Overview of the UK Food Delivery Market

The UK food delivery market continues to expand, with projected growth of 3.1% to reach a market size of £14.3bn in 2025. Market statistics reveal expansion opportunities through AI-driven apps, delivery-only kitchens, and day-part innovation. This article provides vital insights on food delivery statistics and shifts in market share for stakeholders seeking growth, competitive edge, and strategic investment in this sector.

Explore the insight covered in this article:

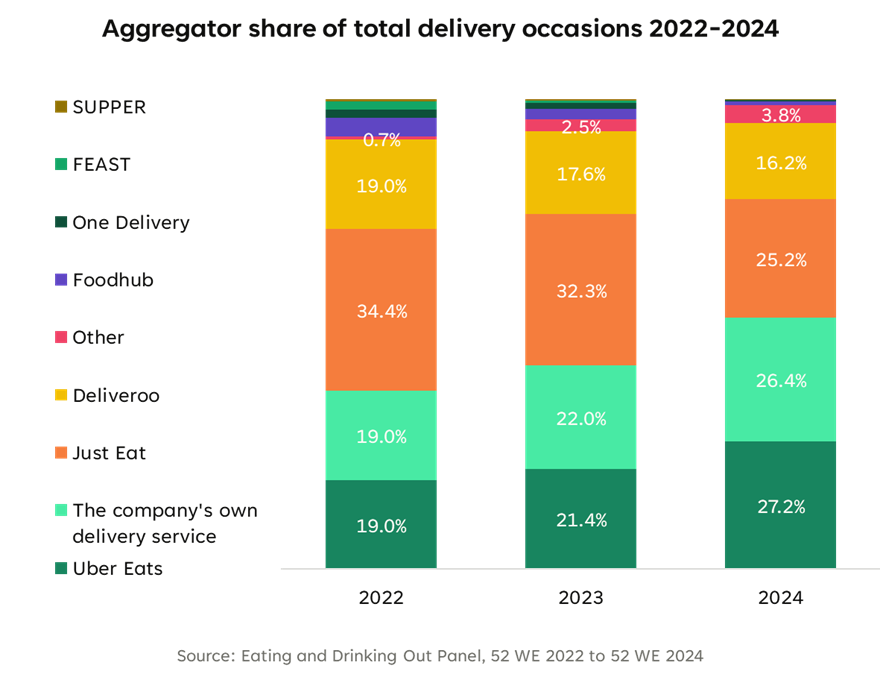

Our UK food delivery market overview reveals a sector undergoing transformation, driven by evolving consumer preferences and technology innovation. Key players such as Deliveroo, Uber Eats, and Just Eat dominate the online food delivery market, though aggregator share is shifting. In 2024, Uber Eats overtook Just Eat, accounting for over half of all delivery occasions. The market spans direct-to-consumer models, where brands own the customer journey, and third-party platforms, offering scale but limited control. Growth is fuelled by app enhancements, white label integration, and demand for flexible delivery, reshaping current UK delivery trends.

Market Growth Trends

The UK food delivery market has shown strong growth since 2019, evolving through pandemic-driven acceleration and now stabilising with consistent year-on-year expansion. Market value surged from £7.6bn in 2019 to a projected £14.3bn in 2025, representing an overall increase of 87%. Peak market growth occurred in 2020 at +53.8%, as lockdowns pushed demand to unprecedented levels. Since then, food delivery growth has moderated, with the market forecast to grow by +3.1% in 2025, staying resilient despite macroeconomic challenges.

The 2025 food delivery market growth will be underpinned by several key drivers. These include rising consumer demand for convenience, the continued expansion of delivery-only kitchens, and enhanced user experiences through mobile app innovation and AI-powered functionality. Leading players like Uber Eats are scaling reach via app integrations and optimised ordering journeys. Additionally, the growing share of direct-to-consumer models is boosting margins and brand control.

Importantly, while inflationary pressures and labour costs challenge operators, technological investments are enabling businesses to scale efficiently. As the market growth stabilises, it continues to present opportunities, particularly in diversifying delivery channels and capitalising on wider day-part demand.

A range of powerful food delivery market drivers are fuelling sustained growth, with consumer behaviour at the core. Convenience remains a dominant influence, as time-poor consumers seek fast, flexible dining solutions that fit modern lifestyles. Delivery occasions now account for up to 19.9% of total market occasions, underpinned by penetration growth (+0.7ppts) and rising average spend (+24% YoY).

The growth of e-commerce and the mainstreaming of online food ordering platforms such as Uber Eats and Deliveroo have enabled greater reach and brand control. These platforms now account for over half of all foodservice delivery occasions in the UK, supporting market scalability.

UK FOODSERVICE DELIVERY MARKET REPORT 2025

The definitive source of insight into the UK’s foodservice delivery sector.

Technology also plays a pivotal role. Advances in mobile ordering apps, loyalty integrations and AI-driven personalisation have enhanced the user journey. White-label platforms like Deliverect offer operators real-time integration, order tracking, and improved fulfilment, meeting rising consumer expectations for seamless experiences.

Finally, the legacy of COVID-19 cannot be overstated. The pandemic accelerated digital adoption and redefined dining habits, shifting preference from in-store to on-demand. As hybrid work patterns persist, lunch and solo missions now lead growth segments.

Together, these drivers position the UK food delivery market for long-term, innovation-led expansion.

The UK food delivery market share is increasingly consolidated among a few dominant platforms, though the broader competitive landscape remains active. By 2024, Uber Eats emerged as the market leader, capturing 27.2% of all delivery occasions. Close behind, company-owned delivery platforms – including brand-run services like McDonald’s McDelivery – held 26.4%, showcasing the growing strength of direct fulfilment strategies.

Just Eat, once the leading player, saw a decline to 25.2%, down -9.2ppts from 2022, while Deliveroo held 16.2%, continuing its gradual decrease. The rest of the market is shared among smaller aggregators and white-label services, which, while individually marginal, collectively underscore the expanding diversity in fulfilment models.

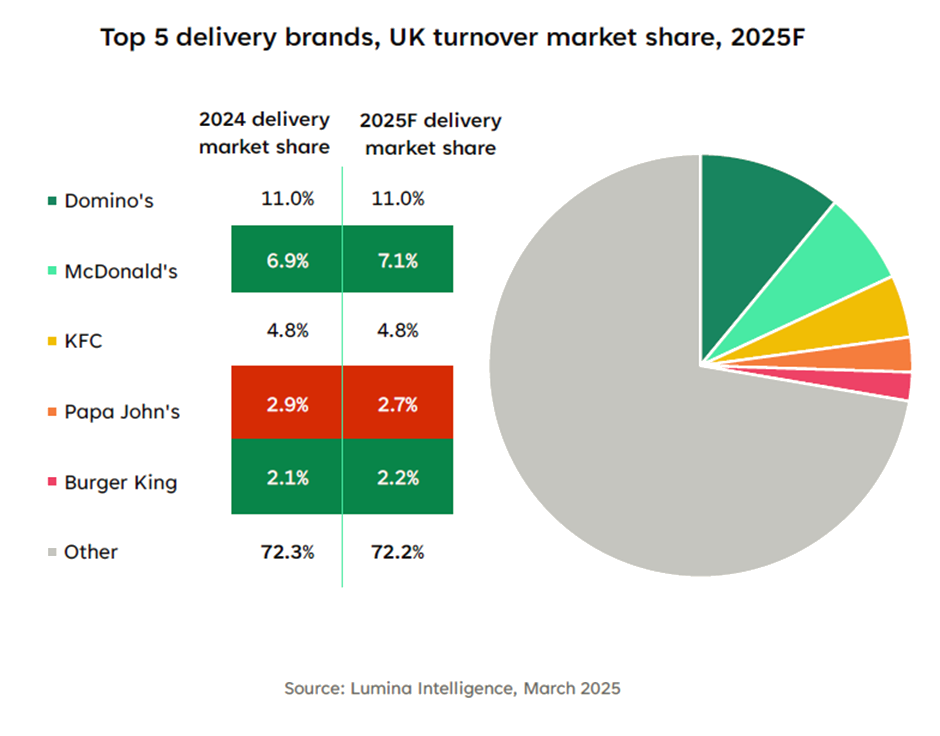

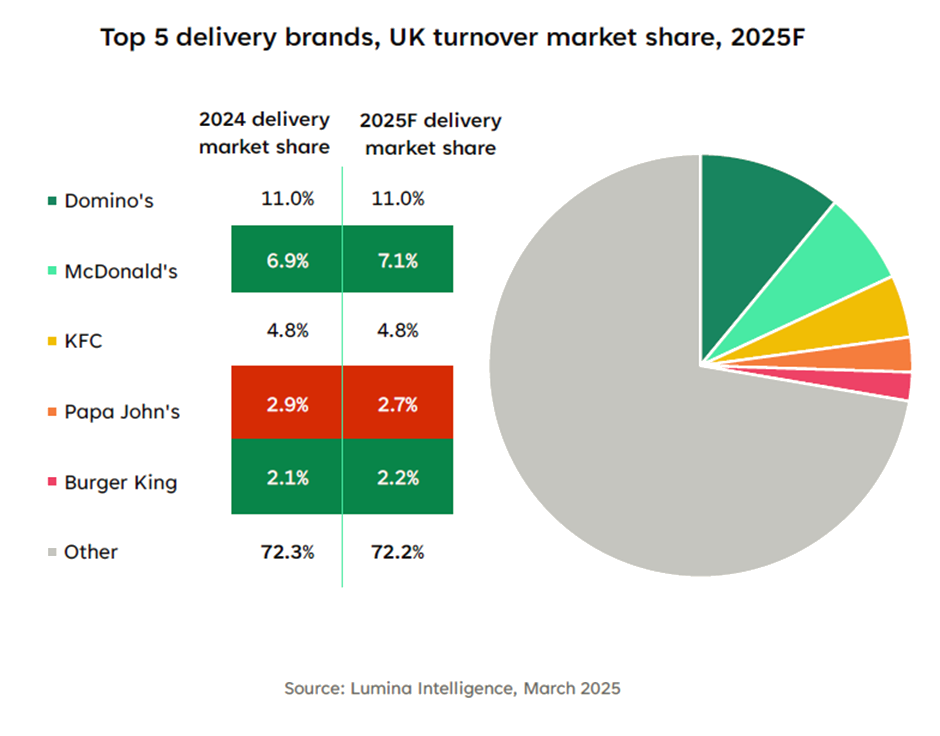

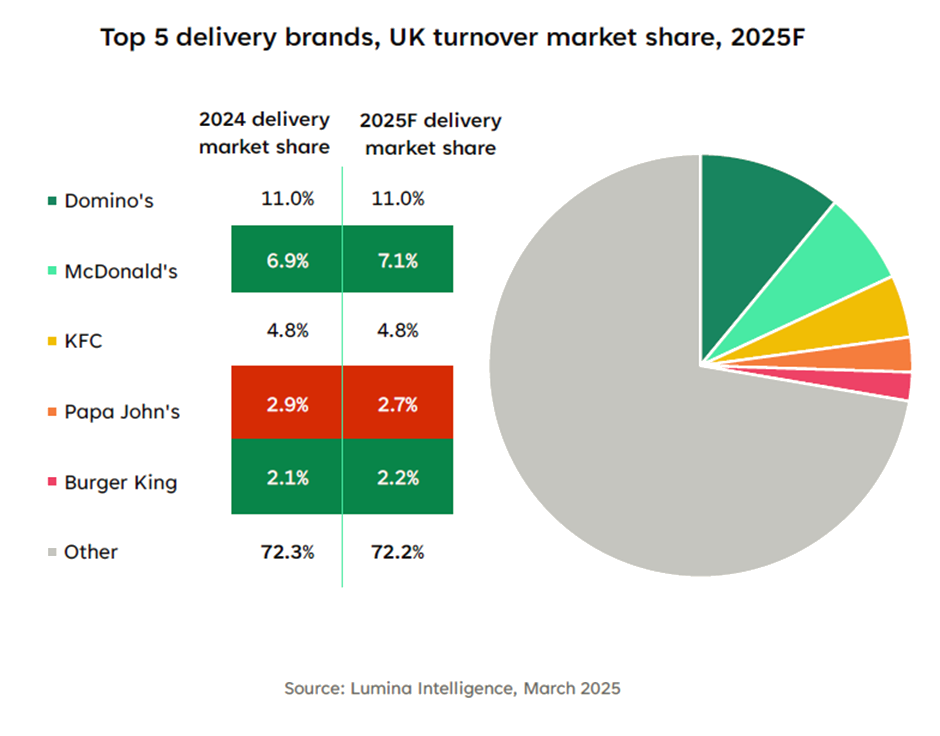

From a turnover perspective, Domino’s maintained its lead with an 11.0% share in 2025F, followed by McDonald’s (7.1%) and KFC (4.8%). These key players benefit from strong branding and well-established delivery infrastructure, contributing to their market dominance.

Market Size Statistics

Building on steady momentum, the UK food delivery market size is projected to be £14.3 billion in 2025, following modest year-on-year growth of 3.1%. This reflects not only recovery from pandemic volatility but also sustained structural demand, with the sector having grown nearly 87% since 2019.

Segmenting the 2025 market size, aggregators such as Uber Eats, Deliveroo and Just Eat now share space with company-owned platforms, which together account for over 53% of delivery occasions. Regionally, London dominates with 21.1% of all delivery share, supported by higher affluence and digital adoption, while younger, ABC1 consumers, especially those aged 25–34, continue to drive food delivery revenue through frequent and premium-led usage.

These market size statistics highlight a sector maturing in complexity, yet full of opportunity.

In summary, the UK food delivery market outlook points to sustained growth, evolving consumer preferences and greater digital integration. The future of food delivery will reward businesses that stay agile, track market trends, and embrace innovation. Adapting to change is essential to unlock value in this sector.

Frequently Asked Questions

What are the key drivers of growth in the UK food delivery market?

The main UK food delivery market drivers include consumer demand for convenience, adoption of mobile apps, AI-enhanced customer experiences, and the expansion of white-label and direct-to-consumer platforms.

Which company has the largest market share in UK food delivery?

In 2024, Uber Eats held the largest share of delivery occasions at 27.2%, followed closely by company-owned delivery platforms (26.4%) and Just Eat (25.2%).

How fast is the UK food delivery market growing?

The market is forecast to grow by +3.1% in 2025 to reach a value of £14.3 billion, continuing a steady post-pandemic trajectory.

What are the biggest challenges in the UK food delivery sector?

Key challenges include rising labour costs, tightening regulation (e.g. Employment Rights Bill), and inflationary pressure impacting consumer spending and operator margins.

What trends are shaping the future of UK food delivery?

Trends include growing delivery among 25–34-year-olds, value-seeking behaviour during group events, weekday lunchtime growth, and increasing use of technology to streamline ordering and fulfilment.

How is the UK food delivery market segmented?

By region, London leads with over 21% of delivery occasions. By demographic, ABC1 consumers and younger age groups dominate. By model, aggregators and brand-owned platforms now share the majority of delivery volume.

Why is it important for businesses to monitor food delivery trends?

Staying informed helps brands align with changing consumer expectations, invest in the right technology, and identify new opportunities in a market forecast to exceed £15.8 billion by 2028.