Digestion and immunity probiotic supplements in e-commerce

€1,800

About the report

2020 was a game changer for the probiotic industry, with an unprecedented level of consumer activity in the online space, derived from both existing and new consumers. This report summarises consumer and prospect activity around probiotic supplements claiming to support digestion and immunity.

Part one provides a top line market overview of the online engagement of current customers through metrics such as online reviews and star rating. Part two tracks the research new customers are doing online at the pre-purchase stage in search engines like Google. Part 3 features over 130 pages of regional and country-specific infographics to highlight geographical differences in the global development of the probiotic supplement e-commerce.

What this report tells you

- Analysis of the online engagement of current customers with the ingredient and label claims information of 2003 products positioned for immunity and/or digestion, encompassing 889 brands and 807 companies. Selected products are bestsellers in the e-commerce space in 25 countries.

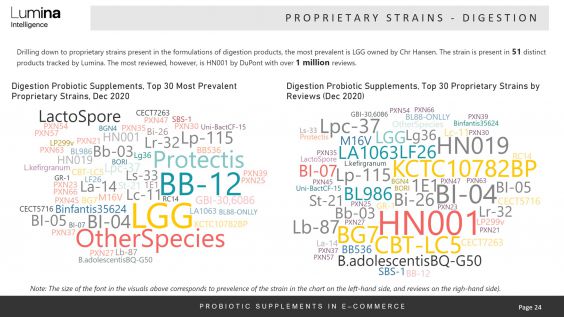

- Leading probiotics manufacturers, brands, probiotic suppliers, species and proprietary strains based on how products resonate with the end user.

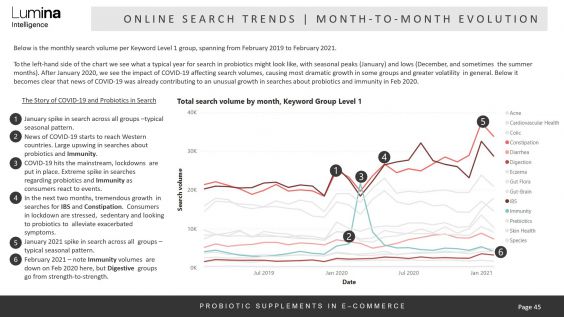

- A summary of how consumers research probiotics online pre-purchase, what this tells us about them and how the pandemic has accelerated or hindered particular trends, with deep-dives on IBS, Constipation, Digestion and Immunity.

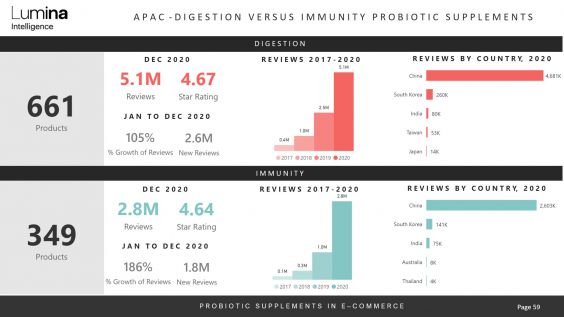

- Top-line infographics for regions (Asia Pacific, Americas, Europe) and per country to better understand regional nuances.

- Outlook and future recommendations for probiotics positioned for immunity and/or digestion, through the lens of both consumer post-purchase engagement and pre-purchase online research.

- Prevalence of and engagement with digestion and immunity-positioned probiotic supplements – Global overview

- Competitive landscape by:

- Brand owners

- Brands

- Probiotics suppliers

- Species

- Prevalence vs engagement

- Proprietary strains

- Target populations

- Prevalence vs engagement

- Proprietary strains

- Target populations

- Prevalence vs engagement

- Engagement impact factors

- Health claims

- Prevalence of and ingredient source of claim

- On pack vs on website claims

- Online search trends analysis to better understand new consumers

- Outlook

- Regional infographics

- Country infographics