As the drive for personalisation continues across all aspects of individual life, we are seeing parallel developments in two consumer groups – those wellness-focused – i.e. someone who is consciously taking control of their wellbeing – and consumers who are looking to find products which meet a very specific health condition – the symptom consumers.

Understanding what drives the behaviour of these two very different demographics in the probiotic supplements’ category will be key to commercial success. Not unsurprisingly the past few months has seen a surge in consumer usage of probiotic supplements. According to a new survey from DuPont Nutrition & Biosciences, America, consumer usage of probiotic supplements in the US increased by 66% in May this year, compared to six months earlier, with daily usage also increasing.

The survey found that among American probiotic users, the number of Americans taking probiotic supplements every day or more often increased from 37% to 61%.

The survey also collected data from Italy and China, both of which experienced huge increases in usage of probiotic dietary supplements. Consumers in Italy reported the greatest increase in usage (188%) and weekly compliance (83%) in May, compared to six months prior, while China saw a 108% increase in total users (23% vs 48%), according to the survey.

growth in consumer usage of probiotics supplements in the US (May 2020 vs 6 months previous)

These figures tie in with the increase in reviews that the latest update of review data from Lumina Intelligence. Review growth across the 25 countries regularly surveyed by Lumina shows a 31% increase from January 2020 to July 2020, with both India and South Korea showing the greatest increase (46% and 740% respectively, albeit from a small base especially in India) *

View all our reports

See the range of reports we offer for the probiotics market including market overviews, deeper examinations of niche markets, country insights and more.

But equally interesting, and especially relevant for brands looking to position their products to maximise commercial effectiveness, Lumina has drilled down to analyse the review data provided by symptom consumers. Despite being seen as niche, this group already delivers 28% of all online reviews, and underpins the growth of the online engagement with probiotics in Europe. * Symptoms which are top of mind for the online consumer in the first half of 2020, include constipation, vaginal health and eczema.

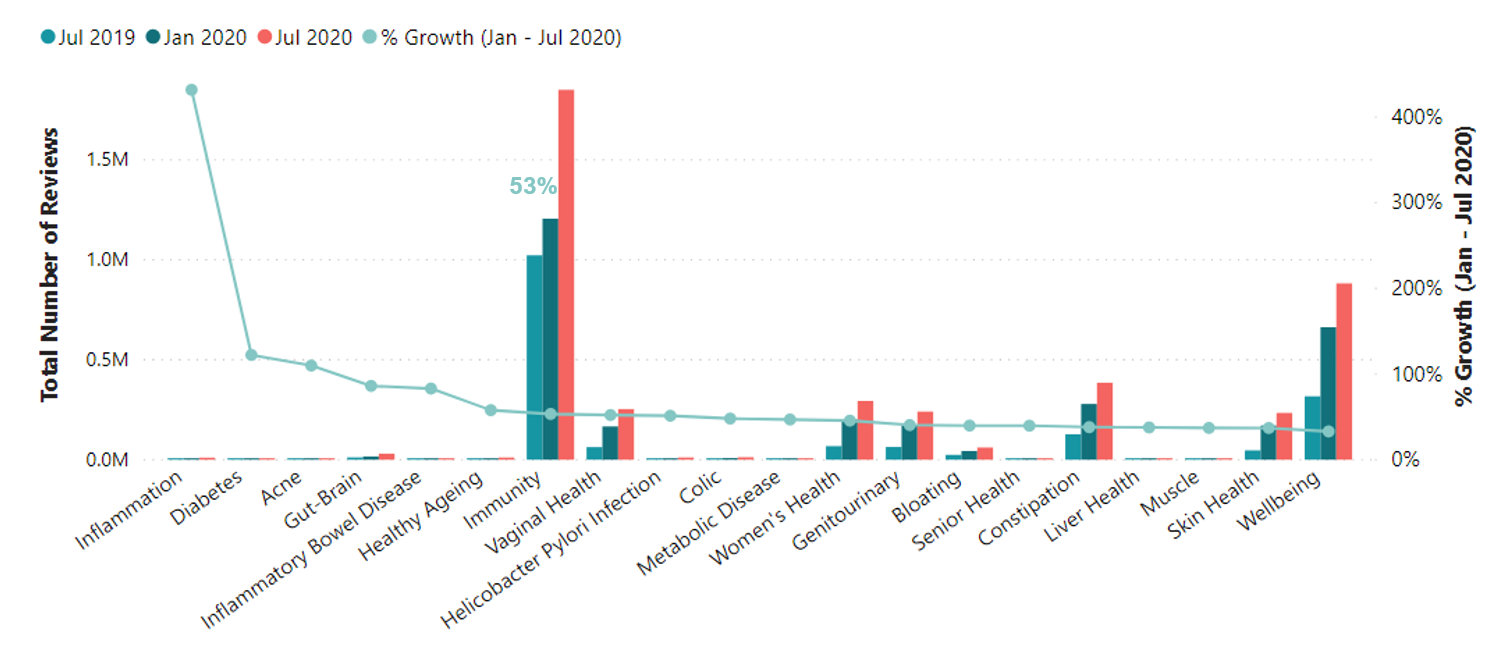

Probiotics, total number of reviews (Jul 2020) and % growth (Jan to Jul 2020) by health benefit, 25 countries

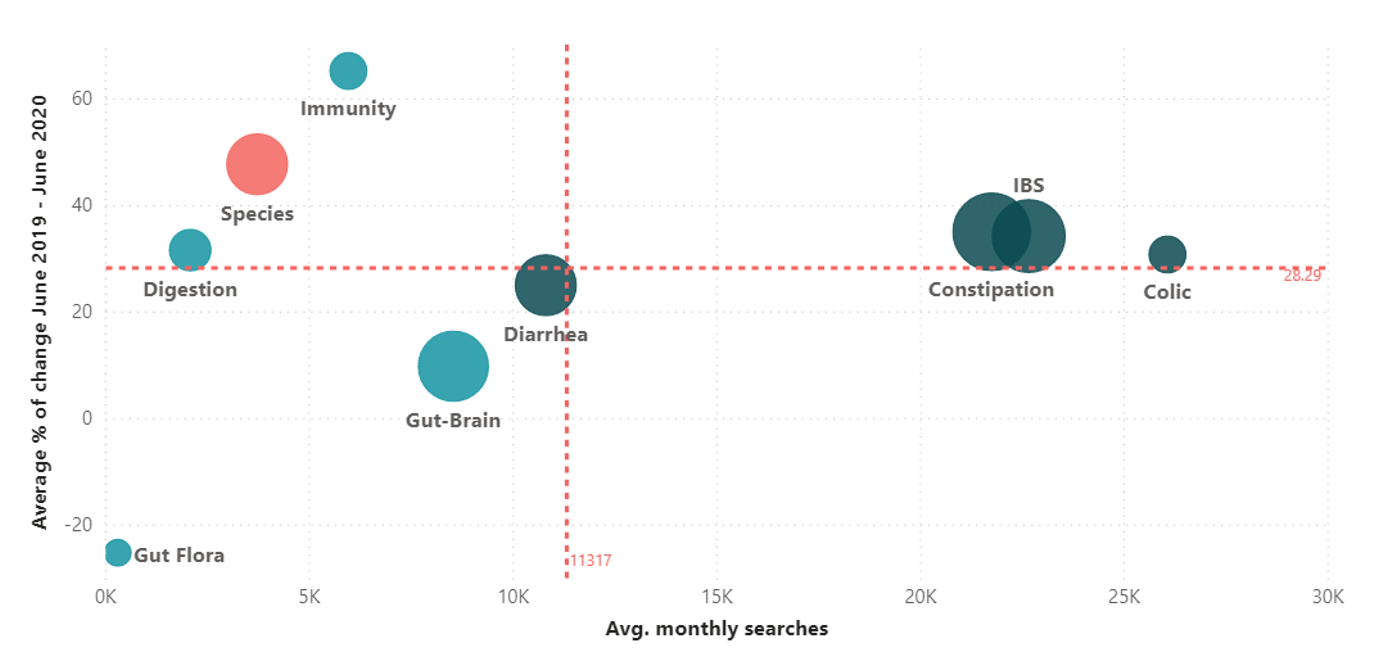

If we add into the mix search trends from Google over the last 12 months, June 2019 – June 2020, when online searches for probiotics are grouped by key area, those pertaining to specific symptoms/chronic conditions received a high number of searches, with high growth over the 12 months.

IBS

- Average monthly searches: 23k

- Average search volume % growth: 34%

Constipation

- Average monthly searches: 22k

- Average search volume % growth: 35%

Colic

- Average monthly searches: 26k

- Average search volume % growth: 31%

Average monthly searches and average % change, Jun 2019 to Jun 2020

Additionally:

- Users seeking relief from IBS symptoms are using informational queries to find out the efficacy of probiotics. Searches concerning how probiotics can help IBS grew by 44% in 12 months (June 2019 – June 2020) and searches on the best probiotics for IBS grew by 75%.

- Symptom-driven consumers also show some scepticism in their searches, with queries questioning if probiotics can make IBS symptoms worse growing by 56% in 12 months.

Commenting on the updated data from Lumina, Ewa Hudson, Director of Insights said “there are clear opportunities to develop supplements which target specific conditions. Understanding the concerns of the symptom consumer and winning them is a stamp of approval that probiotics work.”

Get the full picture

Find out how Lumina Intelligence’s data for the probiotics market can help inform your NPD, marketing and business strategies.