Awareness of probiotics is high across Latin America and the region has seen good growth in recent years, but the eCommerce landscape is very different between the two gorillas in the Latin American room: Brazil and Mexico.

With 341 million people living in Mexico and Brazil, the two countries contribute just over 50% of the entire population of Latin America and the Caribbean (669 million, according to the United Nations). Mexico’s proximity to the US means it’s heavily influenced by its northerly neighbor, Brazil has more in common with Europe.

Mexico’s internet has until recently been seen as unreliable, which suppressed eCommerce in the country. But, as was seen in other countries, the COVID-19 pandemic dramatically accelerated eCommerce adoption in Mexico, according to the US Department of Commerce [1].

Indeed, Mexico’s domestic eCommerce market was valued at US$19.7 billion in 2021, growth of 27% over 2020, according to the Mexican Online Sales Association. Internet penetration in the country is around 71%, according to the World Bank, putting it significantly behind the US (90% in 2021) and Brazil (81% in 2021).

A 2018 report by Kerry claimed that Latin America was one of the largest opportunities for probiotic fortified foods and beverages, with Brazil contributing 52% of the areas total probiotic market with Mexico is second, with 28% of regional growth [2].

As of today, Mexico’s online probiotic supplements market remains underdeveloped compared to its neighbors, according to Lumina Intelligence [3]. Despite sales growth of 25% in 2022, this was from a very small base of just under US$1million. This put the country 24th out of the 25 probiotic supplement e-commerce markets researched by Lumina.

Technical improvements in the digital infrastructure hints at an exciting future for ecommerce in Mexico, especially when viewed in combination with the country’s health challenges. Top of this list is the surging obesity rate, which was classified as the country’s leading public health concern in 2020 in a paper in The Lancet – Diabetes & Endocrinology [4]

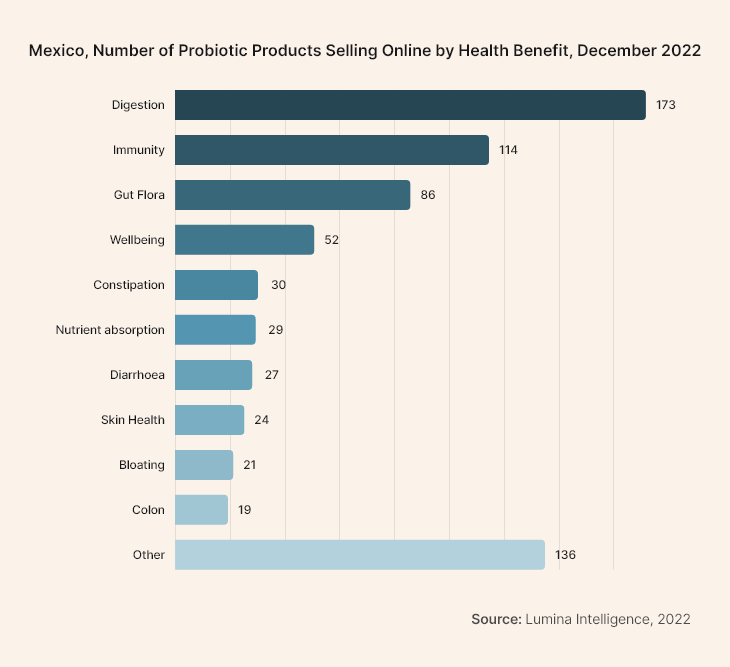

Despite the soaring obesity rates (75% of Mexicans are considered overweight or obese), probiotics positioned for weight management are yet to make much headway in ecommerce. Digestion and Immunity lead the way with weight management not even making the list.

Brazil

While Mexico may be lagging when it comes to online sales and engagement with probiotics, Brazil is booming.

ANVISA, Brazil’s health agency, implemented new regulations for dietary supplements just before the pandemic, and published guidance on necessary requirements when applying to use probiotics in food and make associated health claims [5].

Brazil was the second fastest-growing online probiotic market of the 25 tracked by Lumina in 2022. Sales surged 36.6% in 2022, reaching US$18.4m, which meant Brazil was the 11th biggest market in the world.

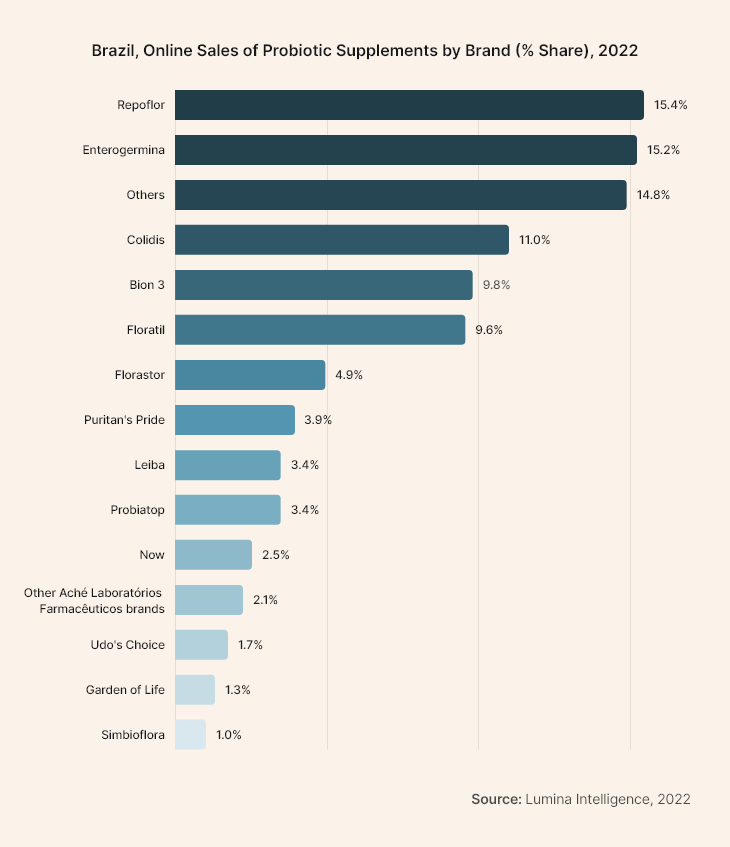

The market is driven mainly by the popularity of probiotic-enriched foods and beverages. For probiotic supplements the two leading brands in eCommerce are Repoflor and Enterogermina with 18% and 17.7% market share, respectively in 2022.

September 2022 saw the first psychobiotic launched – Probid by Apsen Farmaceutica SA featuring Lallemand Health Solutions proprietary probiotic, Cerebiome (a blend of Lactobacillus helveticus Rosell-52 and Bifidobacterium longum Rosell-175). The product is aided by it being the first probiotic with a gut-brain axis health claim authorized by the Brazilian Health Regulatory Agency (ANVISA).

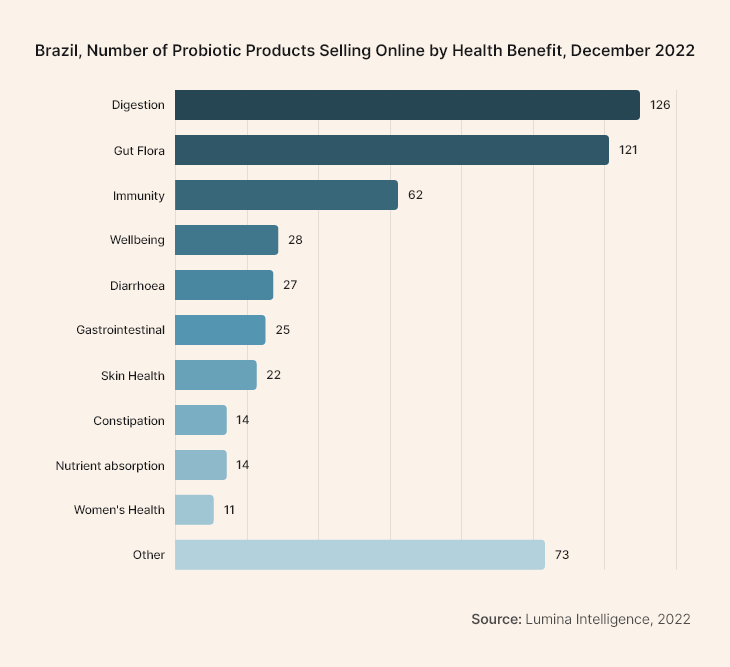

Just as we see in Mexico, Brazil’s probiotic products are mostly positioned for digestion, gut flora, and immune support.

The psychobiotic play does appear to be an opportunity in Brazil, given that the country has the highest prevalence of anxiety disorders and the fifth highest rate of depressive disorders in the world, and Lumina already tracks 10 probiotic products positioned for stress/ anxiety.

Weight management products do have a presence in this market with six products already being tracked.

Take homes

Awareness of probiotics – and to a lesser extent prebiotics – is high in Mexico and Brazil, and the COVID-19 pandemic has accelerated eCommerce in both countries, as it did in many other nations around the world.

We expect to see more approvals by ANVISA for probiotic-related health claims in the coming years and these will further buoy a robust market in Brazil. Mexico is at an intriguing point in its development, and given the strength of the US probiotic supplement market to its north and the States’ influence on the Mexican market, this country could be nicely poised to boom in the coming years, particularly given its public health challenges.

Sources

[1] Mexico – Country Commercial Guide, by the International Trade Administration at the US Department of Commerce. https://www.trade.gov/country-commercial-guides/mexico-ecommerce Accessed March 3, 2023

[2] Daniells, FoodNavigator-LATAM, 2018, https://www.foodnavigator-latam.com/Article/2018/06/11/Latin-America-is-the-fastest-growing-market-for-probiotics-with-Brazil-Mexico-leading-the-way-Kerry-Ganeden Accessed March 3, 2023

[3] Hudson and Chitakasem, Globiotics 2023, Lumina Intelligence, January 2023.

[4] Barquera and Rivera, The Lancet – Diabetes & Endocrinology, 8, (9), 746-747, (2020), doi: https://doi.org/10.1016/S2213-8587(20)30269-2

[5] Culliney, NutraIngredients-LATAM, 2019, https://www.nutraingredients-latam.com/Article/2019/04/04/ANVISA-probiotics-in-food-application-RDC-241-2018-guidance Accessed March 3, 2023

After the pandemic: Business lessons and insights from 25 probiotic supplement e-markets

In this report, Lumina explores how different markets, probiotic firms, and governments are adapting to the post-pandemic world, while also examining the rise of social commerce, the e-commerce performance of key probiotic strains.