Video Transcript

Hello and welcome to this Lumina Intelligence marketing workshop. I’m Zoe and today I’m going to share 5 insights to help you attract online audiences to your website now, based on fresh search data from Google.

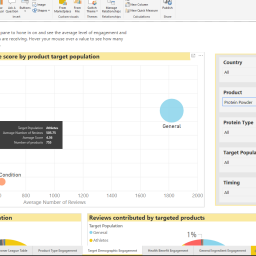

Through various keyword research techniques I’ve created an online search universe for the gut microbiome, then run my keywords through Google Keyword Planner. I’ve exported the keyword volume and competition data, grouped the keywords into two levels and calculated the change in search volume for each keyword between June 2018 and June 2020. Then I’ve imported this file into Power BI to visualise my findings.

So in this chart we have the average monthly search volume for the keyword group plotted along the X axis and the % change between June 2018 and June 2020 on the Y axis. The size of the bubbles represents the number of keywords captured in my research (in total this file contains data for just short of 650 keywords). As we are reliant on Google Keyword Planner data this isn’t a perfect science but will help us compare and identify high-search and growth areas in the gut microbiome space – on both a macro and micro level. Grouping the keywords has allowed me to split the data by key areas in keyword level 1 and, in keyword level 2, by common words that appear in searches, which is going to help inform us about the intent behind these queries when consumers search online.

Let’s dive into this and get some actionable insights for your marketing strategy.

Insight #1: Chronic conditions are key areas

Insight 1 is that chronic conditions like IBS and colic key areas and by that I mean they are high search volume and also high growth. Let’s get some more specific insights. So we’re now in the keyword level 2 for searches on “colic”. My first insight on colic specifically is that format really maters in this sector. “Drops” has 20k monthly searches with a 46% growth in 24 months.

If you provide probiotics in this area put format at the forefront of your marketing, in the product title, description etc. Looking at specific keywords used, don’t forget to use a variety of semantics – so as well as “baby” you will want to make sure you use other words like “infant”, “newborns”, “1 year old” in your product description to capture all those different searches.

Looking at another key area – IBS. Diving down into keyword group level 2 allows us to see that consumers seeking relief from these symptoms are using informational queries. So for example “help”. More specifically queries like “do probiotics help IBS”, “do probiotics help IBS symptoms”, “will probiotics help IBS” from people who are trying to find out about the efficacy of probiotics on IBS.

This category is particular has 2.8k searches per month and has had a 36% growth in 24 months. Consumers are even seeking out information on forums like Reddit – that particular group of keywords has a very high growth rate of 116% over the last 24 months.

Our recommendation off the back of this would be to provide this content on your blog to get your brand in front of consumers in this research and consideration stage. You could look at the cluster of keywords where consumers are looking for particular product recommendations – so which probiotics are best for IBS for example. It’s a unique opportunity to recommend your products or strains to consumers who are trying to find out more about the efficacy of probiotics on this specific health condition.

View all our reports

See the range of reports we offer for the probiotics market including market overviews, deeper examinations of niche markets, country insights and more.

Insight #2: Negative searches also growing

Staying on IBS, our second insight is that searches for negative side effects pertaining to probiotics are also growing. You can see here there’s a keyword group in IBS level 1 called “make worse” where we have these specific keywords which are quite negative and sceptical.

Our recommendation off the back of this would be to not shy away from these questions. Great content on your company blog could convert skeptics to customers if you thoroughly and transparently address their concerns. You could have a piece of content which links to a variety of studies pertaining to the benefits of probiotics on IBS and then as a counter-balance see if there are any studies on the negative effects that consumers are searching about.

Insight #3: Personalisation expected in broad areas

Going back up to our key areas in keyword level 1, our third insight is that in broad areas consumers expect more personalisation. So let’s look at constipation, which is a very broad health area. When you dive down into keyword level 2 you can see that our very high growth keyword clusters are related to target populations. For example, “baby” has 850 searches a month and has had 74% growth in the last two years. When we dive down into that we can see the specific searches being used. Equally, you can find other niches in the broad ungrouped keywords for example people on a keto diet and the elderly.

Our recommendation from insight is in product pages on your website explicitly state in your product titles and description who your product is for. In the description provide additional personalisation for example why the species in your product are particularly pertinent for that target group.

Insight #4: Niche searches could be more valuable

Going back up to keyword level 1 for our fourth insight which is don’t neglect these high-growth, niche areas that have lower search volume. Search volume is not necessarily a primary indicator of how valuable a keyword is. If we go into “species” for example – which has had a 50% growth rate in the last two years and gets about 1200 searches per month. At the moment we have three families of species leading the online search presence. The thing about these lower volume keywords is that they indicate people seeking out a particular species in combination with a different attribute of a product for example health benefit (anxiety) or target population – here we have a keyword pertaining to babies specifically. Keywords like this that are longer tailed often have a better conversion rate because the consumers searching in this way know precisely what they are looking for and they are ready to take action. Don’t neglect these areas just because they appear to have lower search volume – it doesn’t necessarily correlate to how valuable they are.

This can be reiterated if we go to the competition tab, which we’ve created to capture the percentage of keywords in each group and used the Google Competition Value Index to rate the perceived commercial value of the keyword according to advertisers. So in the species group 71% of the keywords are high competition – so they have a high perceived commercial value.

Our recommendation here is that long form content like blog posts or lengthy and informative product descriptions will give you the opportunity to cover strain and species detail. Make the most of it to capture this niche and commercially valuable search traffic.

Insight #5: Be seen first with educational content

Our final insight is that writing well thought-out content that answers consumer queries in the research and consideration stage is going to get your brand in front of customers first. When we say the “research and consideration” stage, these keywords are typically going to fall under the “low” competition bracket because these queries are more open and broad. We can see an example of that if we go to one of our key growth areas – IBS – and we look at the commercial value of the individual keywords themselves. There are lots of questions on whether probiotics help IBS, how long they take to work, how long you should take them for etc. You can also get some insight into condition-related semantics for example IBS D and IBS C”. This is a very handy way to view the keywords being used and craft the long form content that is going to inform these consumers and get your brand in front of them before your competitors.

Our recommendation, and a good recommendation to end this workshop on, is that Google’s main objective is to provide high-quality content to users that reflects their search intent. That should absolutely as a marketer be your objective too with your content. The exercise of building a keyword universe like this helps you understand the types of questions consumers are asking but it’s no replacement for high-quality content that shows authority on a topic.

That concludes this workshop I hope you’ve found it insightful. If you are interested in a step by on step on how to build a keyword universe that you can visualise in this way please let us know and we can create another video on it at some point in the future. In the meantime if you have any further questions you can contact us on help@lumina-intelligence.com.

Request a demo

Talk to us today about how a Lumina Intelligence probiotics subscription will guide your business strategy.