Longevity nutrition is rising in importance as consumers increasingly prioritise “ageing in good health and longevity.” Insights from Lumina Intelligence and FoodNavigator’s global study reveal that health goals are shifting, purchasing behaviour is changing, and functional ingredients are becoming central to how people support their long-term wellbeing.

With health priorities influencing product choices across the world, the longevity space is becoming a key commercial frontier for brands.

Healthspan Over Lifespan: A Shift in Global Health Goals

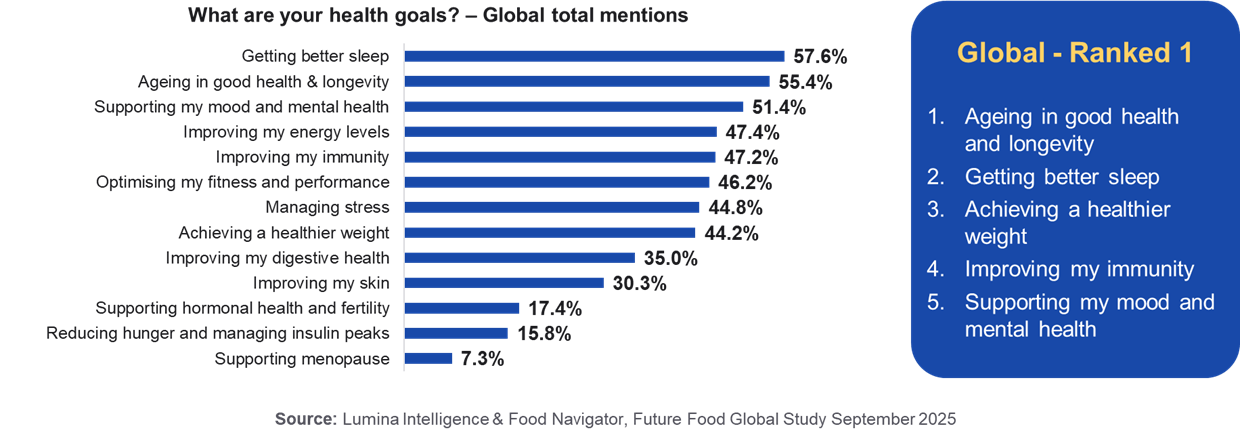

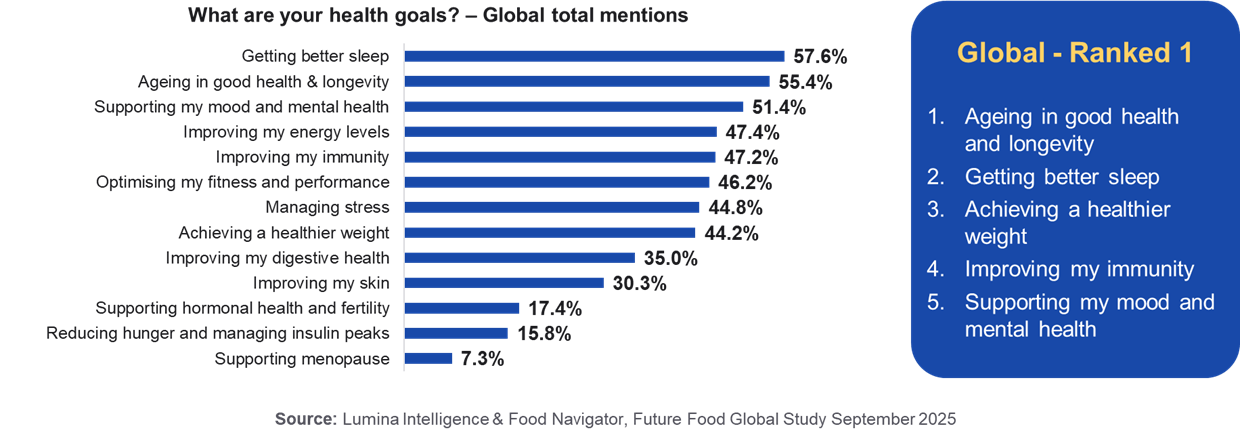

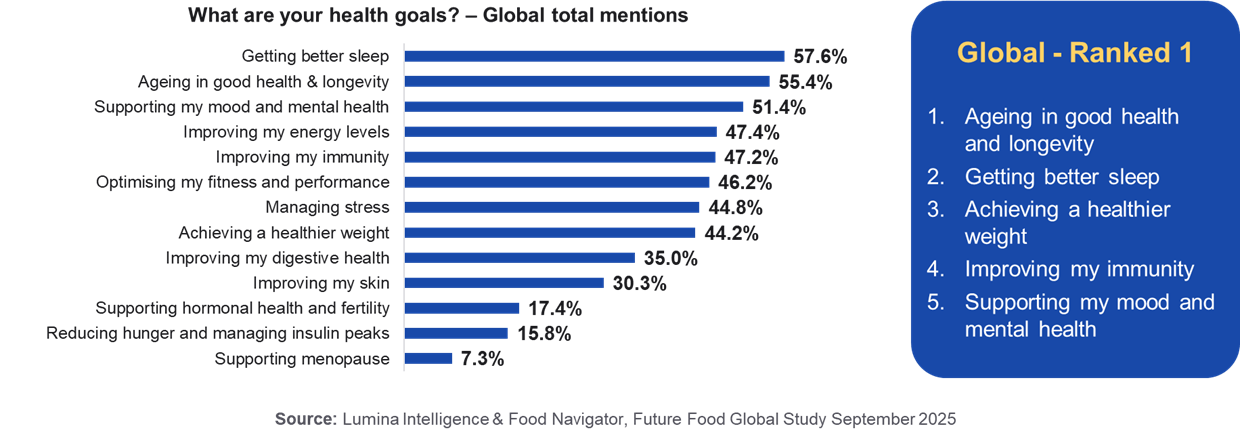

Our data shows that ageing in good health and longevity is the top global health goal, ranking first among consumers worldwide. Sleep is the most cited health goal, but when asked to rank priorities, longevity leads. Regional differences shape these motivations: Western countries prioritise ageing in health and longevity, while Singapore and Japan place stronger focus on sleep due to demanding work cultures.

In China and India, Traditional Chinese Medicine and Ayurvedic practices make immunity the top goal. While longevity is universally relevant, its drivers vary across cultural contexts.

The Ingredient Boom Fueling the Longevity Market

83% of consumers worldwide buy foods with added benefits, demonstrating strong demand for functional ingredients. Vitamins are the most commonly bought, followed by fibre and minerals. Interest in functional mushrooms, adaptogens, nootropics, and collagen is growing, especially in China and India, where wellness categories are more established and rooted in local dietary traditions.

| Added benefits | Total Global |

|---|---|

| Added protein | 34.3% |

| Added vitamins or minerals | 34.0% |

| Gut health | 28.3% |

| Immune support | 27.0% |

| Energy or focus | 20.3% |

| Heart health or cholesterol | 15.3% |

| Mental wellbeing / calmness / relaxation | 12.7% |

| Skin health / beauty-from-within management | 11.3% |

| Weight management (e.g. appetite control products) | 10.2% |

| Muscle recovery or sports performance | 9.6% |

| Anti-ageing | 9.4% |

Asia leads global engagement with functional ingredients, while uptake in the West is emerging, opening opportunities for growth. Categories such as:

- gut health

- immune support

- mental wellbeing

- anti-ageing benefits

are shaping how consumers choose products that support long-term health.

From Wellness to Science: The New Longevity Consumer

Consumers increasingly seek proof-based benefits in the products they choose. Across all new food technologies, proven health benefits are the number-one driver of adoption. High-protein formulations are especially influential in markets like the US, UK and Australia, where protein purchasing trends are already strong. Younger, health-led consumers also display higher awareness and willingness to try new technologies, while older consumers show more resistance. This reinforces the importance of clear communication, transparency, and scientific validation as central expectations for longevity-minded shoppers.

Innovation Spotlight: How Brands CAN Reframe

We have identified the categories where consumer interest aligns with longevity priorities:

- sleep support

- immunity

- gut health

- mental wellbeing

To address these, functional mushrooms, adaptogens and nootropics are becoming more commonplace in high-engagement markets, while added protein remains a strong driver of purchase, indicating clear opportunities for product innovation that supports ageing well. As wellness influences buying behaviour globally, demand is rising for foods, drinks and ingredients that reflect these goals.

What’s Next: The Commercial Opportunity in Healthspan Nutrition

With longevity becoming a leading global health priority, there is cross-category potential for brands that combine science-backed benefits with clear communication. Significant demand for functional ingredients and strong interest in health-enhancing innovations makes the longevity space opportunity-rich across regions, particularly in Asia and Western markets with high engagement in added-benefit foods. There is undoubtedly a growing need for positive health messaging, education, and transparency.

FAQs

What is “longevity nutrition”?

Longevity nutrition focuses on foods and drinks formulated to support healthspan—the years someone lives in good health. It emphasises functional benefits like immunity, gut health, sleep, cognition and anti-ageing rather than simply extending lifespan.

Why is longevity becoming a key health goal?

Global consumer research shows that “ageing in good health” is now the top health priority worldwide. While people often mention sleep as a concern, when asked to rank priorities, longevity comes first. This reflects a widespread desire to proactively maintain wellbeing over time.

Do consumer priorities differ by region?

Yes.

- Western countries put the strongest emphasis on ageing well.

- Singapore and Japan focus more on sleep because of intense work pressures.

- China and India prioritise immunity, shaped by Traditional Chinese Medicine and Ayurveda.

These cultural differences influence ingredient and product demand.

Which functional ingredients are most popular?

Globally, 83% of consumers buy foods with added benefits. The most widely purchased are:

- Vitamins and minerals

- Fibre

- Protein

Consumers are also increasingly interested in functional mushrooms, adaptogens, nootropics, and collagen, especially in Asia where wellness traditions are deeply rooted.

What added benefits are consumers looking for?

Top desired benefits include:

- Added protein

- Added vitamins/minerals

- Gut health

- Immune support

- Energy/focus

- Heart health

- Mental wellbeing

- Skin health/beauty-from-within

- Weight management

- Anti-ageing

These all align closely with long-term health and longevity goals.

Why is Asia leading the longevity nutrition trend?

Asia shows the highest engagement with functional ingredients due to strong cultural familiarity with food-based wellness approaches. Markets like China, India, Japan and Singapore already have established consumer awareness around mushrooms, botanicals and holistic nutrition.

What makes the new longevity consumer different?

Consumers now demand evidence-based benefits. Proven results are the top factor driving adoption of new food technologies. Younger, health-driven consumers are more open to innovations such as high-protein formulations and novel ingredients, while older shoppers prefer clarity and transparency.

Which product categories offer the strongest opportunities?

The categories most aligned with longevity priorities include:

- Sleep support

- Immunity

- Gut health

- Mental wellbeing

- High-protein products

- Adaptogens, nootropics and functional mushrooms

These areas show both high engagement and strong growth potential.

How should brands communicate longevity benefits?

Effective communication should be:

- Clear and transparent

- Focused on science-backed claims

- Positive rather than fear-based

- Easy for all age groups to understand

Credibility is key for the longevity-minded shopper.

Why is longevity nutrition a major commercial opportunity?

With longevity now a leading global health priority and consumer demand for functional ingredients stronger than ever, the market offers significant growth potential across both Asian and Western regions. Brands that combine credible science with accessible messaging are best positioned to win.

About the data

These insights have been powered by Lumina Intelligence’s global quantitative online survey, commissioned exclusively for Food Navigator. Fieldwork was completed in July 2025, capturing the views of 9,500 consumers across 13 countries: Australia, China, France, Germany, India, Italy, Japan, Malaysia, Singapore, South Korea, Spain, the UK, and the USA. Each national sample is representative, with larger bases in China and the USA (2,000 respondents each) and 500 respondents in all other markets.