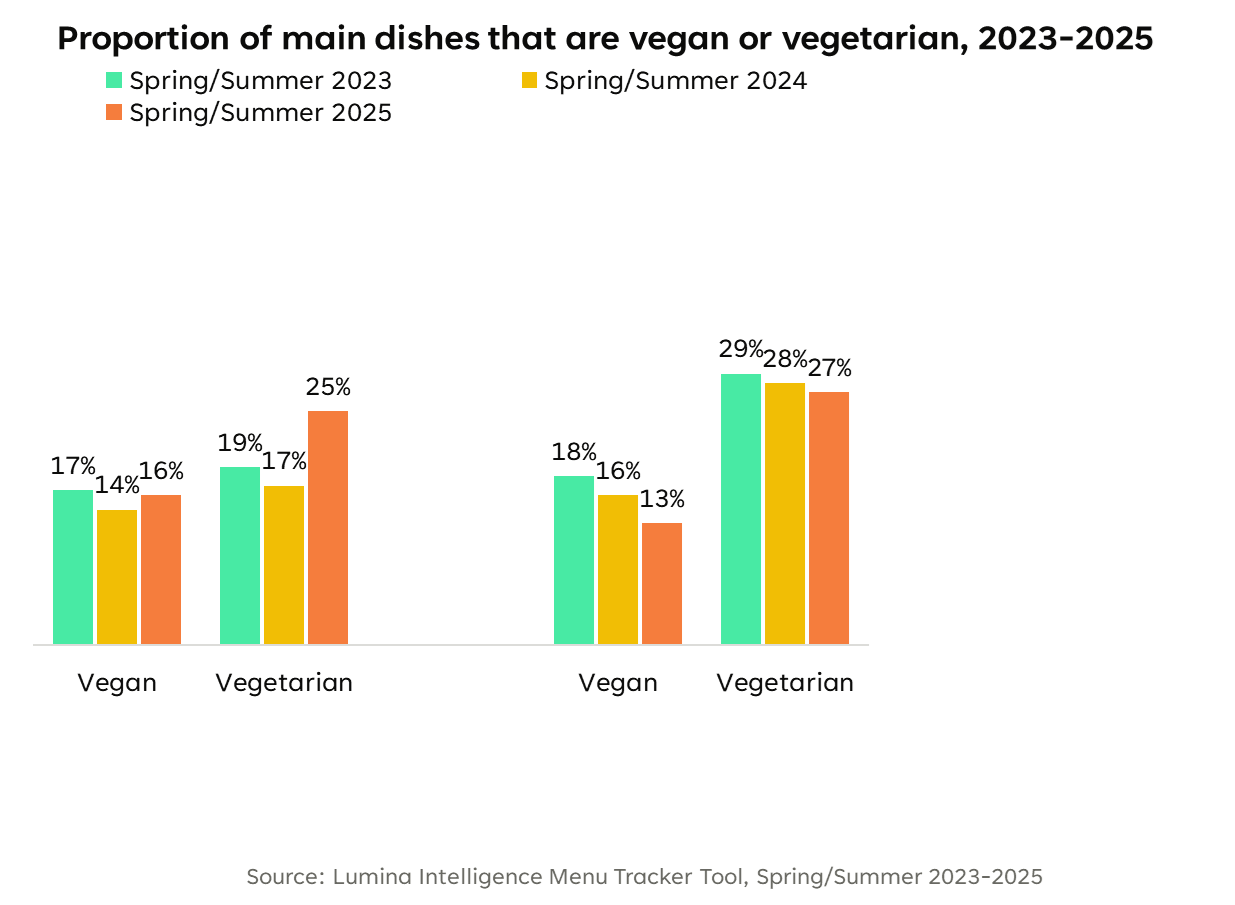

Plant-based dish growth has retracted in restaurants but continues to rise in pubs and bars. Operators are moving away from meat alternatives and towards whole vegetables and minimally processed plant-based dishes. This reflects growing concern around ultra-processed ingredients and a flexitarian “some, not none” mindset.

Hence, plant-based is evolving rather than disappearing. The divergence between pubs, bars and restaurants reflects different responses to changing consumer behaviour, with pubs increasing vegetable-led options while restaurants refine their offer. This shift is less about reducing choice and more about moving away from ultra-processed meat alternatives towards whole, high-quality vegetables, in line with a flexitarian “some, not none” mindset. The data illustrates how plant-based menus in 2026 are becoming more selective and quality-focused, favouring dishes that deliver flavour, credibility and broad appeal over volume-led expansion.

5. Guided Personalisation Replaces Unlimited Choice

Customisation is now expected rather than preferred. While build-your-own concepts still exist, menus are increasingly anchored to specific cuisines or formats that guide decision-making. Curated customisation, using hero bases with controlled swaps, is emerging as the preferred model.

6. Provenance Gains Commercial Importance

Provenance is becoming an increasingly important driver of perceived value, moving beyond sustainability messaging towards trust, transparency and quality assurance. Over a third of consumers say they would be willing to pay more for provenance, particularly when it is linked to traceable supply chains, highlighting how origin is now closely tied to confidence in what is being served

Beyond being an ethical marker, provenance is increasingly used to reinforce broader quality cues, from ingredient sourcing to production methods. This is evident in the growing visibility of regenerative and locally sourced products across menus, which help justify price points while aligning with health-led and quality-led decision-making.

Examples such as Wildfarmed grains appearing across multiple price points demonstrate how provenance can scale commercially, supporting both premium positioning and everyday accessibility. As awareness around food origins continues to grow, provenance is set to play a larger role in value communication, menu storytelling and brand trust in 2026.

7. Indulgence Becomes Increasingly Drink-Led

Indulgence is shifting from food towards drinks-led experiences, including layered, experiential and visually engaging beverages. This trend is particularly visible across QSR, coffee shops and sandwich-led formats, where drinks offer both margin opportunity and excitement.

Rather than relying solely on food for indulgence, brands are using drinks to deliver dopamine-boosting moments, from premium coffee builds to alcohol-free cocktails and limited-edition formats.

8. Experiential Food Drives Choice

Experiential food is becoming an increasingly important reason for choosing an establishment, particularly among Millennials, who are more likely to prioritise experiences alongside food quality. The report highlights that experiential elements, from events and pop-ups to limited-time menus and collaborations, are no longer peripheral, but are actively shaping where and how consumers choose to eat.

These experiences often intersect with digital discovery, social sharing and cultural relevance, helping brands stand out in a crowded market.

9. Digital Discovery Moves into Real Life

Digital discovery is now closely linked to real-world food experiences. Social platforms, creators and collaborations are shaping consumer expectations, while brands are translating online engagement into physical initiatives such as pop-ups, partnerships and curated experiences.

10. Smarter Menu Engineering Under Inflation Pressure

Rising ingredient and operational costs continue to shape menu strategies. Operators are refining menus by trimming lower-performing items, leaning into sides and ancillary revenue, and nudging spend per head rather than relying on headline price increases.

Outlook for 2026

Together, these trends highlight a UK food and beverage market that is quality-led, value-conscious and increasingly strategic. As inflation, health priorities and consumer expectations continue to converge, success in 2026 will depend on delivering perceived value through quality, clarity and carefully engineered choice.

About the data

These insights have been powered by Lumina Intelligence’s Menu & Food Trends Report 2025, the most comprehensive view of how UK chain restaurants and pubs & bars have navigated menu strategy through a year defined by inflation, cost pressure and recalibrated consumer expectations.

FAQs

What are the key food and beverage trends for 2026 in the UK?

The key trends include a redefinition of value beyond price, a shift towards quality-led menus, embedded healthier eating, whole-vegetable plant-based dishes, guided personalisation, drink-led indulgence, experiential dining, digital discovery translating into real-life experiences, and smarter menu engineering under inflation pressure.

How is value changing in the UK foodservice market?

Value is no longer defined purely by low prices. Consumers increasingly associate value with quality, taste, freshness and health credentials. Operators are responding by refining menus and avoiding blanket price increases.

Is plant-based food still growing in the UK?

Plant-based growth is diverging by channel. While restaurants have reduced vegan and vegetarian options, pubs and bars continue to increase plant-based dishes, particularly those centred on whole vegetables rather than meat alternatives.

What does “some, not none” mean in food trends?

“Some, not none” refers to a flexitarian mindset where consumers reduce meat consumption without eliminating it entirely. This is influencing menus towards balanced, plant-forward dishes rather than strictly vegan offerings.

How is customisation evolving on UK menus?

Unlimited customisation is being replaced by guided or curated customisation, where menus offer hero bases and controlled swaps. This simplifies decision-making for consumers while supporting operational efficiency.

Why is provenance becoming more important?

A growing share of consumers are willing to pay more for provenance, particularly when food comes from traceable supply chains. Provenance now plays a role in perceived quality and trust rather than sustainability alone.

What is driving drink-led indulgence?

Indulgence is increasingly moving into beverages, with layered, experiential and visually engaging drinks becoming a key source of excitement and margin, especially in QSR and café formats.

How are operators responding to inflation?

Operators are refining menu engineering strategies, trimming lower-performing items, leaning into sides and ancillary revenue, and nudging spend per head instead of relying on headline price increases.

How does digital discovery influence food trends?

Social media, creators and online platforms now shape food trends that quickly translate into physical experiences, including pop-ups, collaborations and limited-edition launches.

What will define successful food brands in 2026?

Brands that succeed in 2026 will balance quality, clarity and value, delivering simple formats done well, communicating trust through freshness and provenance, and using menu strategy to manage both cost pressures and consumer expectations.