According to Lumina Intelligence’s Menu Tracker Q1 data, total dish prices rose by +7.4%, signalling a broad-based move by operators to elevate premium offerings.

Menus have grown in restaurants and QSRs, while coffee shops and pubs have shrunk their menus, reflecting a need to streamline. The expansion from restaurants and QSRs aims to attract wider demographics while staying competitive with the increased footfall that convenience channels are experiencing. Conversely, the opposite strategy is being executed in the pubs, bars, and coffee and sandwich shop sectors, in an effort to cut costs amid increased operational challenges and labour shortages.

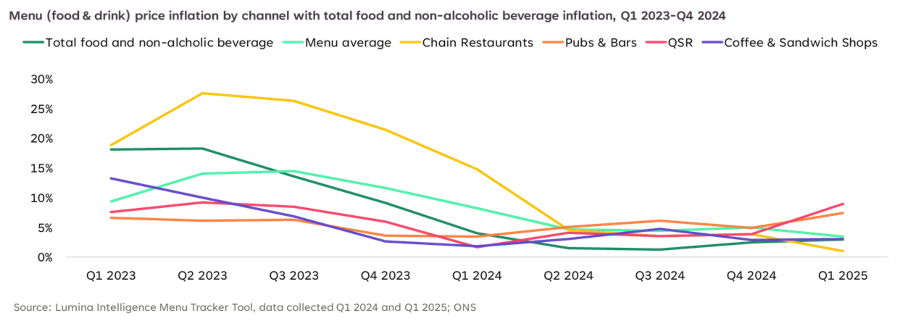

Coffee and sandwich channels feature the highest inflation, at +5% greater than total food and beverage inflation. As menu inflation rises well above ONS’s food and beverage inflation, operators have increased menu costs by between +3% and +13.9%. Restaurants, facing increased competition from QSR and convenience channels, have introduced price hikes to maintain business stability.

When it comes to pricing, rather than applying sharp increases across all items, operators are using a tactical approach, raising prices on mains and sides while holding hikes on discretionary items like desserts. Within same-line dishes, sides and mains have seen the greatest price increases, as operators rely on both value-driven main items and spend-increasing extras.

Price increases remain relatively similar across same-line and total dish prices, reflecting the common sentiment that margins remain slim. Same-line dish price increases are consistent across courses, ranging from +2.5% to +4.3% in Q1 2025. Mains have experienced the highest same-line price increases, indicating how operators are focusing on them as an integral source of consumer spend. Desserts have seen the lowest increases, as operators prioritise more essential spending items.

A deep dive per channel shows us that QSR and coffee and sandwich have performed the largest price increase compared to other channels (+£0.59 & +£0.51), both driven by increasing costs. A still stable demand for indulgence and treat occasions, as well as convenience give these channels more leverage to pass on these extra costs to customers without major impact.

Total food and non-alcoholic beverage prices have increased by over 3.0%, while the average menu price remains higher at +3.9%, prompted by operational cost increases. Pubs and bars retain the highest inflation at +9.0%, whilst chain restaurants have seen the lowest at 1.0%.

What will the future hold for menu engineering in the UK eating out market? If inflation remains a reality for UK menus, we could see strategies such as the adoption of value bundles, further developments in perks and loyalty programmes, or more agile pricing models. These could be especially effective in high-volume QSR venues, but restaurants and pubs and bars would benefit as well from them.