Kombucha – a drink with a mission

€500

About the report

This report examines the rise and expected trajectory of the fermented beverage kombucha. The dynamic US market has been pinpointed as the driving force behind the kombucha craze, but there is plenty of local variation in other markets feeding and cross-fertilising innovation across the globe.

What this report gives you

- An overview of the global kombucha market including product removals.

- What factors are driving demand for kombucha, who the target market is and how consumer search for the beverage has evolved.

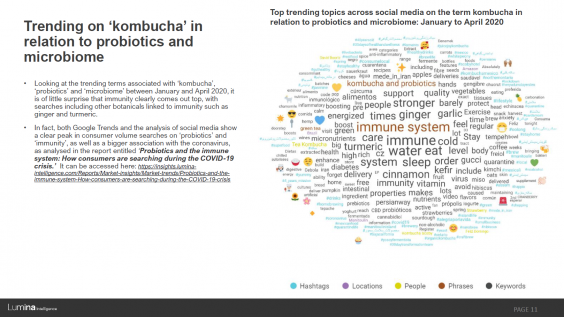

- Social media overview – how is kombucha discussed on social channels and in what context? Which channel dominates the online conversation? How do consumers talk about kombucha in relation to probiotics and the microbiome?

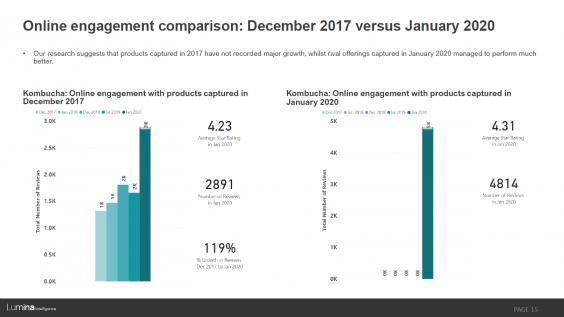

- Consumer engagement data for kombucha products including a comparison with other categories in the probiotics space, how engagement has changed over the last two years and country breakdown.

- The world’s highest rated kombucha brands with case studies on Kombucha Wonder Drink, Yogi Tea Kombucha and Kombucha+Kouso.

- Health claims overview: Which ingredients kombucha health claims are based on, the most common claims and which attract the most consumer engagement.

- Trends to watch and future outlook.

- What is kombucha and what drives demand?

- Online engagement is key

- The world’s top reviewed & rated kombucha brands

- What claims are kombucha products making?

- Trends to watch

- Outlook

About the author

Ewa Hudson

Director of Insights Lumina Intelligence

With 20+ years experience in tracking health and wellness, microbiome and e-commerce trends, Ewa offers a unique perspective and expertise on the marketplace and its growth opportunities. She oversees the research and content strategy for Lumina Intelligence, a business intelligence service from William Reed. In her previous role, Ewa managed the global Health and Wellness, Nutrition and Ethical Labels industries at Euromonitor International. She has a master’s degree in economics from the university of Poznan, Poland and a postgraduate Marketing studies at the University of Westminster in London.