A Market in Transition

Still navigating through economic headwinds, the UK pub and bar market is regaining momentum, forecast to grow +1.9% in 2025F to £24.1bn, reaching £25.7bn by 2028F (CAGR +2.1%). Managed and branded operators ( now 51% of market value despite representing just a quarter of outlets) are outperforming independents, underlining the advantages of scale and capital reinvestment.

Affluent 25–34-year-olds are powering the rebound, particularly in London and the South East, as return-to-office routines, sports viewing and rising disposable income lift social occasions.

Consumers continue to drink, but the approach has changed, and currently they are valuing brand, health and quality over volume.

Gen Z Redefines Drinking: From Sober to Selective

Despite former data indicating the opposite, the Gen Z’s “sober stereotype” is fading. UK Alcohol occasions among 18–34s have increased +4.2ppts YoY, while total alcohol penetration rose +1.1ppts, ending the long-term decline.

More young adults now drink often or sometimes, as tailored offers and stronger finances encourage selective participation. This has lead to the UK pubs and bars market gaining +2.5ppts in alcohol-led share, driven by these younger drinkers who balance moderation with mindful enjoyment.

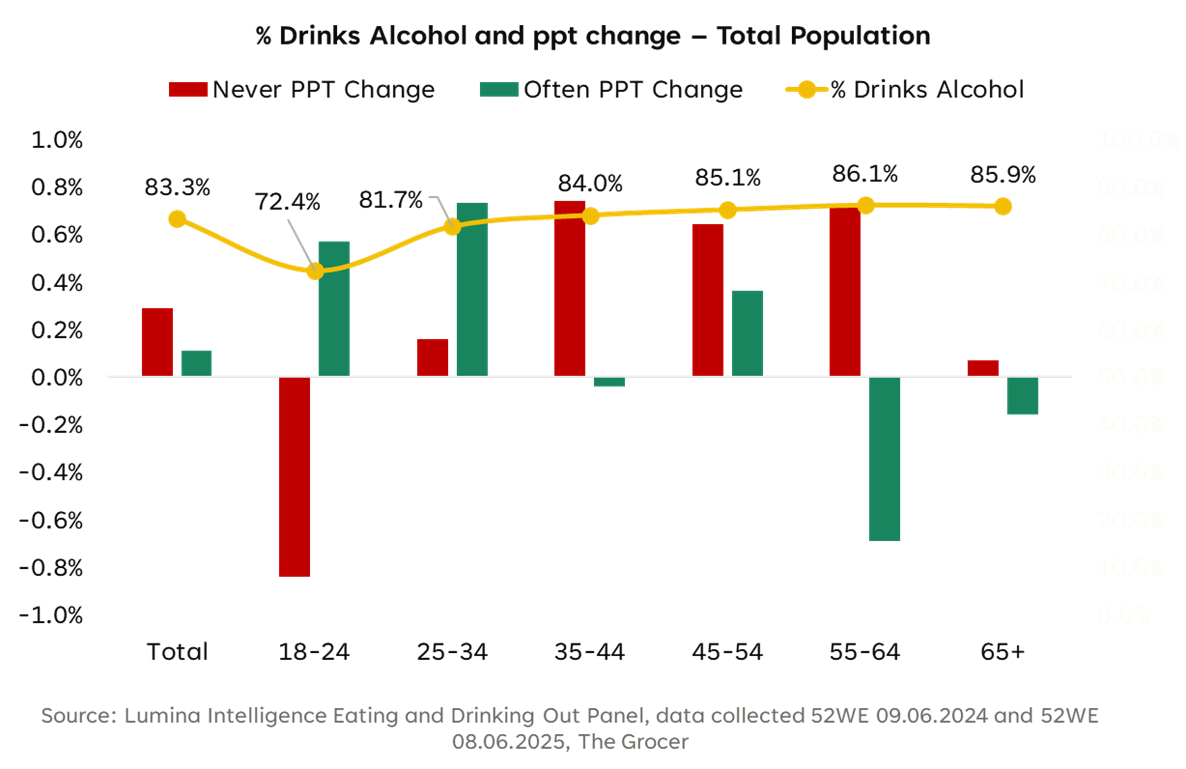

Percentage of adults who drink alcohol and year-on-year change

This chart combines: (1) the share of the population who drink alcohol and (2) percentage point changes in those who never drink vs. those who drink often, broken down by age group.

- Total population: ~83% drink alcohol. Small increases in both non-drinkers and frequent drinkers.

- 18–24: Lowest drinking incidence (~72%). Fewer non-drinkers year-on-year but more frequent drinkers.

- 25–34: ~82% drink. Growth in both non-drinkers and frequent drinkers, showing polarisation.

- 35–44: ~84% drink. Rising non-drinkers; stable frequent drinkers.

- 45–54: ~85% drink. Increase in both never-drink and often-drink cohorts.

- 55–64: ~86% drink (highest). Strong rise in never-drinkers; sharp drop in frequent drinkers.

- 65+: ~86% drink. Slight growth in frequent drinkers but still down overall.

Source: Lumina Intelligence Eating and Drinking Out Panel, data for 52WE 09.06.2024 and 52WE 08.06.2025.

Beer Holds Its Ground But Premium Spirits Are Winning

Beer still leads, representing 63% of pub and bar alcohol occasions, though share is flat year-on-year. Spirits (+1.4ppt) and cocktails (+0.6ppt) are the fastest-growing categories, confirming that premiumisation continues to shape the on-trade.

Average spend emphasises the value in premium serves: with cocktails priced at £23.36 vs beer £12.85. Considering this trend, upselling high-value drinks and refreshing menus with experiential options is proving key for profitability for UK pub operators.

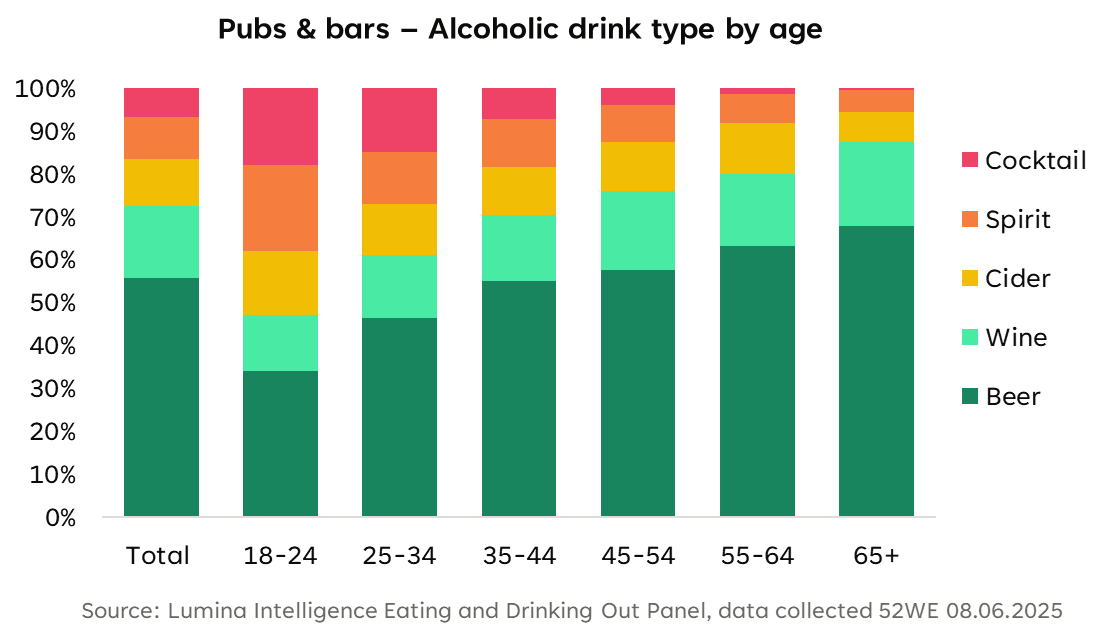

Pubs & bars – Alcoholic drink type by age

This chart shows the mix of alcoholic drink types ordered in pubs and bars by age group. Beer is the leading drink in every age band, with its share increasing with age. Younger adults favour cocktails and spirits more strongly.

- Total: Beer dominates overall, followed by wine; cider, spirits and cocktails make up smaller shares.

- 18–24: Most diverse drink mix. Higher share of cocktails, spirits, and cider compared with older groups.

- 25–34: Beer grows in share; cocktails and spirits remain important.

- 35–44: Beer becomes the clear leader; wine increases; cocktails and spirits decline.

- 45–54: Beer strengthens further; wine continues growing in relevance.

- 55–64: Beer and wine dominate strongly; very low share of other drinks.

- 65+: Beer overwhelmingly dominant; wine second; very small share of cocktails, spirits and cider.

Source: Lumina Intelligence Eating and Drinking Out Panel, 52WE 08.06.2025.

Young Consumers Drive Cocktail Culture

18–34-year-olds are less engaged with beer and wine but are the main drivers of growth in spirits and cocktails. They prefer novelty, flavour, and experiences that translate to social content, from sweet infusions to brand-led collaborations.

A standout example is Tipsy Tapioca (Bristol), offering alcoholic bubble tea cocktails that blend Gen Z’s love for flavour and shareability.

The Rise of Functional and Health-Led Drinks

Changing social habits are impacting the drinks mix in pubs and bars. What are these new habits?

- Early-evening visits are on the rise.

- Low-tempo visits are also up.

- Health-conscious occasions are now integral.

Showcasing this shift towards healthier occasions, we have observed fruit juices and smoothies gained +1.9ppts in occasion share, leading the non-alcoholic growth.

Alcohol-free cocktails also went up +27%, as did alcohol-free beers (+38%), showcasing consumers are mixing social and functional choices. Health-conscious occasions are no longer niche, they support the upward curve towards daytime and early-evening visits.

Digitalisation and Dynamic Pricing Shape the Future Pub

Technology is redefining the pub experience. Greene King, Stonegate and Heartwood are scaling app-based loyalty schemes, offering personalised rewards and gamified offers.

For some operators, loyalty-linked transactions now account for up to 22% of total sales. AI-led back-of-house systems, CRM marketing, and app ordering are improving efficiency and engagement.

Meanwhile, dynamic pricing models, such as O’Neill’s £2 late-night surcharge or Hollydale’s “Pint by the Hour”, are gaining ground to offset cost pressures.

Conclusion: Raising a Glass to Resilience

Growth is being fuelled by four converging trends: premiumisation, health-led consumption, Gen Z re-engagement, and digital innovation, supporting a steady recovery through 2028F.

The UK alcohol consumer is drinking less but better, balancing mindful consumption with meaningful experiences.

FAQs

How much is the UK pub and bar market worth in 2025?

The UK pub and bar market is forecast to reach £24.1bn in 2025, rising to £25.7bn by 2028F – a CAGR of +2.1%. Growth is led by managed and branded operators, which now represent 51% of total market value.

Are younger consumers drinking less alcohol?

Not anymore. While Gen Z traditionally drank less, 2025 data shows a +4.2ppt rise in alcohol occasions among 18–34s, with total alcohol penetration up +1.1ppts year-on-year. Young adults are shifting from “sober” to selective drinking, choosing quality over quantity.

Which alcoholic drinks are growing fastest?

Spirits (+1.4ppt) and cocktails (+0.6ppt) are gaining share, driven by premiumisation and younger consumers’ preference for flavour, presentation and experience. Beer remains the largest category at 63% of alcohol occasions, but its share is flat year-on-year.

What’s behind the rise in cocktail culture?

The growth of cocktails and flavoured spirits reflects Gen Z’s appetite for social, photogenic drinks.

Concepts such as Tipsy Tapioca in Bristol – serving alcoholic bubble tea – illustrate the fusion of fun, flavour and experience defining modern pub menus.

Are low and no-alcohol drinks still growing?

Yes. Alcohol-free beers (+38%) and alcohol-free cocktails (+27%) continue to expand, as fruit juices and smoothies (+1.9ppts) lead non-alcoholic growth. These health-led drinks appeal to “sober curious” consumers and daytime occasions.

How are technology and digitalisation changing pubs?

Operators are investing in AI, app ordering and CRM-driven loyalty.

Major groups such as Greene King, Stonegate and Heartwood report loyalty-linked transactions making up to 22% of total sales.

Meanwhile, dynamic pricing – like O’Neill’s surcharges and Hollydale’s “Pint by the Hour” – is helping to protect margins.

What are the key trends shaping 2025?

Four macro themes define the market:

- Premiumisation – consumers trading up to quality.

- Health-led choices – growth in low/no and functional drinks.

- Gen Z re-engagement – younger consumers returning to pubs.

- Digital innovation – technology enhancing experience and efficiency.

What’s the outlook for the UK drinks industry?

The British drinks market continues to “drink less but better”, balancing mindful consumption with meaningful experiences.

Moderate yet sustained growth is expected through 2028F, supported by health awareness, brand loyalty and tech-driven engagement.