Lumina Intelligence’s Eating and Drinking Out Panel (EDOP) offers a snapshot of how UK consumers continued to navigate eating out during a period of economic pressure and shifting priorities. As we analyse the 13 weeks to 29 June 2025, the data reveals a market defined by selective spending, health-conscious choices, and a preference for trusted brands. Together, these trends show how diners are adapting their habits rather than retreating altogether from out-of-home occasions.

An Era of Selective Spending

In Q2 2025, UK consumers continued to tread carefully with their spending amid a tougher economic climate. April recorded the sharpest GDP contraction since October 2023, just as tax rises from the Autumn Budget came into effect. Against this backdrop, eating-out penetration declined year on year by 0.8 ppts, while consumer confidence sank to its lowest level in 18 months.

Consumer confidence improved slightly in May and June, but most diners still prioritised value for money. Better summer weather pushed eating-out frequency up 5.9%, led by 25–34-year-olds, yet families reduced dining-out occasions (-0.5ppts) as financial strain persisted. QSRs drove most of the growth, and inflation continued to lift average spend.

Value-Driven Dining: Smart Choices Over Cheap Eats

Price seems to no longer be the sole driver of dining decisions. The data shows that while value-led behaviour dipped slightly (-1ppt), more consumers are now motivated by other factors: quality (+3ppts), brand trust (+3ppts) and health considerations (+5ppts). Diners seem to be seeking experiences that feel worth their money. In a market still under financial pressure, consumers are balancing affordability with reassurance, reliability and wellbeing when choosing where to eat out.

It’s worth noting the generational divide in dining priorities: younger consumers, particularly 25–34s, are leading growth through social, experience-driven dining, choosing brands and venues that feel authentic and worth their spend. In contrast, older age groups (especially 35–44s balancing family costs) are tightening budgets, focusing more on essential or at-home occasions.

The Rise of the Mindful Diner: Health Meets Indulgence

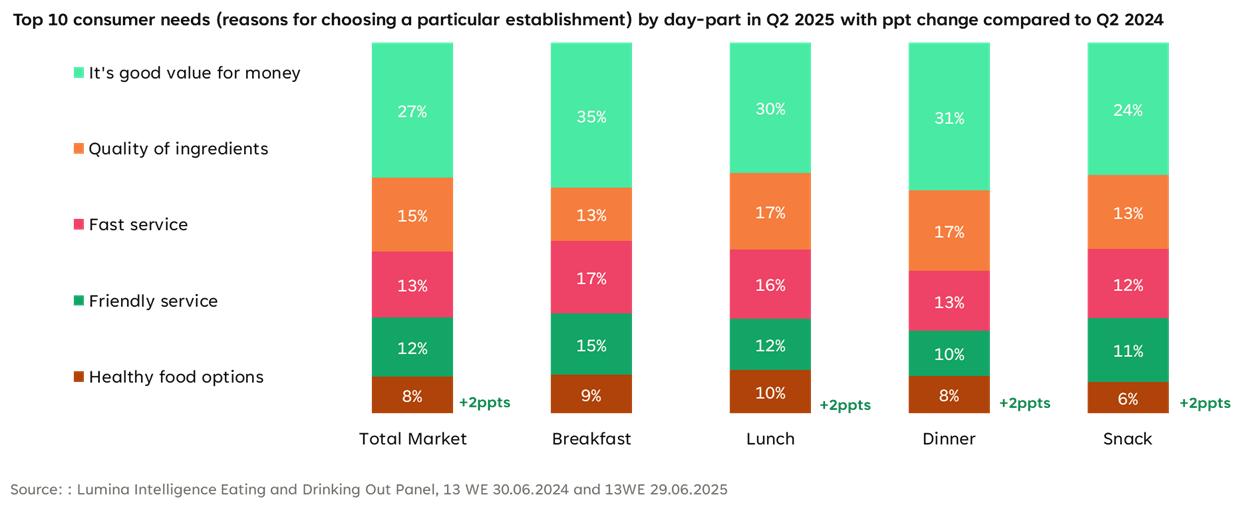

Health is also becoming a stronger priority for consumers, particularly around lunch, dinner, and snacking occasions, illustrating a growing desire for more mindful choices throughout the day.

Across the day, from lunch to dinner and snacks, a higher proportion of consumers are choosing outlets because they offer healthy food options, up +2 percentage points across the total market. Meanwhile, traditional priorities such as fast service or familiarity have decreased slightly, suggesting that consumers are re-evaluating what “value” means, favouring venues that help them feel good, not just full.

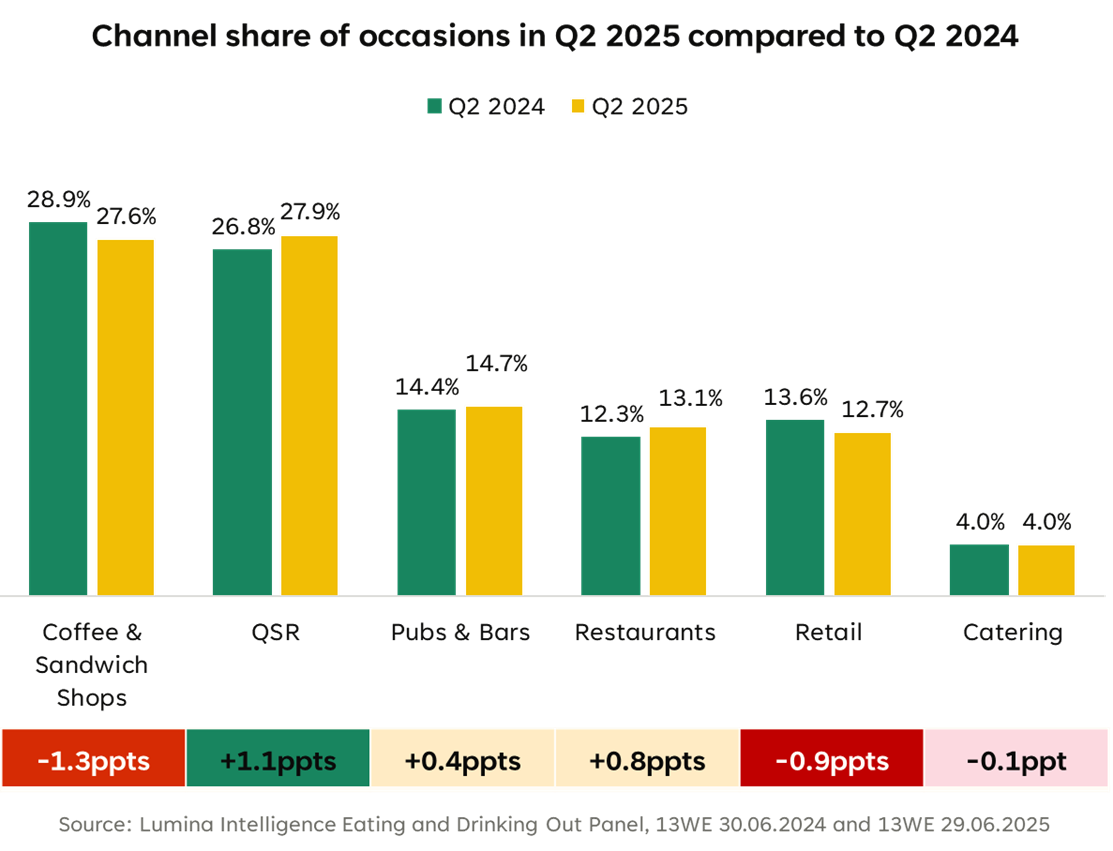

QSRs & Affordable Indulgence: Winners in the Value Race

Quick-service restaurants (QSRs) led channel growth in Q2 2025, gaining +1.1 percentage points and reversing the slight dip seen in 2024, as consumers made more conscious, value-driven choices. Competitive pricing and new meal offers helped QSRs capture spend from coffee and sandwich shops, which fell –1.3ppts over the same period. Within the top 10 brands, Domino’s recorded the strongest quarterly rise (+1.4ppts) following the launch of its £4 lunch deal, while Burger King, Wetherspoons, and KFC also gained share.

Menu preferences mirrored this shift: burgers and pizza increased their share among the top 10 dishes consumed out of home, consistent with the growth seen across QSRs, pubs, and restaurants. This indicates that consumers are still seeking affordable indulgence, opting for satisfying, familiar favourites that balance value, comfort, and convenience amid ongoing financial pressures.

Smart Indulgence as the New Normal

The Q2 2025 data shows a market shaped by deliberate choices rather than broad decline. Diners are weighing quality, trust, and wellbeing alongside price when deciding where to eat.

Quality, brand, and value now coexist as key drivers of eating-out decisions. Operators offering reliability, recognisable brands, and consistent value are capturing spend, particularly across QSRs, pubs, and casual dining venues that balance affordability with comfort.

The 2025 diner is health-aware, socially motivated, and brand-loyal, yet remains cautious. Rising health-led motivations (+5ppts) and greater preference for venues offering healthy food options show that wellbeing is increasingly tied to perceived value. Consumers are spending selectively, favouring trusted, affordable formats that align with their priorities.

This pattern of smart indulgence suggests a steady recalibration of the UK eating-out market. As financial pressure persists, brands that deliver both reassurance and relevance are best positioned to maintain loyalty and drive sustainable growth.

About the data

The insights in this article are from Lumina Intelligence’s Eating and Drinking Out Panel (EDOP), built on 78,000 annual surveys across 900+ operators, this solution provides a nationally representative view of UK out-of-home eating and drinking behaviour across dine-in, takeaway, and delivery occasions. For more information or tailored insight, visit lumina-intelligence.com

FAQs

What is the timeframe covered in this analysis?

The insights are based on data from Lumina Intelligence’s Eating and Drinking Out Panel (EDOP) for Q2 2025, covering the 13 weeks ending 29 June 2025. This period compares year-on-year performance against Q2 2024.

How did overall eating-out participation change?

Participation fell slightly by 0.8 percentage points year on year, as consumer confidence reached an 18-month low in April. However, frequency increased by 5.9%, helped by warmer weather and stronger engagement from 25–34-year-olds.

Which channels performed best?

Quick-service restaurants (QSRs) recorded the strongest growth, up +1.1ppts, reversing a small decline in 2024. Coffee and sandwich shops saw the largest fall (–1.3ppts), while pubs and restaurants posted modest gains as consumers took advantage of social opportunities in better weather.

What are consumers prioritising when choosing where to eat?

Price remains important, but quality, brand trust, and health gained ground. The proportion of consumers led by quality increased by +3ppts, brand-led by +3ppts, and health-conscious by +5ppts, while value-led behaviour dipped –1ppt.

What’s driving the rise in health-focused choices?

More diners are seeking balance rather than restriction. The share of consumers choosing outlets for healthy food options rose +2ppts across the total market, with similar gains at lunch, dinner, and snack occasions.

Which dishes and brands gained share?

Burgers and pizza increased their share of the top 10 dishes consumed out of home, reflecting the appeal of affordable indulgence. Among brands, Domino’s posted the biggest gain (+1.4ppts) after launching its £4 lunch deal, followed by Burger King, Wetherspoons, and KFC.

How did demographics influence eating-out behaviour?

The 25–34 age group drove growth through more social and experience-led occasions, while 35–44s, often balancing family expenses, reduced discretionary dining. This generational divide is shaping how value and indulgence are defined across the market.

What does “smart indulgence” mean in this context?

It describes how diners are managing economic pressure by seeking affordable moments of enjoyment. Rather than cutting back completely, consumers are being selective — prioritising trusted brands, comfort food, and venues that deliver perceived quality and value.

What can operators take away from this?

Brands that combine affordability with reassurance — through transparent pricing, consistent quality, and balanced menu options — are best positioned to maintain loyalty. Smart indulgence is emerging as the central theme shaping the UK eating-out market in 2025.