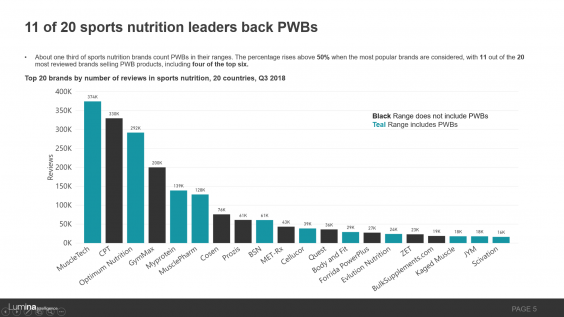

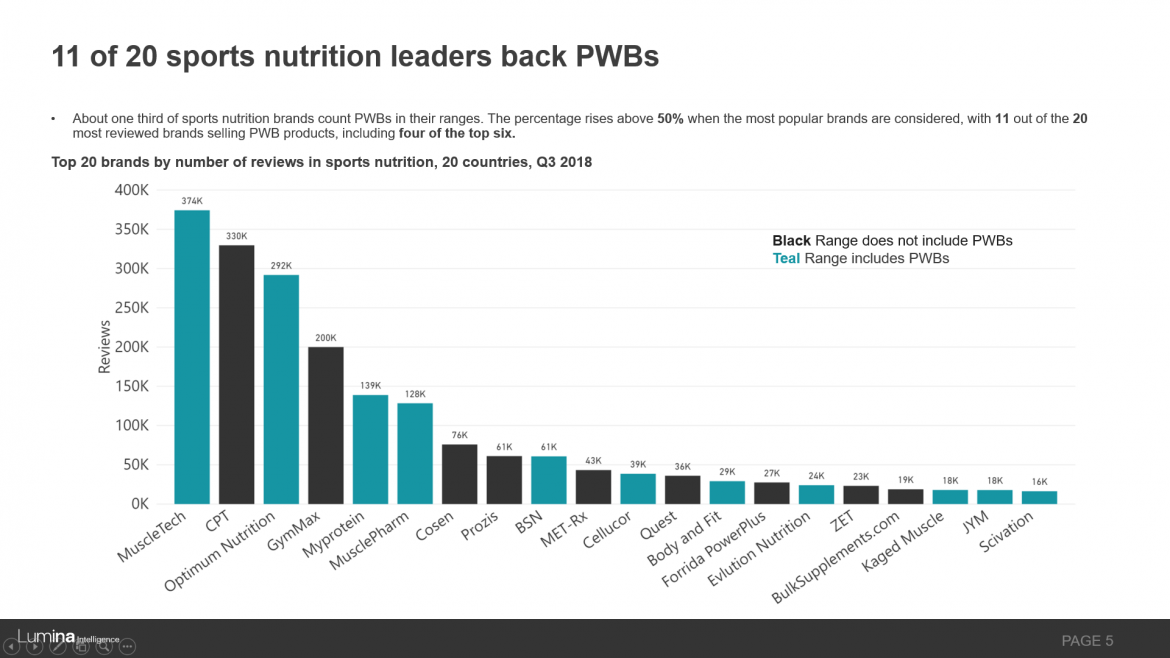

Published July 2019. A growing proportion of gym-goers and other athletes swear by pre-workout blends to boost performance. Half of the most popular sports nutrition brands carry PWB versions. Lumina’s data dive found 200+ brands in 20 countries and much potential for expansion beyond the gym-going hardcore toward energy drinks and non-powder formats – even as its ratings underperform against other sports nutrition categories over quality and efficacy concerns. We report on a challenging but potentially lucrative category.

€900

What this report gives you:

- A summary of the global pre-workout landscape including leading brands, reception by consumers, formats, science, ingredients, demographics, brand positioning, claims and labelling.

- Pre-workouts in the content of the online space: how many companies take their online presence seriously, which countries are particularly engaged online, trends and opportunities.

- An examination of pricing, proprietary ingredients and positioning in the competitive landscape, including case studies of leading brands embracing pre-workout blends.

- A deep-dive on particularly countries and regions: China, US, Japan, South Korea, Australia, Brazil, Mexico and Europe.

Quick facts:

- In Lumina’s 20-country data capture consumers reviewed Pre-Workout Blends (PWBs) 136,000 times with NutraBolt, JYM, Cobra Labs, Optimum Nutrition and Kaged Muscle out front in terms of online engagement.

- Use of amino acids including branched chain amino acids (BCAAs) is nearly mandatory with B-alanine present in 75% of 206 PWB brands we captured, often in branded ingredient form. Creatine is another key nutrient. Caffeine is present in 73%, and more than 50 botanicals formulated in varying ways into 61% including ginseng and green tea.

- PWBs incorporating proprietary ingredients (as opposed to proprietary blends) are scoring higher with consumers in a category that is one of the worst performing in the world of sports nutrition. While average star ratings are above 4/5, other categories like protein powders and BCAAs outperform it.

Preview – 2 slides of 73:

Chapters

- Global pre-workout landscape & product analysis

- Digital disruption & the rise of the review

- Competitive landscape

- Nutrabolt/Cellucor

- Cobra Labs

- BSN

- Kaged Muscle

- Country focus

- China

- US

- Japan/South Korea/Australia

- Brazil/Mexico

- Europe

- Conclusions

- Appendix of studies

Total slides = 64

Got questions about the sports nutrition market?

We examine the key players, trends and target consumers in 20 countries, as well as explore how Lumina can help you form a fact-based business or NPD strategy.