The UK pub market 2025, worth £24.1bn, is a vital part of Britain’s economy and social fabric. Despite pressures from rising costs and outlet closures, managed and branded operators continue to grow in value, supported by scale and investment. Consumer demand is resilient, with higher spend, more frequent visits, and younger audiences driving occasions. For suppliers, operators, and investors, understanding market size, growth, and evolving behaviours is key to navigating one of the UK’s most culturally significant sectors.

This article provides a detailed pub market analysis with updated pub industry statistics, from our recently released UK Pub & Bar Market Report 2025.

Insight covered in this article

UK Pub Market Size

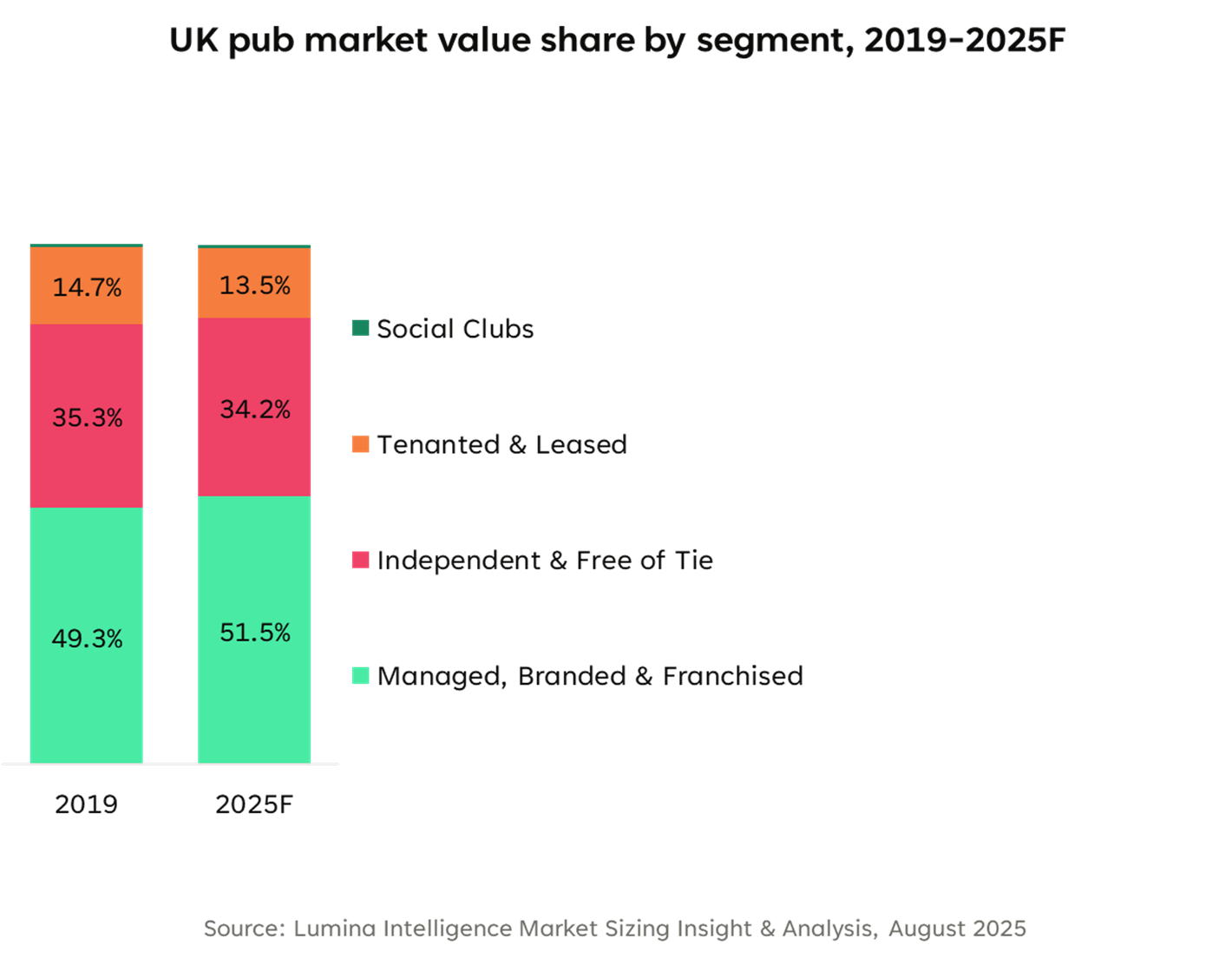

The UK pub & bar market 2025 is forecast to reach £24.1bn, a modest +1.9% growth year-on-year, though still trailing behind the wider eating-out market. Managed, branded, and franchised groups are driving the bulk of this value at £12.4bn, underlining the resilience of scale and investment, even as outlet numbers fall. According to our pub industry analysis, the UK pub industry market share of managed operators is expanding steadily.

| Segment | 2025F Turnover | Growth | Outlets | Outlet Change |

|---|---|---|---|---|

| Managed, Branded & Franchised | £12.4bn | +2.8% | 10,687 | -1.1% |

| Independent & Free of Tie | £8.2bn | +0.9% | 16,409 | -0.8% |

| Tenanted & Leased | £3.3bn | +1.0% | 12,405 | -1.0% |

| Social Clubs | £138m | +0.7% | 2,191 | -1.0% |

| Total | £24.1bn | +1.9% | 41,691 | -1.0% |

Outlets 2019–2025F:

- 2019: 45,791 outlets

- 2020: 44,192 (–3.5%)

- 2021: 43,245 (–2.1%)

- 2022: 42,938 (–0.7%)

- 2023: 42,464 (–1.1%)

- 2024: 42,094 (–0.9%)

- 2025F: 41,691 (–1.0%)

Across the sector, the number of operating pubs and bars will drop to 41,691 in 2025F, with around eight net closures per week. Independents, tenanted & leased pubs, and social clubs are all experiencing outlet decline, though turnover is supported by price inflation.

Compared with 2019, when there were nearly 46,000 outlets, the market has shed over 4,000 sites. While closures remain a challenge, steady turnover growth signals that pubs and bars continue to play a critical role in the UK’s economy and cultural life, adapting formats and pricing to evolving consumer behaviour.

UK Pub Market Growth Trends

The UK pub market is forecast to grow +1.9% in 2025, remaining behind the wider eating out sector as outlet decline and rising costs continue to put pressure on margins. Looking further ahead, the UK pub industry is expected to deliver a CAGR of +2.1% between 2025F–2028F, supported by volume recovery and fewer closures as estate optimisation stabilises. Even so, operational costs – particularly labour, energy, and supply chain – will continue to weigh on profitability.

Growth Drivers

- Estate investment and premiumisation.

- Digitalisation and tech-led innovations.

- Mission-led formats, targeting local communities.

- Legislative support.

- Domestic tourism.

Challenges

- Rising staff costs and workforce shortages.

- Debt burdens and weak cash reserves.

- Estate rationalisation.

- Increased employer costs.

Market Share Breakdown

Managed, branded and franchised pubs are forecast to account for over half of market revenue, from a quarter of sites in 2025. Scale and capital enable managed groups to absorb cost shocks better, invest in refurbishments and digital, and execute tighter pricing and premium mix – lifting revenue per site. Ongoing conversions from tenancies and pruning of weaker independents will keep tilting share toward managed through 2026.

There are varying benefits and challenges across the three main pub market models. In recent years more operators and groups are pushing towards managed sites whilst tenanted & leased operations have been declining at a steeper rate.

Food-led vs. Wet-led Pubs

Wet-led pubs were driving much of the M&A activity, following a shift in consumer preference. A growth of acquisitions in this segment highlights their rising importance in the market:

- Admiral Taverns acquired 18 wet-led pubs from Marston’s in Sep 2024

- Investment in pub estates by operators like TRG and Upham Inns suggests consolidation around businesses that have strong wet-led performance and room offerings.

Not all operators thrived, but the overall trend still leans toward expansion of wet-led pubs in the UK.

Regional Differences

Latest Lumina Intelligence pub and bar data showcases London accounting for 12.7% of all pub & bar occasions. London has overtaken the North West to become the UK’s second-largest region, behind the South East. Its upward momentum is fuelled by young, urban professionals with disposable income.

As for the rest of the UK, the South East is the largest region, accounting for 13.7% of occasions (+0.5ppts YoY). The North West dropped slightly, losing share to London. Yorkshire, West Midlands and East of England remain strong contributors. Scotland declined slightly, and Northern Ireland continues to be the smallest region.

In terms of growth, London is leading on UK for pubs & bars in 2025, outpacing most other regions by leveraging its concentration of young, affluent urban consumers. The rest of the UK, while still significant, is more fragmented, with rural and suburban locations underperforming as consumers increasingly favour city-centre socialising.

Consumer Behaviour in Pubs

Pubs and bars have benefitted from an uptick in frequency (+4.3%) as well as penetration (+1.3ppts). Consumer confidence remains fragile amid global uncertainty but spend continues to rise due to more consumers choosing better quality food and drink.

- Average spend: £24.59 (52 weeks ending 08/06/2025)

- Penetration: 11.3%

- Visit frequency: 1.20.

Beer remains the most popular choice at 63% of drinking occasions, though growth is flat.

Premiumisation is strong, with spirits (+1.4ppt) and cocktails (+0.6ppt) driving revenue growth. Wine declined slightly, while cider consumption contracted, showing mixed trends.

Food remains anchored by chips, burgers, and steak dishes, but sharable items like pizza and wings are growing.

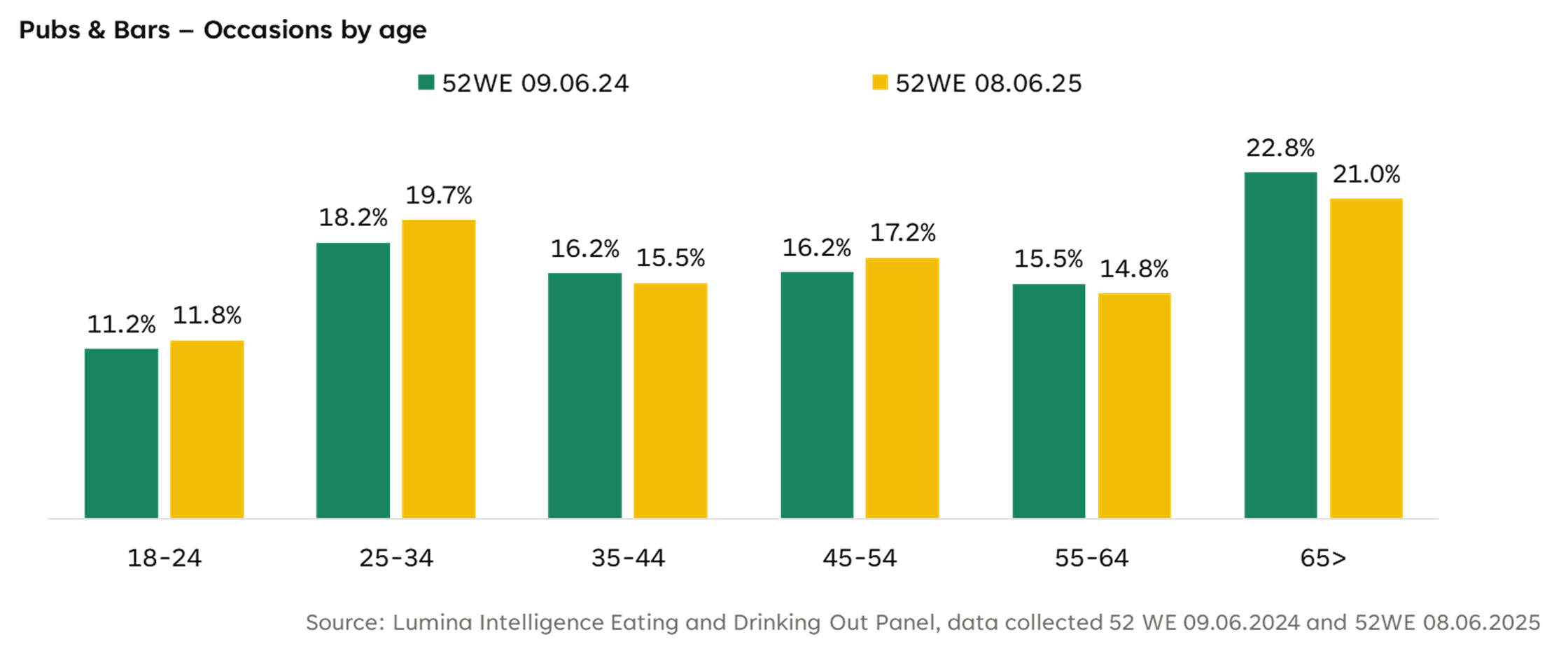

Millennials VS GenZ

Occasion share rose for millennials, from 18.2% to 19.7% year-on-year (+1.5ppts). They show the highest gain across all age groups (+0.4ppt), fuelled by higher disposable income, fewer dependents, and concentration in urban areas. Millennials are leading the recovery for pubs & bars, making them the most engaged group according to our data.

Gen Z’s (18–24) occasion share increased slightly from 11.2% to 11.8% (+0.6ppts). Their penetration change was +0.2ppt, showing signs of recovery after a decline. Still, Gen Z participation is lower compared with millennials, reflecting budget constraints and differing social habits.

Competitive Landscape

The top 10 pub operators represent the most influential players in the UK market, and their performance shapes much of the industry outlook.

- Scale players like Wetherspoon and M&B are stable leaders.

- Young’s is the fastest-growing due to its premium urban positioning.

- Groups facing debt or strategic exits (Stonegate, Whitbread) show vulnerabilities.

The managed model is outperforming, gaining share both in outlets and turnover. This reflects consumer demand for consistency, investment in experience, and premiumisation, areas where independents struggle to compete.

Outlook for the UK pub market

The UK pub & bar market is forecast to reach £25.7bn by 2028F, moving from contraction to steady growth. Managed and premium-focused formats will lead, supported by sustainability, digitalisation, and experiential offerings.

For suppliers and brands, investment opportunities lie in premium products, digital solutions, sustainable practices, and partnerships in hybrid venues. Emerging UK pub market trends highlight digitalisation, diversification, consolidation, and earlier, lower-tempo occasions as key drivers.

Sustainability and automation will provide efficiency gains, while long-term demographic and work-pattern changes will reshape the industry. Looking back to 2020, today’s pub market analysis signals resilience and adaptability in a changing landscape.

For a deeper dive into the latest pub market analysis, all figures and insights in this article are sourced from the Lumina Intelligence UK Pub and Bar Market Report 2025. The full report provides comprehensive pub industry statistics, market share data, and emerging UK pub market trends to support suppliers, operators, and investors in making informed decisions.

Key statistics this article covers:

- Market value 2025: £24.1bn (+1.9% YoY growth)

- Forecast value 2028F: £25.7bn (+2.1% CAGR, 2025F–2028F)

- Total outlets 2025F: 41,691 pubs & bars (down from 45,791 in 2019; ~8 net closures per week)

- Managed, branded & franchised pubs: £12.4bn turnover (+2.8% growth), 10,687 outlets

- Independent & free-of-tie pubs: £8.2bn turnover (+0.9%), 16,409 outlets

- Tenanted & leased pubs: £3.3bn turnover (+1.0%), 12,405 outlets

- Consumer spend: Average £24.59 per visit (+7.3% YoY)

- Biggest regional shares: South East 13.7%, London 12.7%, North West 11.7%

What is the size of the UK pub market in 2025?

The UK pub market is valued at £24.1bn in 2025, with growth of +1.9% year-on-year.

How many pubs are there in the UK in 2025?

There are around 41,691 pubs and bars in the UK in 2025, down from nearly 46,000 in 2019.

What is the forecast growth of the UK pub market?

The UK pub market is forecast to reach £25.7bn by 2028F, growing at a +2.1% CAGR from 2025–2028.

Who are the biggest pub operators in the UK?

Leading operators include JD Wetherspoon, Mitchells & Butlers, and Greene King, with Young’s identified as the fastest-growing premium operator.

What is the UK pub industry market share of managed operators?

Managed, branded, and franchised pubs generate over 50% of market revenue while representing about a quarter of all UK pub sites.

What are the main drivers of growth in the UK pub market?

Key drivers include estate investment and premiumisation, digital ordering and payment systems, mission-led local formats, supportive legislation, and domestic tourism.

What challenges face the UK pub industry?

The UK pub industry is challenged by rising staff costs, labour shortages, high debt levels, estate closures, and increased employer costs such as National Insurance, minimum wage rises, and reduced business rates relief.

What consumer trends are shaping the UK pub market?

Consumers are spending more per visit (£24.59 on average), visiting more frequently, and shifting towards premium drinks such as spirits and cocktails. Beer remains dominant at 63% of drinking occasions.

How do millennials and Gen Z compare in UK pub market trends?

- Millennials (25–34): Share grew from 18.2% to 19.7%, making them the most engaged group.

- Gen Z (18–24): Share rose from 11.2% to 11.8%, showing recovery but still lower engagement than millennials.

What are the leading regions in the UK pub industry?

The South East holds the largest share at 13.7%, followed by London at 12.7% and the North West at 11.7%. London’s growth is driven by younger, affluent, urban consumers.

What food trends are influencing UK pubs?

Core dishes like chips, burgers, and steak dominate, while pizza, wings, and sharing plates are gaining share, reflecting demand for more social dining formats.

What is the outlook for the UK pub industry?

The UK pub industry outlook is steady growth to £25.7bn by 2028F, led by managed and premium formats, with trends such as sustainability, digitalisation, experiential venues, and consolidation shaping the market.