Within creatine supplements, Lumina Intelligence captured 446 products in 20 countries, across 6 continents. The category has become part of the sports nutrition establishment, and benefits from solid science and favourable regulatory environments. Despite its traditional bodybuilder image, the ingredient is now beginning to make its way into the hands of broader audiences.

The purpose of this report is to examine factors, drivers and trends behind the rapidly evolving creatine space, from formulation to claims, and identifies the top creatine brands within the sports nutrition space. Inclusion of the voice of engaged consumers has become increasingly important to successful product formulation strategies.

This report examines the growing importance of online consumer engagement in creatine in an era where a product’s fate is increasingly determined by consumer ratings and reviews.

€1,900

What this report gives you:

- The current picture for creatine: Consumer sentiment split by country, brand owners, brand.

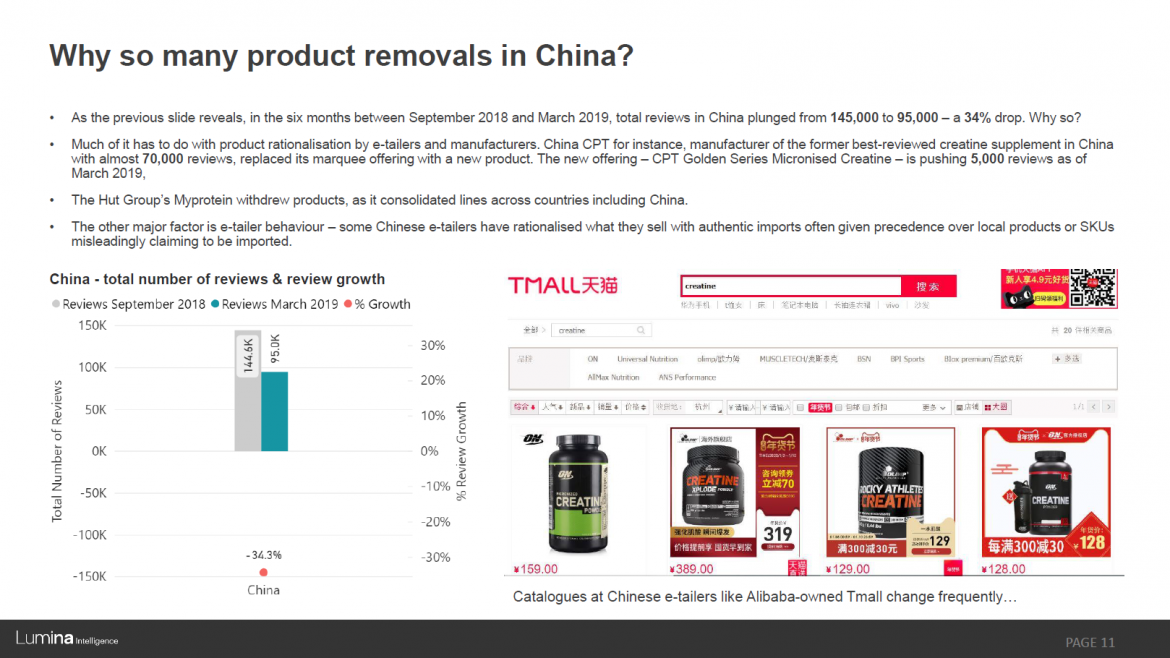

- Creatine product removals and what is causing them (includes deeper look into removals in China). How do reviews influence retailers’ decision to remove products?

- Deep dive into creatine science and formulation. Which creatine forms are most common and which resonate best with consumers?

- Exploration of creatine health claims, formats, pricing and demographics.

- Brand case studies including Iovate Health/MuscleTech, BSN, CPT and Creapure.

- How online is changing the retail landscape: reviews, Amazon age survival strategies and creatine’s social media presence.

- Country focus featuring China, Russia, The US and Europe.

- Conclusions and recommendations.

Quick facts:

- The current top players are Iovate Health Sciences’ MuscleTech, Glanbia-owned Optimum Nutrition, and China CPT.

- Increased exposure is occurring as a value-added ingredient in categories like pre-workout blends (where it appears in more than 40% of products) and protein powders (7.3%).

- The category is pushing 170,000 customer reviews, across the 20 markets captured by Lumina Intelligence.

- It has the second highest star rating (4.42 out of 5) among all sports nutrition categories, behind BCAAs.

- Water stability remains an issue for breaking into broad audience food industry (via RTDs, etc), but recent advances from ingredient suppliers such as Glanbia with CreaBev may help deal with this.

Preview – 2 slides of 73:

Chapters

- Global creatine trends

- Competitive landscape & case studies

- Iovate Health/MuscleTech

- BSN

- CPT

- Creapure

- Digital disruption & the rise of reviews/ratings

- Country/regional focus

- China

- The US

- Russia

- Rest of Europe

- Conclusions

Got questions about the sports nutrition market?

We examine the key players, trends and target consumers in 20 countries, as well as explore how Lumina can help you form a fact-based business or NPD strategy.